Should You Buy Nvidia Stock? Three Key Factors To Evaluate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Nvidia Stock? Three Key Factors to Evaluate

Nvidia (NVDA) has become a household name, synonymous with high-performance graphics processing units (GPUs) and a leader in the burgeoning field of artificial intelligence (AI). But is now the right time to buy Nvidia stock? The answer, as with any investment, is complex and depends on a careful evaluation of several key factors. This article will explore three crucial elements to consider before adding NVDA to your portfolio.

1. The Unstoppable Rise of AI: A Major Growth Driver

Nvidia's recent meteoric rise is undeniably linked to the explosive growth of artificial intelligence. Their GPUs are not just for gaming anymore; they're the engines powering the AI revolution across various sectors. From data centers processing massive datasets for machine learning to the development of self-driving cars and advanced robotics, Nvidia's technology is at the heart of it all.

- Data Center Dominance: Nvidia's data center business is booming, fueled by the insatiable demand for powerful computing solutions for AI applications. This segment is a significant contributor to NVDA's revenue and is expected to continue its rapid expansion.

- AI Software Ecosystem: Nvidia isn't just selling hardware; they're building a robust software ecosystem around their GPUs, further strengthening their position in the AI market. This creates a powerful network effect, attracting developers and reinforcing their market leadership.

- Long-Term AI Growth: The long-term potential of AI is immense, and Nvidia is well-positioned to capitalize on this growth for years to come. This makes NVDA an attractive investment for those with a long-term investment horizon.

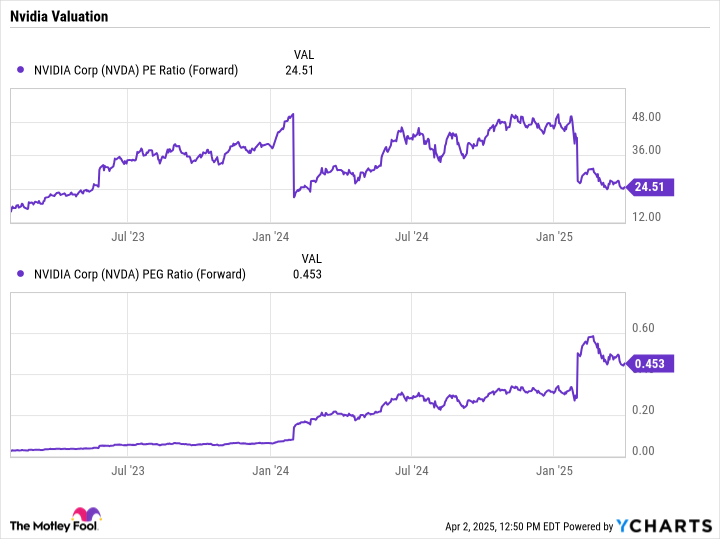

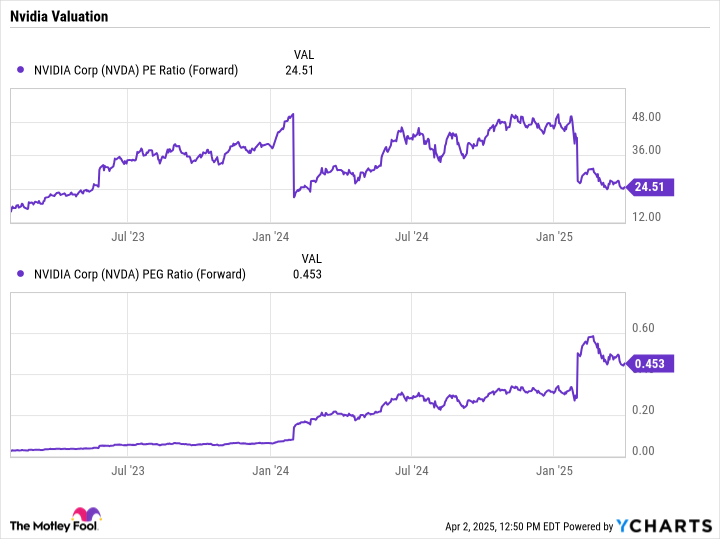

2. Valuation and Market Sentiment: Navigating the Price

While the future looks bright for Nvidia, it's crucial to assess its current valuation. The stock price has experienced significant gains recently, leading some analysts to question whether it's overvalued.

- Price-to-Earnings Ratio (P/E): Analyzing Nvidia's P/E ratio compared to its competitors and historical trends is essential. A high P/E ratio can indicate a potentially overvalued stock, while a low P/E ratio may suggest undervaluation. However, a high P/E ratio can also reflect high growth expectations.

- Market Volatility: The tech sector, and particularly chipmakers, is susceptible to market volatility. Investors need to consider their risk tolerance and understand the potential for price fluctuations.

- Analyst Ratings and Forecasts: Staying informed about analyst ratings and future earnings forecasts can provide valuable insights into market sentiment and future price projections. However, remember that these are predictions, not guarantees.

3. Competition and Technological Disruption: Staying Ahead of the Curve

While Nvidia currently dominates the market, competition is always a factor. Other companies are investing heavily in GPU technology and AI solutions, posing a potential threat to Nvidia's market share.

- AMD's Growing Presence: Advanced Micro Devices (AMD) is a significant competitor, offering its own range of GPUs and vying for market share in the data center and AI spaces.

- Technological Advancements: The rapid pace of technological advancement means that Nvidia needs to constantly innovate to maintain its leadership position. Failure to adapt could impact its future growth.

- Supply Chain Risks: Global supply chain disruptions can affect Nvidia's production and profitability, highlighting the importance of considering geopolitical factors.

Conclusion: A Calculated Risk?

Investing in Nvidia stock presents both significant opportunities and considerable risks. The company's strong position in the rapidly growing AI market is a compelling reason for optimism. However, a careful evaluation of its valuation, competitive landscape, and potential market volatility is crucial before making an investment decision. Consider diversifying your portfolio and conducting thorough due diligence before committing any funds. This article provides a starting point for your research; consulting with a qualified financial advisor is always recommended before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Nvidia Stock? Three Key Factors To Evaluate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Who Wins Lehecka Or Korda Atp Monte Carlo Masters 2025 Prediction

Apr 07, 2025

Who Wins Lehecka Or Korda Atp Monte Carlo Masters 2025 Prediction

Apr 07, 2025 -

Mixed Results For Usmnt In Milan Pulisics Success Musahs Setback

Apr 07, 2025

Mixed Results For Usmnt In Milan Pulisics Success Musahs Setback

Apr 07, 2025 -

Monday April 7th Nyt Connections Puzzle Solutions

Apr 07, 2025

Monday April 7th Nyt Connections Puzzle Solutions

Apr 07, 2025 -

Vale Percy Knight A Historical Perspective

Apr 07, 2025

Vale Percy Knight A Historical Perspective

Apr 07, 2025 -

Political Satire And Country Music Snls Take On Trump And Wallen

Apr 07, 2025

Political Satire And Country Music Snls Take On Trump And Wallen

Apr 07, 2025