Shifting Sands At DBS: Piyush Gupta's Banking Masterplan And Its Demise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Shifting Sands at DBS: Piyush Gupta's Banking Masterplan and its Demise

The long reign of Piyush Gupta at DBS Bank, marked by ambitious expansion and digital transformation, is facing increasing scrutiny as headwinds buffet the Asian banking giant. Gupta's strategic vision, once lauded as a blueprint for future banking in Asia, is now under the microscope as economic uncertainties and shifting regulatory landscapes challenge its core tenets. This article delves into the key elements of Gupta's masterplan, its successes, and the reasons behind its apparent waning influence.

The Gupta Era: A Decade of Transformation

Piyush Gupta's tenure as CEO of DBS Bank has spanned over a decade, a period witnessing significant changes in the global financial landscape. His strategic plan focused on several key pillars:

-

Aggressive Expansion: DBS, under Gupta's leadership, significantly expanded its regional footprint, particularly in Southeast Asia. This involved strategic acquisitions and organic growth, aiming to capitalize on the burgeoning economies of the region. While successful in expanding market share, this rapid expansion has also been cited as a contributing factor to current challenges.

-

Digital-First Approach: Recognizing the growing importance of technology in the financial sector, Gupta championed a digital-first strategy. This involved substantial investments in fintech and digital infrastructure, aiming to create a seamless and user-friendly banking experience. While DBS has indeed become a leader in digital banking in Asia, the massive investment required has come under question amidst changing market conditions.

-

Focus on Wealth Management: Gupta prioritized the wealth management segment, recognizing the growing affluence in Asia and the potential for substantial revenue growth. This strategy involved targeted acquisitions and the development of sophisticated wealth management products and services. This sector, while performing relatively well, has still felt the pressure of global economic slowdown.

The Cracks in the Foundation: Challenges Facing DBS

Despite its past successes, DBS, like other major banks, is facing several significant challenges:

-

Geopolitical Uncertainty: The ongoing geopolitical tensions, particularly the war in Ukraine and rising US-China tensions, have created significant economic uncertainty, impacting investment and growth across Asia. This has directly affected DBS's expansion strategies and investment returns.

-

Rising Interest Rates: The global increase in interest rates, intended to combat inflation, has squeezed profit margins for banks, impacting lending and investment activities. DBS, despite its strong capital position, has not been immune to these pressures.

-

Regulatory Scrutiny: Increased regulatory scrutiny of the financial sector, aimed at improving stability and preventing future crises, has imposed additional costs and compliance burdens on banks like DBS. Navigating this complex regulatory landscape is proving challenging.

-

Talent Acquisition and Retention: The competitive landscape for skilled professionals in the finance industry is fierce. Attracting and retaining top talent is crucial for DBS to maintain its competitive edge and execute its strategic plan effectively.

The Future of DBS: Adapting to the Changing Landscape

The initial masterplan, while ambitious and largely successful in its initial phases, requires adaptation in the face of these new realities. While Gupta's legacy remains significant, the current economic climate demands a recalibration of strategies. The focus may shift towards cost optimization, risk management, and a more cautious approach to expansion. The coming years will be crucial in determining how DBS navigates these challenges and re-establishes its position as a leading Asian bank. The narrative around Piyush Gupta’s legacy is, for now, far from concluded.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Shifting Sands At DBS: Piyush Gupta's Banking Masterplan And Its Demise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Making The Most Of Friday March 28th The Final Push

Mar 30, 2025

Making The Most Of Friday March 28th The Final Push

Mar 30, 2025 -

Ipl 2025 Analyzing Mumbai Indians Decision To Exclude Vignesh Puthur From Gt Match

Mar 30, 2025

Ipl 2025 Analyzing Mumbai Indians Decision To Exclude Vignesh Puthur From Gt Match

Mar 30, 2025 -

South Carolinas Staley Highlights Team Resilience In A Close Win

Mar 30, 2025

South Carolinas Staley Highlights Team Resilience In A Close Win

Mar 30, 2025 -

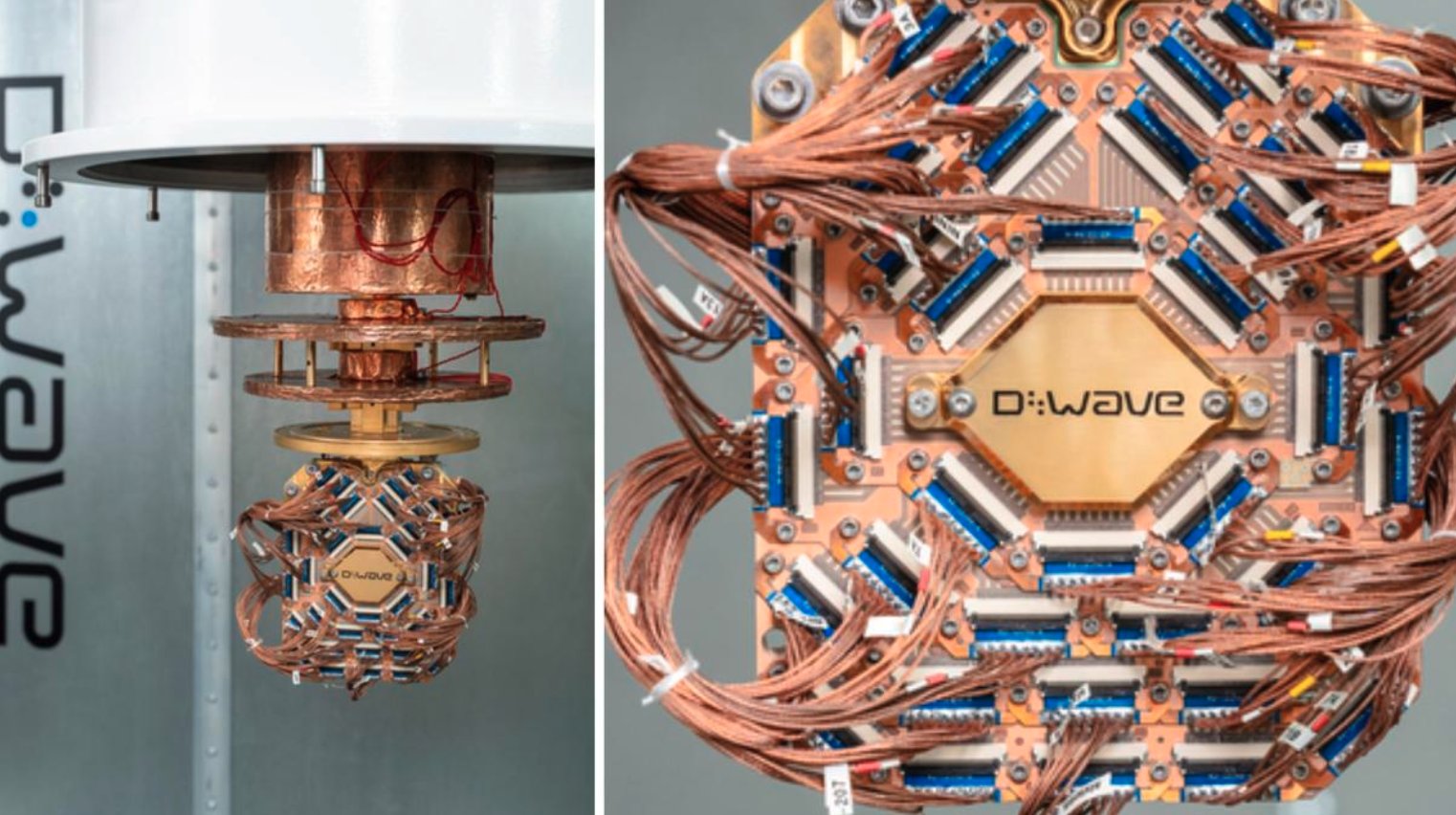

Quantum Leap D Waves Annealer Solves Materials Science Problem Faster Than Supercomputers

Mar 30, 2025

Quantum Leap D Waves Annealer Solves Materials Science Problem Faster Than Supercomputers

Mar 30, 2025 -

Shah Rukh Khan And Dilip Kumars Dubai Trip Coinciding With 1993 Mumbai Attacks Fact Or Fiction

Mar 30, 2025

Shah Rukh Khan And Dilip Kumars Dubai Trip Coinciding With 1993 Mumbai Attacks Fact Or Fiction

Mar 30, 2025