Should You Buy Nvidia Stock? Three Key Factors To Consider

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Nvidia Stock? Three Key Factors to Consider

Nvidia (NVDA) has skyrocketed in recent years, becoming a Wall Street darling and a symbol of the booming artificial intelligence (AI) sector. But is now the right time to buy Nvidia stock? The answer, as with any investment, is complex and depends on several key factors. This article will delve into three crucial considerations before you add NVDA to your portfolio.

H2: 1. The Unstoppable AI Train: Growth and Future Potential

Nvidia's recent success is undeniably linked to the explosive growth of artificial intelligence. Their high-performance GPUs (graphics processing units) are the engine powering many of the world's most advanced AI systems, from large language models like ChatGPT to autonomous vehicles and data centers. This dominance in the AI hardware market gives Nvidia a significant competitive advantage.

- Market Leadership: Nvidia holds a commanding market share in AI accelerators, making them a key player in the ongoing AI revolution. This leadership position translates to significant revenue growth and strong profit margins.

- Data Center Demand: The increasing demand for powerful computing infrastructure to support AI development and deployment fuels Nvidia's data center business, a key driver of their revenue.

- Future Innovation: Nvidia continues to invest heavily in research and development, ensuring they remain at the forefront of AI technology and maintain their competitive edge. However, relying solely on AI growth presents a risk. Competition is increasing.

H2: 2. Valuation and Risk Assessment: Is the Price Right?

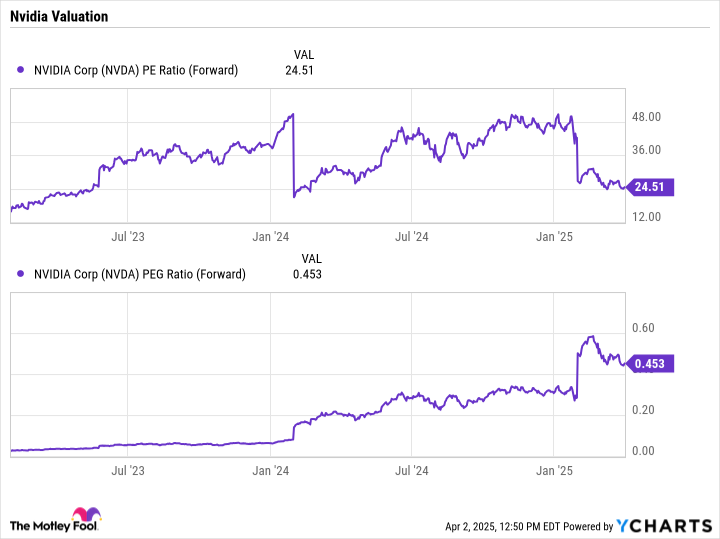

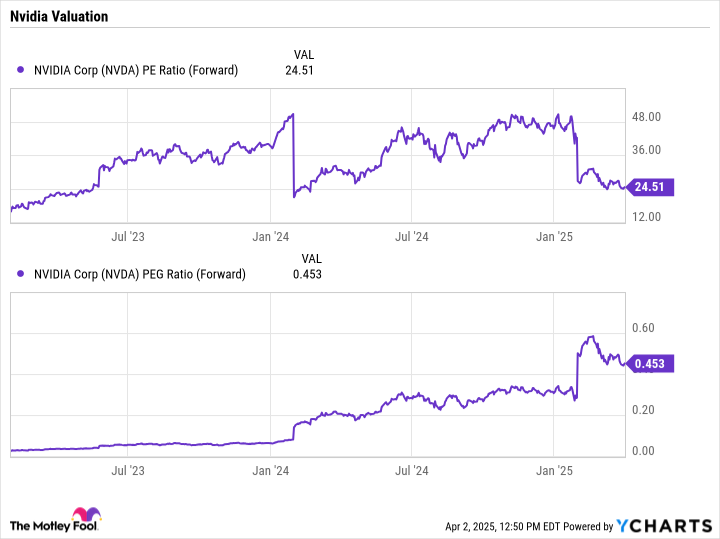

While Nvidia's growth is impressive, its stock price has also risen dramatically, leading to questions about its valuation. Investors need to carefully consider the potential risks:

- High Stock Price: NVDA's current valuation is high relative to its historical performance and industry peers. This means the stock is priced for significant future growth, and any slowdown could significantly impact the share price.

- Market Volatility: The technology sector, and particularly the AI market, is notoriously volatile. Geopolitical events, economic downturns, and unexpected technological advancements can all influence Nvidia's stock price.

- Competition: While currently dominant, Nvidia faces increasing competition from companies like AMD and Intel, who are investing heavily in their own AI technologies. This competitive pressure could impact Nvidia's market share and profitability.

H3: Analyzing Key Financial Metrics: Before investing, thoroughly research Nvidia's financial statements, including revenue growth, profit margins, and debt levels. Compare these figures to industry averages and historical trends.

H2: 3. Your Investment Strategy and Risk Tolerance:

Finally, and perhaps most importantly, consider your own investment goals and risk tolerance. Nvidia stock is not suitable for all investors:

- Long-Term vs. Short-Term: Investing in Nvidia is generally considered a long-term strategy. Short-term traders might find the stock too volatile.

- Risk Tolerance: NVDA is a growth stock with inherent risk. Investors with a low risk tolerance should consider other investment options.

- Diversification: It's crucial to diversify your portfolio. Don't put all your eggs in one basket, even if that basket seems promising.

H2: Conclusion: A Calculated Investment

Nvidia's position in the rapidly expanding AI market is undeniably compelling. However, the high valuation and inherent risks associated with the tech sector require careful consideration. Before investing in Nvidia stock, conduct thorough due diligence, analyze the financial statements, assess your risk tolerance, and consider diversification strategies. Remember that past performance is not indicative of future results. Investing in the stock market always involves risk, and it's crucial to make informed decisions based on your individual circumstances and financial goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Nvidia Stock? Three Key Factors To Consider. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hands On With Walmarts Leaked Google Tv Streaming Device First Impressions

Apr 07, 2025

Hands On With Walmarts Leaked Google Tv Streaming Device First Impressions

Apr 07, 2025 -

Resurgent Matildas Aim For Victory Against South Korea

Apr 07, 2025

Resurgent Matildas Aim For Victory Against South Korea

Apr 07, 2025 -

Bitcoin Investors Beware A Critical Metric May Soon Provide A Deceptive Buy Signal

Apr 07, 2025

Bitcoin Investors Beware A Critical Metric May Soon Provide A Deceptive Buy Signal

Apr 07, 2025 -

Jacob Elordis Narrow Road To The Deep North Finding Fulfillment In Challenging Roles

Apr 07, 2025

Jacob Elordis Narrow Road To The Deep North Finding Fulfillment In Challenging Roles

Apr 07, 2025 -

Nyt Mini Crossword Answers Saturday April 5th Full Solution Guide

Apr 07, 2025

Nyt Mini Crossword Answers Saturday April 5th Full Solution Guide

Apr 07, 2025