Shopee's Parent Company, Sea, Launches New Fintech Hub In Singapore And Rebrands SeaMoney

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sea Launches New Fintech Hub in Singapore, Rebrands SeaMoney to Boost Southeast Asia's Digital Economy

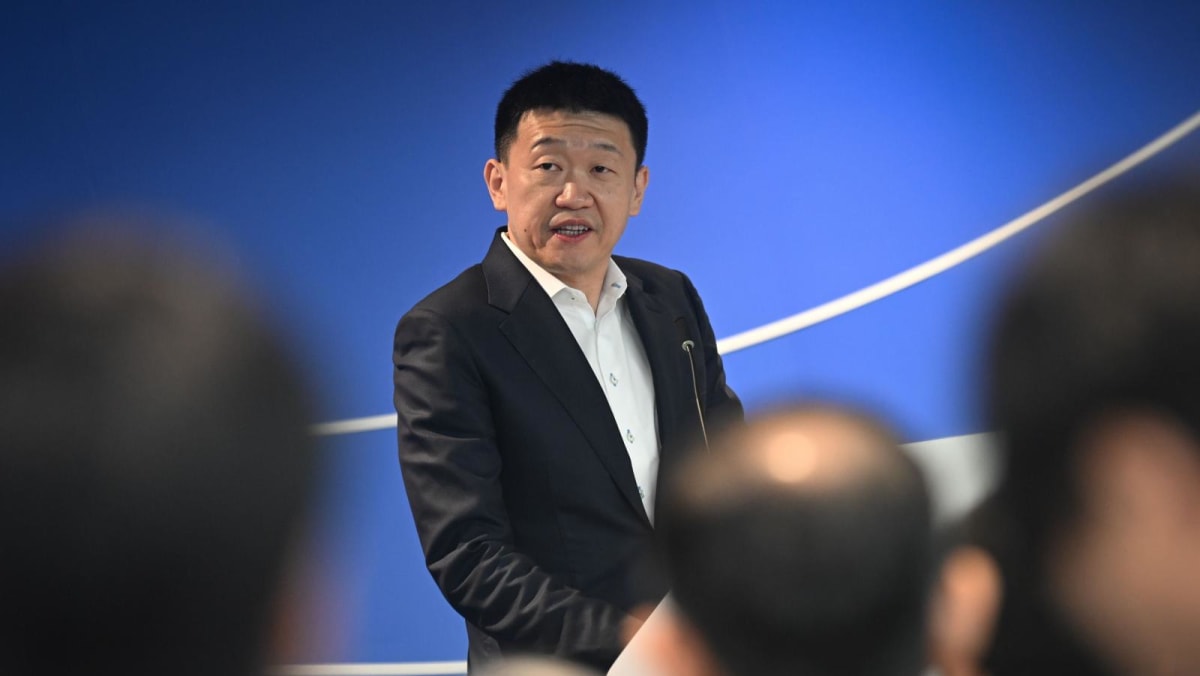

Singapore, [Date of Publication] – Sea Limited, the parent company of e-commerce giant Shopee and popular gaming platform Garena, is making a significant push into the fintech sector with the launch of a new fintech hub in Singapore and a rebranding of its digital financial services arm, SeaMoney. This strategic move aims to consolidate Sea's financial services offerings and accelerate growth within Southeast Asia's rapidly expanding digital economy.

The new Singapore-based hub will serve as a central command for SeaMoney's operations, bringing together its engineering, product, and business teams. This centralized approach is expected to foster innovation and streamline the development and deployment of new financial products and services across the region. The move underscores Sea's commitment to its fintech ambitions and its belief in the immense potential of the Southeast Asian market.

SeaMoney Rebranding: A Fresh Look for a Growing Fintech Player

SeaMoney, previously operating under a less unified brand structure, has undergone a significant rebranding. While specific details about the new branding haven't been fully released, the move signals a strategic shift towards a more cohesive and recognizable identity. This rebranding is intended to enhance customer recognition and build brand trust as SeaMoney expands its range of financial services.

The rebranding coincides with increased competition in the Southeast Asian fintech landscape. Companies like Grab and Gojek are already significant players, offering a diverse range of financial services. Sea's renewed focus on SeaMoney and the establishment of the Singapore hub indicate a determined effort to maintain its competitiveness and capture a larger market share.

Expanding Financial Inclusion in Southeast Asia: Key Services Offered by SeaMoney

SeaMoney's services cater to the diverse needs of Southeast Asian consumers, many of whom are underserved by traditional financial institutions. Key services offered include:

- Digital Payments: SeaMoney provides a convenient and secure platform for online and offline transactions, contributing to a cashless society. This includes person-to-person transfers, mobile wallets, and integration with Shopee's e-commerce platform.

- Mobile Lending: Access to credit is crucial for many, and SeaMoney provides micro-loans and other financial products to individuals and small businesses. This plays a significant role in fostering financial inclusion and economic growth.

- Financial Management Tools: The platform offers tools designed to help users manage their finances effectively, including budgeting and savings features.

- Insurance Products: SeaMoney is expanding into insurance offerings, providing affordable and accessible insurance solutions to a wider audience.

These services are designed to cater to both the underbanked and the banked populations, providing essential financial tools that are often unavailable through traditional banking channels.

The Strategic Significance of the Singapore Fintech Hub

Choosing Singapore as the location for the new hub is a strategic move. Singapore’s robust regulatory environment, its strong position as a regional financial center, and its access to a highly skilled talent pool make it an ideal location for SeaMoney's expansion. This location will not only improve operational efficiency but also attract top talent and facilitate partnerships with other financial institutions.

The Future of SeaMoney and Sea's Fintech Ambitions

Sea's investment in its fintech division demonstrates its long-term commitment to the sector. The launch of the Singapore hub and the rebranding of SeaMoney are significant milestones in this journey. As Southeast Asia continues its rapid digital transformation, SeaMoney is well-positioned to capitalize on the growing demand for accessible and innovative financial services. The company's future success will hinge on its ability to continue innovating, adapting to evolving market needs, and navigating the competitive landscape. This strategic repositioning positions Sea for continued growth and a leading role in shaping the future of fintech in Southeast Asia.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Shopee's Parent Company, Sea, Launches New Fintech Hub In Singapore And Rebrands SeaMoney. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Best Uk Gambling Sites A Comparison Of Top Performing Features

May 09, 2025

Best Uk Gambling Sites A Comparison Of Top Performing Features

May 09, 2025 -

New Digital Finance Hub Sea Opens Singapore Office

May 09, 2025

New Digital Finance Hub Sea Opens Singapore Office

May 09, 2025 -

Jay Lenos Candid Confession Kimmels Humiliation And The O Brien Controversy

May 09, 2025

Jay Lenos Candid Confession Kimmels Humiliation And The O Brien Controversy

May 09, 2025 -

Find Kali Uchis Sincerely Album On Vinyl A Buying Guide

May 09, 2025

Find Kali Uchis Sincerely Album On Vinyl A Buying Guide

May 09, 2025 -

De Adeus Aos Altos Custos Tenha Seu Refugio Na Praia Ou Campo Com Cotas De Imovel

May 09, 2025

De Adeus Aos Altos Custos Tenha Seu Refugio Na Praia Ou Campo Com Cotas De Imovel

May 09, 2025