Sharpest Stock Market Decline Since COVID: China's Tariffs Fuel Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sharpest Stock Market Decline Since COVID: China's Tariffs Fuel Sell-Off

The global stock market experienced its most dramatic downturn since the initial COVID-19 pandemic shock, fueled by a renewed wave of uncertainty stemming from China's newly announced tariffs. Monday's trading saw a significant sell-off, wiping billions off global market capitalization and sending shockwaves through investor confidence. Experts warn that this could be just the beginning of a prolonged period of volatility.

China's Tariff Shockwaves:

The unexpected announcement of increased tariffs on key US imports, coupled with a simultaneous tightening of regulations on several major Chinese industries, triggered a domino effect across global markets. These actions, interpreted by many analysts as a retaliatory measure to ongoing trade tensions, have left investors scrambling to assess the potential long-term impact. The tariffs, targeting crucial sectors like technology and agricultural products, are expected to significantly disrupt global supply chains and further inflame inflationary pressures.

Market Reactions and Analysis:

The immediate reaction was swift and brutal. Major indices across the globe experienced sharp declines, with the Dow Jones Industrial Average falling by over 500 points and the Nasdaq Composite suffering a similar fate. European markets also mirrored this negative trend, indicating a widespread loss of investor confidence. Experts point to several factors contributing to the severity of the sell-off:

- Uncertainty surrounding China's economic policy: The unpredictable nature of recent Chinese government decisions has increased market uncertainty, leading to risk aversion among investors.

- Inflationary concerns: The new tariffs are likely to exacerbate existing inflationary pressures, further impacting consumer spending and corporate profitability.

- Supply chain disruptions: The targeted sectors are critical components of global supply chains, meaning disruptions could have cascading effects on various industries.

- Geopolitical tensions: The escalating trade tensions between the US and China contribute to a broader atmosphere of geopolitical instability, which often negatively impacts investor sentiment.

What's Next for Investors?

The current market volatility underscores the need for investors to adopt a cautious approach. Diversification remains crucial, as does a thorough understanding of the risks associated with global macroeconomic events. Many analysts recommend a wait-and-see approach, suggesting that further clarity on China's economic policies is needed before making significant investment decisions. The situation is rapidly evolving, and continuous monitoring of market trends is essential.

Looking Ahead: Mitigation and Potential Recovery:

While the immediate outlook appears bleak, there's hope for a recovery. Government intervention, either through stimulus packages or diplomatic efforts to de-escalate trade tensions, could play a crucial role in stabilizing the markets. However, the timing and effectiveness of such interventions remain uncertain. Companies within the affected sectors are likely to implement contingency plans to mitigate the impact of the tariffs, potentially through cost-cutting measures or diversification of supply chains. The long-term consequences will depend on the extent to which these mitigation strategies prove successful.

Keywords: China tariffs, stock market crash, global markets, economic downturn, trade war, inflation, supply chain disruption, investor confidence, market volatility, geopolitical risk, economic policy, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sharpest Stock Market Decline Since COVID: China's Tariffs Fuel Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

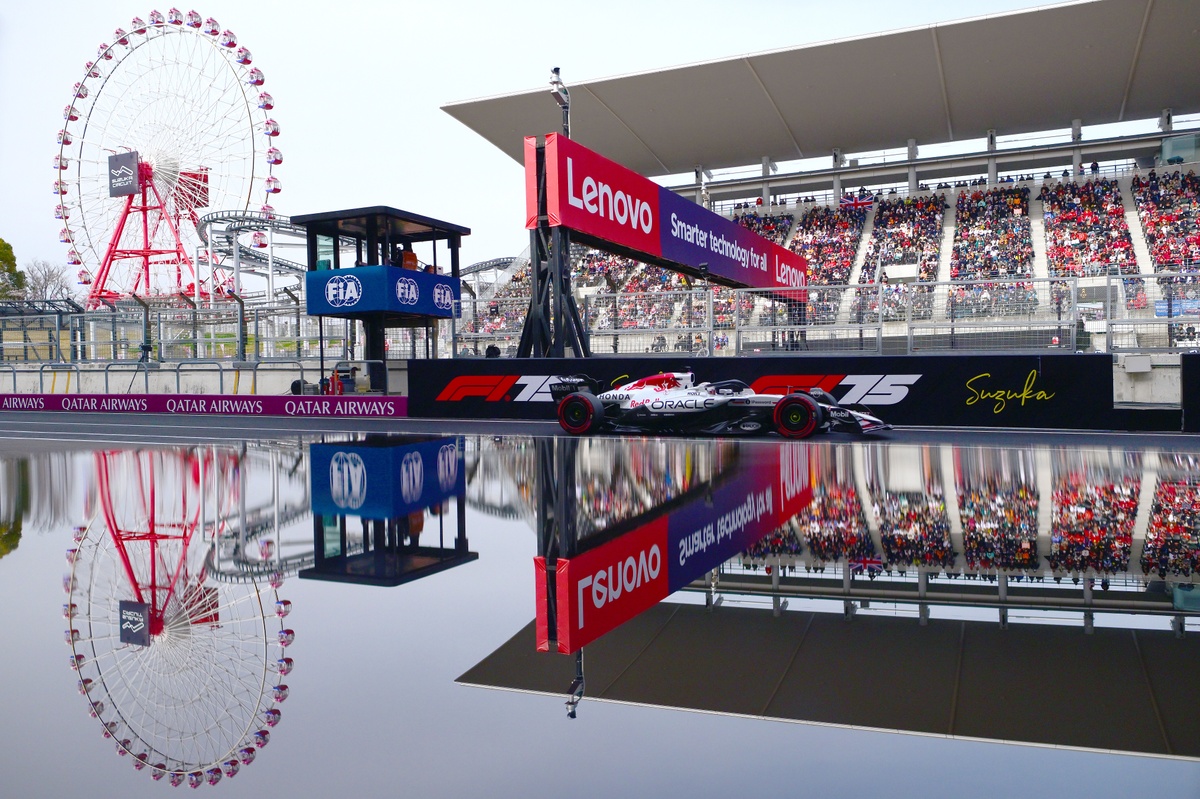

2025 Formula 1 Japanese Grand Prix Live Timing And Results

Apr 07, 2025

2025 Formula 1 Japanese Grand Prix Live Timing And Results

Apr 07, 2025 -

Ligue 1 2023 Paris Saint Germains Triumphant Title Win

Apr 07, 2025

Ligue 1 2023 Paris Saint Germains Triumphant Title Win

Apr 07, 2025 -

College Bulldogs Announce Significant Coaching Shift

Apr 07, 2025

College Bulldogs Announce Significant Coaching Shift

Apr 07, 2025 -

Follow The Action Live F1 Japanese Gp Commentary And Race Day News

Apr 07, 2025

Follow The Action Live F1 Japanese Gp Commentary And Race Day News

Apr 07, 2025 -

Live Updates Mass Fight Mars Saints And Power Afl Clash Hogan Incident Investigated

Apr 07, 2025

Live Updates Mass Fight Mars Saints And Power Afl Clash Hogan Incident Investigated

Apr 07, 2025