Should You Buy Amazon (AMZN)? Think Investments Weighs In.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Amazon (AMZN)? Think Investments Weighs In.

Amazon. The name conjures images of instant gratification, vast online marketplaces, and a seemingly unstoppable technological behemoth. But for investors, the question isn't about convenience; it's about returns. Should you buy Amazon stock (AMZN)? Think Investments, a leading financial analysis firm, offers a nuanced perspective.

The allure of Amazon is undeniable. Its dominance in e-commerce, cloud computing (AWS), and advertising makes it a tempting addition to any portfolio. However, recent market fluctuations and the company's ambitious expansion into new sectors have sparked debate among analysts. Let's delve into the key considerations Think Investments highlights when evaluating AMZN's investment potential.

Amazon's Strengths: A Colossus in Multiple Markets

-

E-commerce Dominance: Amazon remains the undisputed king of online retail. Its Prime membership program, expansive product catalog, and efficient logistics network create a formidable barrier to entry for competitors. This core strength provides a solid foundation for future growth.

-

AWS: The Cloud Computing Juggernaut: Amazon Web Services (AWS) is a profit powerhouse, consistently exceeding expectations and driving significant revenue growth. Its market leadership in cloud infrastructure services ensures continued profitability and diversification beyond retail.

-

Advertising Powerhouse: Amazon's advertising platform is rapidly expanding, leveraging its vast user base and data to compete with industry giants like Google and Meta. This burgeoning revenue stream adds another layer of diversification and growth potential.

Amazon's Challenges: Navigating Headwinds

-

Economic Uncertainty: Global economic slowdowns can significantly impact consumer spending, potentially affecting Amazon's retail sales. This vulnerability highlights the importance of diversified investment strategies.

-

Increased Competition: While Amazon dominates many sectors, competition is intensifying. Rival e-commerce platforms, along with the growth of independent online retailers, present a growing challenge.

-

Inflationary Pressures: Rising costs, particularly in logistics and labor, impact profitability. Amazon's ability to manage these inflationary pressures will be crucial to maintaining its profit margins.

Think Investments' Verdict: A Long-Term Perspective is Key

Think Investments believes Amazon's long-term prospects remain strong, despite the present challenges. The company's diverse revenue streams, innovative culture, and market leadership in several key sectors provide a compelling case for investment. However, they caution against short-term speculation.

Here's what Think Investments recommends:

- Long-term investment: AMZN is best suited for investors with a long-term horizon, prepared to weather short-term market volatility.

- Diversification: Don't put all your eggs in one basket. Amazon should be part of a well-diversified portfolio.

- Risk assessment: Understand the inherent risks associated with investing in any single stock, especially one as heavily scrutinized as AMZN.

Conclusion:

Should you buy Amazon (AMZN)? Think Investments suggests a cautious "yes," but with a long-term perspective and a thorough understanding of the inherent risks. Amazon's strengths are significant, but its challenges shouldn't be ignored. Conduct thorough due diligence, consider your personal risk tolerance, and remember that investment decisions should always align with your overall financial goals. This analysis should not be considered financial advice; consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Amazon (AMZN)? Think Investments Weighs In.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Serangan Tikus Di Ikn Saat Lebaran Otorita Beberkan Fakta Mengejutkan

Apr 08, 2025

Serangan Tikus Di Ikn Saat Lebaran Otorita Beberkan Fakta Mengejutkan

Apr 08, 2025 -

Quantum Physics And The Fight Against Joystick Drift

Apr 08, 2025

Quantum Physics And The Fight Against Joystick Drift

Apr 08, 2025 -

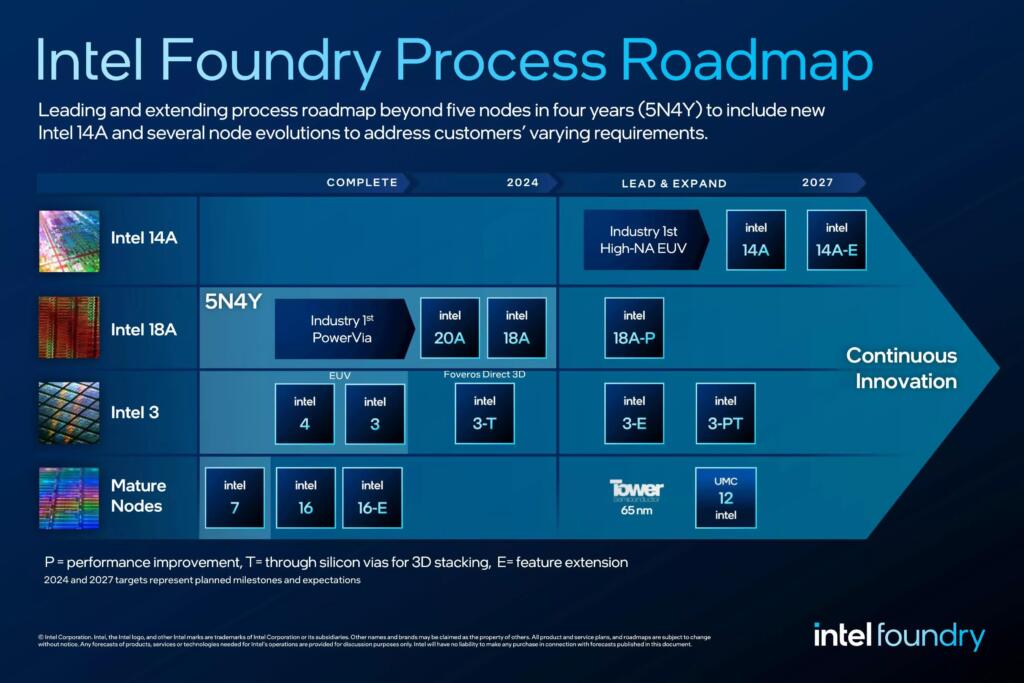

Intels 18 A Chips Mass Production Timeline And Industry Implications

Apr 08, 2025

Intels 18 A Chips Mass Production Timeline And Industry Implications

Apr 08, 2025 -

Understanding The Revised Fha Residency Guidelines For Mortgage Loans

Apr 08, 2025

Understanding The Revised Fha Residency Guidelines For Mortgage Loans

Apr 08, 2025 -

Market Plunge Us Stocks Experience Biggest Weekly Drop Since Covid 19 Crisis

Apr 08, 2025

Market Plunge Us Stocks Experience Biggest Weekly Drop Since Covid 19 Crisis

Apr 08, 2025