Should You Buy Broadcom (AVGO) Stock? Analyzing The Bullish Sentiment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Broadcom (AVGO) Stock? Analyzing the Bullish Sentiment

Broadcom (AVGO) has been a darling of Wall Street lately, enjoying a significant surge in its stock price fueled by strong bullish sentiment. But is this excitement justified? Should you jump on the bandwagon and add AVGO to your portfolio, or is caution warranted? This in-depth analysis explores the factors driving the bullish sentiment surrounding Broadcom and helps you determine if this tech giant is a worthwhile investment.

The Case for Broadcom: Why the Bulls are Charging

Several key factors are contributing to the positive outlook on Broadcom stock:

-

Strong Financial Performance: Broadcom consistently delivers impressive financial results. Recent quarters have showcased robust revenue growth, exceeding analysts' expectations, driven by strong demand across its diverse product portfolio. This consistent outperformance builds investor confidence and fuels the bullish narrative.

-

Diversified Revenue Streams: Unlike many tech companies heavily reliant on a single product or market segment, Broadcom boasts a diversified revenue stream. This diversification across infrastructure software, semiconductor solutions, and networking products mitigates risk and ensures consistent revenue generation, even during market downturns.

-

Strategic Acquisitions: Broadcom's history of strategic acquisitions, such as its acquisition of VMware, demonstrates its ability to identify and integrate promising technologies, expanding its market reach and strengthening its competitive position. These acquisitions often lead to significant revenue synergies and bolster long-term growth prospects.

-

Dominant Market Position: Broadcom holds a dominant market share in several key technology sectors. This market leadership translates to pricing power and significant competitive advantages, contributing to robust profitability and strong cash flow generation.

-

Artificial Intelligence (AI) Growth: Broadcom's exposure to the burgeoning AI market is a significant positive. Its chips and software are crucial components in AI infrastructure, positioning the company for substantial growth as AI adoption accelerates. This sector's explosive growth trajectory directly benefits AVGO's future prospects.

Potential Headwinds: Understanding the Risks

While the bullish sentiment is compelling, it's crucial to acknowledge potential headwinds:

-

Geopolitical Risks: The semiconductor industry is susceptible to geopolitical uncertainties, including trade tensions and potential supply chain disruptions. These external factors can impact Broadcom's operations and profitability.

-

Competition: Despite its market leadership, Broadcom faces fierce competition from other major semiconductor companies. Maintaining its competitive edge requires continuous innovation and investment in research and development.

-

Economic Slowdown: A broader economic slowdown could dampen demand for Broadcom's products, impacting revenue growth and potentially affecting investor sentiment.

Should You Buy? A Balanced Perspective

The decision to buy Broadcom stock hinges on your individual risk tolerance and investment strategy. The bullish sentiment is largely justified by Broadcom's strong financial performance, diversified business model, and exposure to high-growth markets. However, geopolitical risks and potential economic headwinds should be carefully considered.

Before investing, conduct thorough due diligence: research analyst reports, review financial statements, and consider consulting a financial advisor to assess whether AVGO aligns with your personal investment goals. While the outlook appears positive, no investment is without risk.

Keywords: Broadcom, AVGO, stock, investment, bullish sentiment, semiconductor, AI, artificial intelligence, technology, revenue growth, market share, acquisition, VMware, financial performance, risk, analysis, buy, sell, hold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Broadcom (AVGO) Stock? Analyzing The Bullish Sentiment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

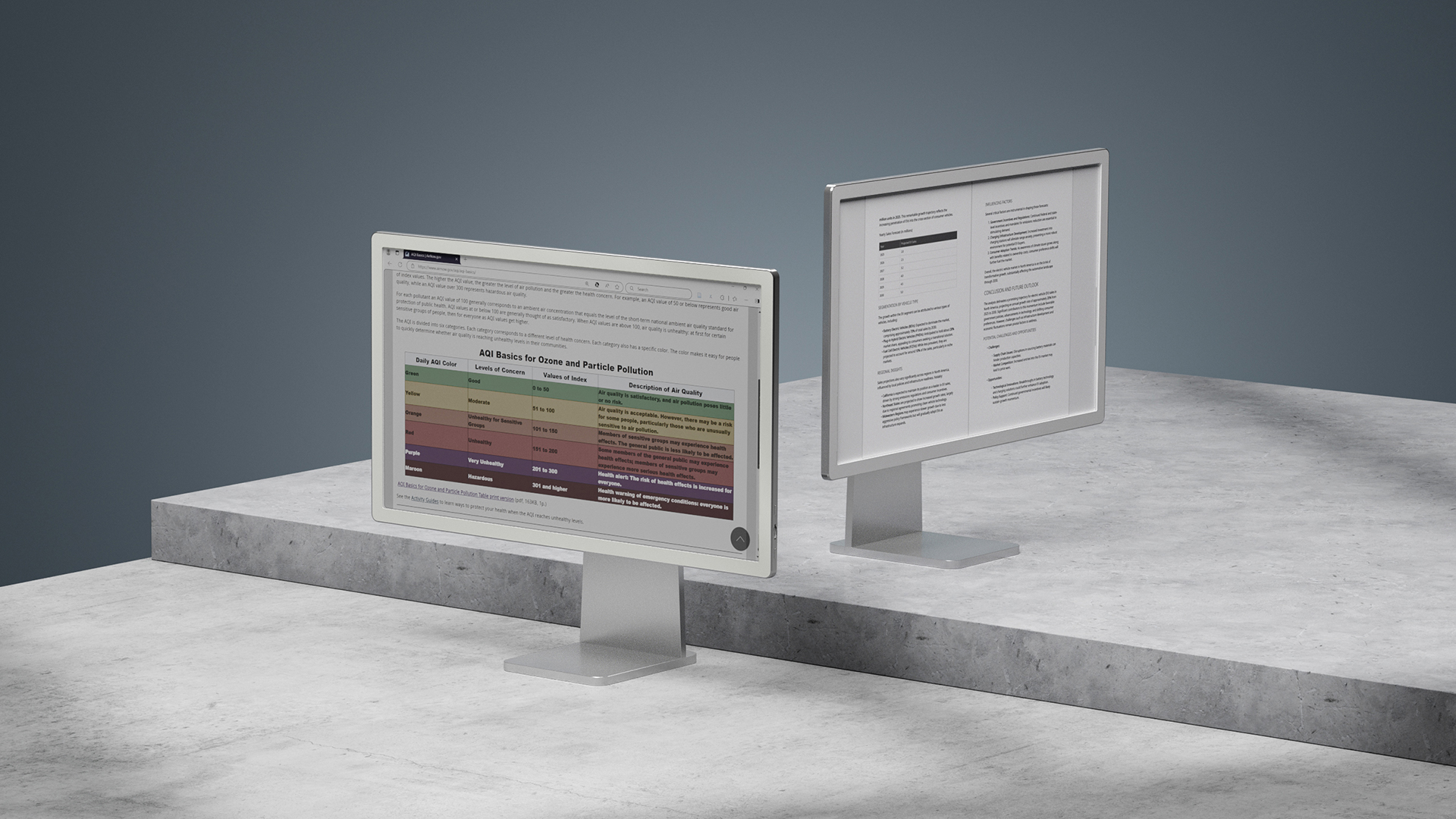

24 Inch Lcd Vs 25 Inch Color E Ink A Practical Comparison And Cost Analysis

May 13, 2025

24 Inch Lcd Vs 25 Inch Color E Ink A Practical Comparison And Cost Analysis

May 13, 2025 -

The Grim Reaper Of Ai Hundreds Of Job Losses At Tech Giants Ibm And Crowd Strike

May 13, 2025

The Grim Reaper Of Ai Hundreds Of Job Losses At Tech Giants Ibm And Crowd Strike

May 13, 2025 -

Arena Slams Fans For Unsanitary Toilet Behavior At Recent Show

May 13, 2025

Arena Slams Fans For Unsanitary Toilet Behavior At Recent Show

May 13, 2025 -

Thunder Secure Game 4 Win With Late Game Scoring Surge

May 13, 2025

Thunder Secure Game 4 Win With Late Game Scoring Surge

May 13, 2025 -

Ais Unexpected Role Pope Leo Xiv Explains Papal Name Choice

May 13, 2025

Ais Unexpected Role Pope Leo Xiv Explains Papal Name Choice

May 13, 2025

Latest Posts

-

Us Imposes Cattle Import Ban On Mexico Due To Maggot Infestation

May 13, 2025

Us Imposes Cattle Import Ban On Mexico Due To Maggot Infestation

May 13, 2025 -

Us China Trade Talks Show Progress Investors React Positively

May 13, 2025

Us China Trade Talks Show Progress Investors React Positively

May 13, 2025 -

Tragedia No Rs Chuvas Intensas Causam 75 Mortes E Devastam Infraestrutura

May 13, 2025

Tragedia No Rs Chuvas Intensas Causam 75 Mortes E Devastam Infraestrutura

May 13, 2025 -

Netflix Faces Criticism After Renewing Poorly Rated Drama For Season 3

May 13, 2025

Netflix Faces Criticism After Renewing Poorly Rated Drama For Season 3

May 13, 2025 -

Thunder Shock Nuggets Tie Nba Playoffs Series 2 2 After Game 4 Win

May 13, 2025

Thunder Shock Nuggets Tie Nba Playoffs Series 2 2 After Game 4 Win

May 13, 2025