Should You Buy AVGO Stock? Wall Street Bulls Weigh In On Broadcom's Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy AVGO Stock? Wall Street Bulls Weigh In on Broadcom's Future

Broadcom (AVGO) has been a tech titan's darling, consistently delivering strong performance and sparking fervent debate among investors: should you buy AVGO stock? The recent surge in share price has many wondering if the ride is over, or if further gains are on the horizon. Wall Street analysts, the self-proclaimed oracles of the market, offer a mixed bag of opinions, painting a complex picture of Broadcom's future.

Broadcom's Impressive Run: A Quick Recap

Broadcom's success story is built on a foundation of strategic acquisitions and a strong presence in high-growth sectors. From its beginnings as a maker of broadband chips, AVGO has expanded aggressively into areas like infrastructure software, wireless communications, and semiconductor solutions. This diversification has proven crucial in navigating market fluctuations and consistently delivering robust financial results. Key to its success is its dominance in crucial markets like data centers and 5G infrastructure. This strategic positioning has made AVGO a favorite among long-term investors seeking stable, high-growth potential.

The Bullish Argument: Why Analysts are Optimistic

Many analysts remain bullish on AVGO stock, citing several key factors:

- Strong Financials: Broadcom consistently exceeds earnings expectations, showcasing a strong financial foundation and demonstrating resilience in challenging economic climates. Their robust free cash flow allows for continued innovation, acquisitions, and shareholder returns.

- Dominant Market Share: AVGO holds significant market share in several key technology sectors. This dominance translates to pricing power and a competitive advantage in a constantly evolving landscape.

- Strategic Acquisitions: Broadcom’s history of successful acquisitions, most notably VMware, demonstrates their ability to identify and integrate valuable assets, expanding their market reach and technological capabilities. This strategic growth is a significant driver of long-term value creation.

- Growth in Key Sectors: The ongoing growth of data centers, 5G infrastructure, and artificial intelligence all bode well for Broadcom's future. Their exposure to these high-growth markets positions them for sustained expansion.

- Return to Shareholders: AVGO consistently rewards its investors through dividends and stock buybacks, showcasing a commitment to shareholder value. This strategy enhances returns and makes it attractive to income-focused investors.

Potential Risks: Clouds on the Horizon

While the bullish outlook is compelling, potential risks should be considered:

- Economic Slowdown: A global economic slowdown could negatively impact demand for Broadcom's products, potentially affecting revenue growth.

- Geopolitical Uncertainty: The ongoing geopolitical tensions and trade disputes could disrupt supply chains and impact the company's operations.

- Increased Competition: The semiconductor industry is highly competitive, and the emergence of new players could erode Broadcom's market share.

- Regulatory Scrutiny: Large acquisitions, like the VMware deal, can attract regulatory scrutiny, potentially delaying or even jeopardizing the completion of such transactions.

The Verdict: Should You Buy AVGO Stock?

The decision to invest in AVGO stock is ultimately a personal one. While the long-term outlook appears promising, driven by strong fundamentals and exposure to high-growth sectors, potential risks should not be ignored. Investors should carefully analyze their own risk tolerance, investment timeline, and financial goals before making any investment decisions. Conduct thorough due diligence, consider consulting a financial advisor, and stay informed about market developments and company-specific news to make an informed choice. The current market sentiment suggests a cautiously optimistic approach, but ultimately, the success of any investment depends on individual circumstances and market dynamics. Remember to diversify your portfolio to mitigate risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy AVGO Stock? Wall Street Bulls Weigh In On Broadcom's Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

El Fichaje De Sorloth Un Acierto O Una Evidencia De Las Fortalezas Del Atletico Sin Un 9 Titular

May 12, 2025

El Fichaje De Sorloth Un Acierto O Una Evidencia De Las Fortalezas Del Atletico Sin Un 9 Titular

May 12, 2025 -

Ai Software Stock Soars 1090 Since Ipo Ives Predicts Another 285 Gain

May 12, 2025

Ai Software Stock Soars 1090 Since Ipo Ives Predicts Another 285 Gain

May 12, 2025 -

Tesla Robotaxi Rollout A Timeline And Analysis Of The Next Year

May 12, 2025

Tesla Robotaxi Rollout A Timeline And Analysis Of The Next Year

May 12, 2025 -

Figma Ceo Discusses The Role Of Ai In The Future Of Collaborative Design

May 12, 2025

Figma Ceo Discusses The Role Of Ai In The Future Of Collaborative Design

May 12, 2025 -

Challengers Prediction Chimaev In For A Grueling Fight With Du Plessis

May 12, 2025

Challengers Prediction Chimaev In For A Grueling Fight With Du Plessis

May 12, 2025

Latest Posts

-

Li Ka Shings Retirement And The Panama Ports Controversy A Deeper Look

May 12, 2025

Li Ka Shings Retirement And The Panama Ports Controversy A Deeper Look

May 12, 2025 -

David Beckhams Sharp Response To Minnesota Uniteds Inter Miami Provocation

May 12, 2025

David Beckhams Sharp Response To Minnesota Uniteds Inter Miami Provocation

May 12, 2025 -

Labor Partys Shock Move Brisbane Mp Faces Expulsion

May 12, 2025

Labor Partys Shock Move Brisbane Mp Faces Expulsion

May 12, 2025 -

Bainbridge Teachers Emotional National Tv Surprise Gifts Gospel Star And School Donations

May 12, 2025

Bainbridge Teachers Emotional National Tv Surprise Gifts Gospel Star And School Donations

May 12, 2025 -

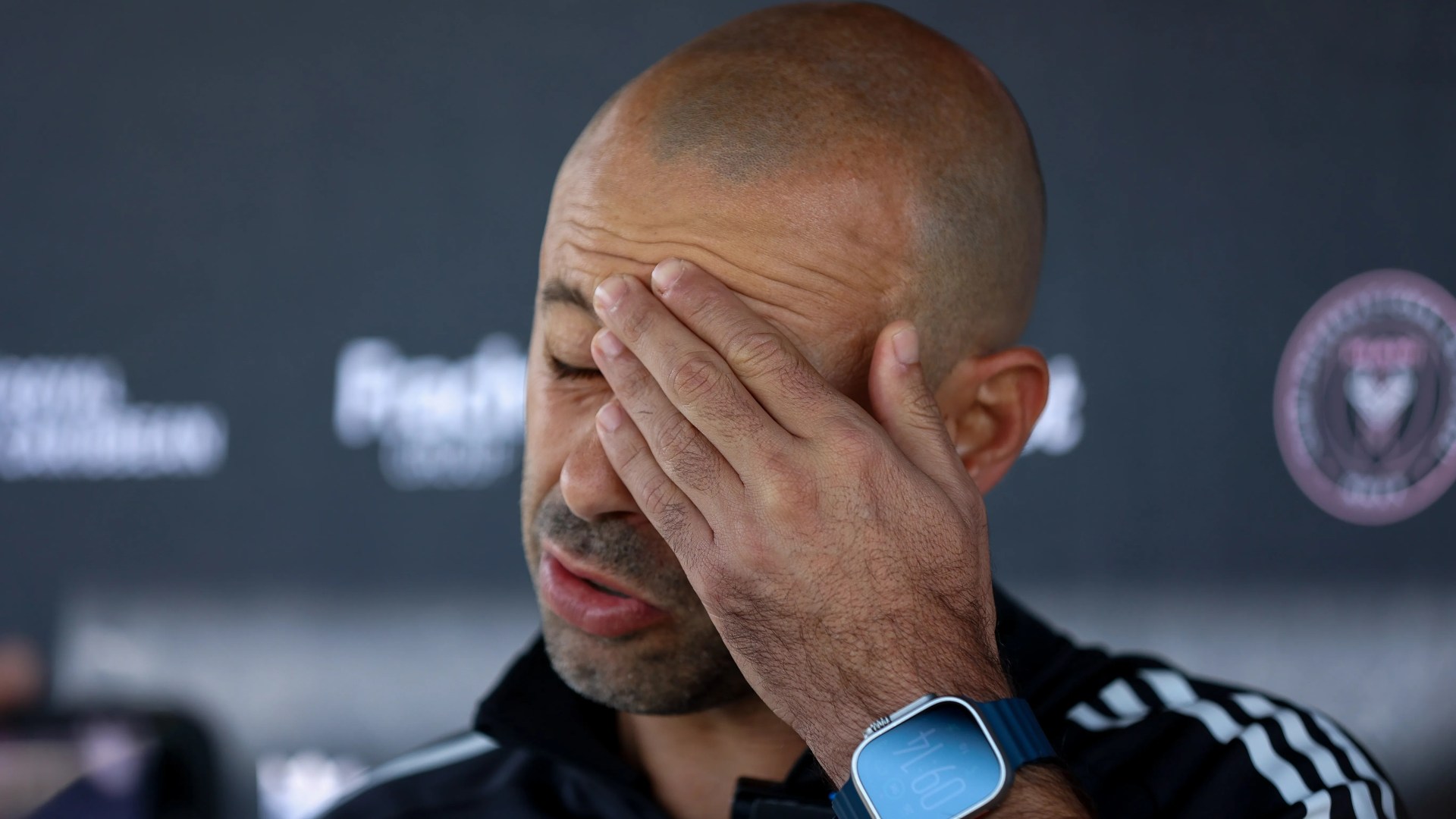

David Beckham Under Fire Mascheranos Job On The Line Following Messis Mls Setback

May 12, 2025

David Beckham Under Fire Mascheranos Job On The Line Following Messis Mls Setback

May 12, 2025