Sharpest US Stock Market Drop Since COVID: China's Tariffs Take Their Toll

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sharpest US Stock Market Drop Since COVID: China's Tariffs Take Their Toll

The US stock market experienced its sharpest single-day decline since the initial COVID-19 pandemic crash, plummeting on mounting concerns over escalating trade tensions with China. Analysts point directly to the newly implemented Chinese tariffs on key US exports as the primary catalyst for this dramatic market downturn. The ripple effect is being felt across various sectors, leaving investors worried about the future trajectory of the US economy.

China's Retaliatory Tariffs: A Market Earthquake

The recent imposition of Chinese tariffs on a wide range of US goods, including agricultural products and technology, has sent shockwaves through Wall Street. These tariffs, seen as a retaliatory measure to earlier US trade actions, represent a significant escalation in the ongoing trade war between the two economic giants. The immediate impact has been a considerable drop in investor confidence, leading to widespread selling and a sharp decrease in market capitalization.

Impact Across Sectors: Beyond the Headlines

The market drop wasn't confined to a single sector. While technology and agricultural stocks suffered particularly heavy losses, the decline was broadly based, reflecting a general sense of uncertainty and apprehension amongst investors. This widespread impact underscores the interconnectedness of the global economy and the significant influence of US-China trade relations on global financial stability.

- Technology Sector: Companies heavily reliant on Chinese markets experienced the most significant drops, reflecting the immediate impact of the new tariffs.

- Agricultural Sector: Farmers, already grappling with various challenges, now face further hardship due to reduced exports to China.

- Manufacturing Sector: Supply chain disruptions and increased input costs are adding further pressure to an already strained sector.

Analyst Reactions and Predictions: Navigating Uncertainty

Market analysts are scrambling to assess the long-term implications of this significant market downturn. Many predict further volatility in the coming weeks and months, as investors grapple with the uncertainty surrounding the future trajectory of US-China trade relations. Some experts are calling for a de-escalation of tensions and a renewed focus on negotiation to avoid further damage to the global economy. Others warn of a prolonged period of economic uncertainty, urging investors to adopt a cautious approach.

What's Next? The Path Forward

The current situation highlights the crucial need for a stable and predictable international trade environment. The dramatic market reaction underscores the significant impact of geopolitical events on global financial markets. The coming weeks will be crucial in determining whether this represents a temporary setback or the start of a more prolonged period of economic uncertainty. The focus now shifts to potential diplomatic solutions and the capacity of both governments to find a pathway towards de-escalation and renewed cooperation. Close monitoring of trade negotiations and economic indicators will be critical for investors navigating this turbulent period. The future of the US stock market, and indeed the global economy, remains heavily intertwined with the resolution of this escalating trade conflict.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sharpest US Stock Market Drop Since COVID: China's Tariffs Take Their Toll. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

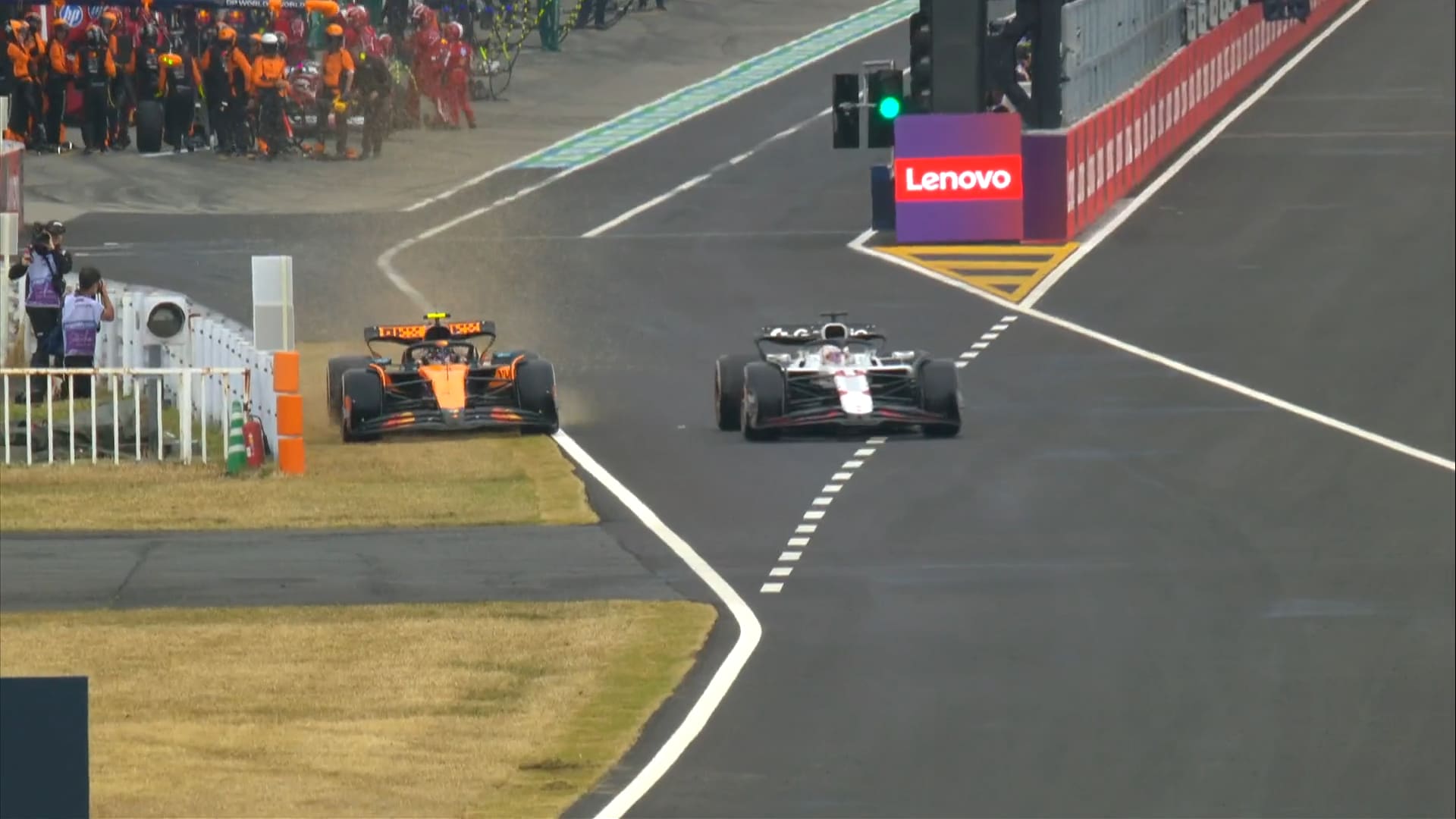

Live 2025 Japanese Grand Prix F1 Race Coverage And Results

Apr 07, 2025

Live 2025 Japanese Grand Prix F1 Race Coverage And Results

Apr 07, 2025 -

Formula 1 Japan Verstappens Race Start Advantage Alonso Gasly Fight

Apr 07, 2025

Formula 1 Japan Verstappens Race Start Advantage Alonso Gasly Fight

Apr 07, 2025 -

Incredibly Uncynical Aimee Lou Wood On The White Lotus Season 3 Ending

Apr 07, 2025

Incredibly Uncynical Aimee Lou Wood On The White Lotus Season 3 Ending

Apr 07, 2025 -

Increased Production Of Semiconductor Packaging Material By Ajinomoto

Apr 07, 2025

Increased Production Of Semiconductor Packaging Material By Ajinomoto

Apr 07, 2025 -

Mobile Legends Pembagian Grup Resmi Turnamen Esl Sps Mobile Masters 2025

Apr 07, 2025

Mobile Legends Pembagian Grup Resmi Turnamen Esl Sps Mobile Masters 2025

Apr 07, 2025