Should You Buy Or Sell QUBT Stock Ahead Of Earnings Report?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy or Sell QUBT Stock Ahead of Earnings Report? Navigating the Uncertainty

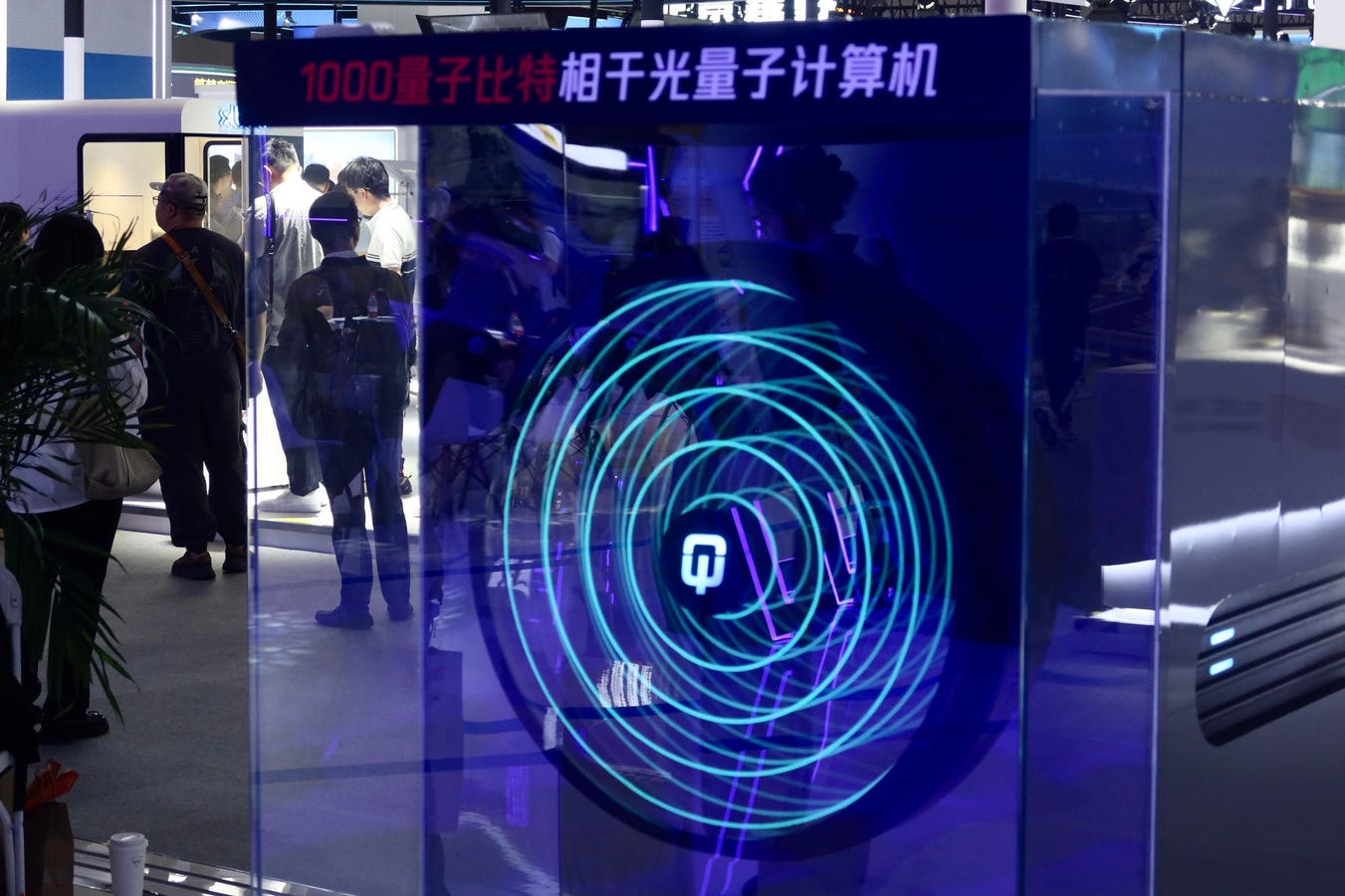

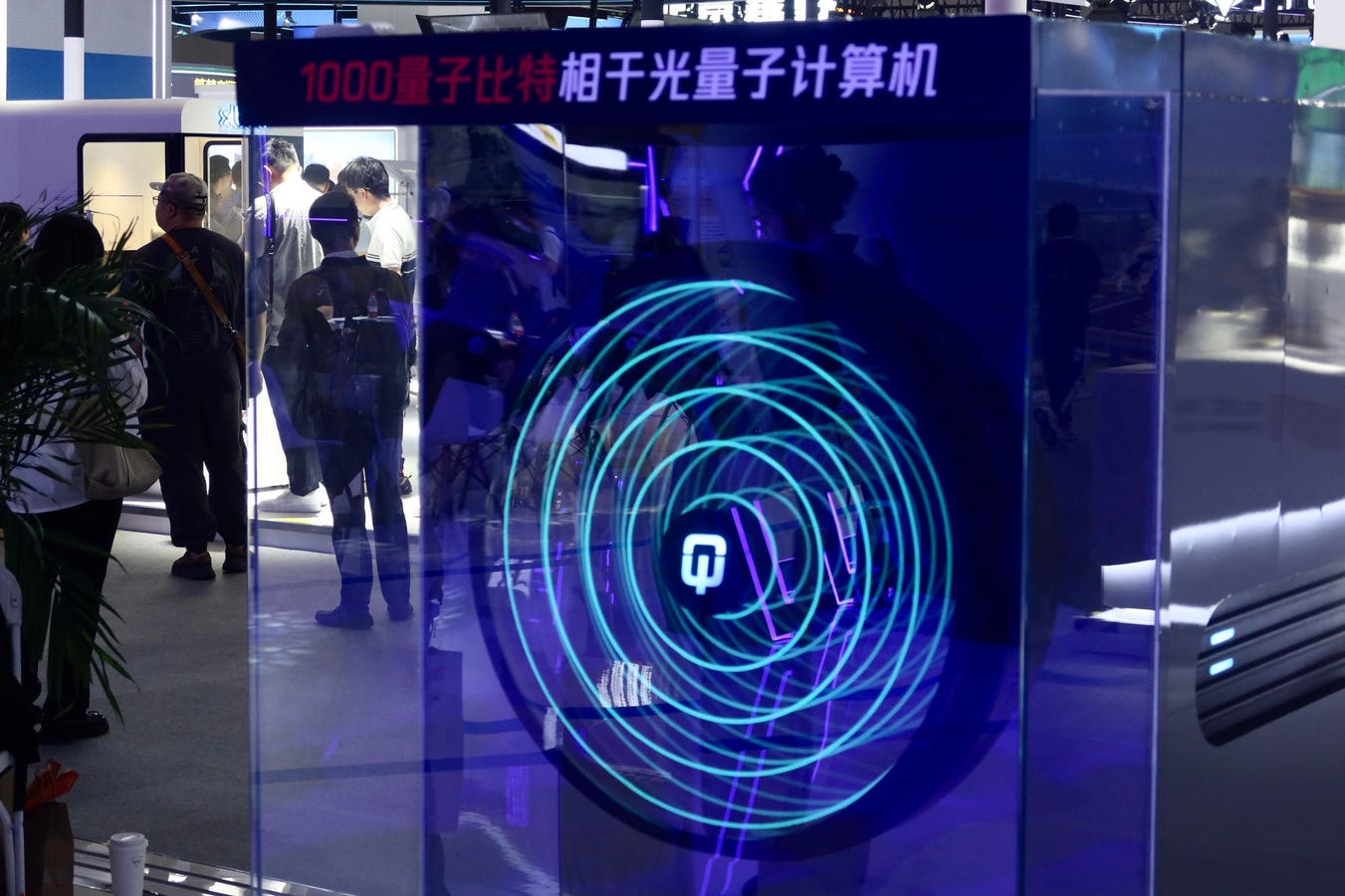

The upcoming earnings report for Quantum Blockchain Technologies (QUBT) has investors buzzing, prompting the crucial question: should you buy, sell, or hold? The stock's recent volatility underscores the need for careful analysis before making any investment decisions. This article delves into the key factors influencing QUBT's price, examining the potential risks and rewards ahead of the earnings announcement.

Understanding the Current QUBT Landscape:

Quantum Blockchain Technologies operates in the burgeoning but volatile cryptocurrency and blockchain technology sectors. This inherent risk is amplified by the company's relatively small size and recent market fluctuations. QUBT's stock price has shown significant swings in the past, reflecting the speculative nature of investments in this sector. Analyzing past performance is crucial, but it's not a reliable predictor of future success.

Factors to Consider Before the Earnings Report:

- Recent Market Trends: The broader cryptocurrency market significantly impacts QUBT's performance. A positive market trend could boost investor sentiment, while a downturn could trigger selling pressure. Keep a close eye on Bitcoin's price and overall market capitalization.

- Analyst Predictions: Examine recent analyst ratings and price targets for QUBT. While not foolproof, these predictions can offer insights into expert opinions on the company's future prospects. Diversify your research and don't rely solely on one source.

- Company News and Developments: Any recent announcements from QUBT regarding partnerships, product launches, or regulatory updates should be carefully considered. Positive news can drive up the stock price, while negative news can trigger a sell-off.

- Financial Health: Review QUBT's financial statements, focusing on revenue growth, profitability, and debt levels. A strong financial position generally instills greater investor confidence.

- Technical Analysis: Chart patterns and technical indicators can provide insights into potential price movements. However, technical analysis should be used in conjunction with fundamental analysis for a more comprehensive view.

The Risks of Trading on Earnings Reports:

Trading on earnings reports is inherently risky. The stock price can react dramatically, either positively or negatively, depending on whether the results meet or exceed expectations. Unexpected news or disappointments can lead to significant losses.

- Volatility: Expect increased volatility in the days leading up to and immediately following the earnings report.

- Market Sentiment: The overall market sentiment towards QUBT and the broader tech sector will play a significant role.

- Unforeseen Circumstances: Unexpected events, both company-specific and external, can significantly impact the stock price.

Strategies for Navigating the Uncertainty:

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification helps mitigate risk.

- Develop a Trading Plan: Establish clear entry and exit points based on your risk tolerance and investment goals. Avoid emotional decision-making.

- Stay Informed: Keep abreast of relevant news and developments related to QUBT and the broader market.

- Seek Professional Advice: If you are unsure about how to proceed, consult with a qualified financial advisor.

Conclusion:

Deciding whether to buy or sell QUBT stock before its earnings report requires careful consideration of numerous factors. Thorough research, risk management, and a well-defined investment strategy are crucial for navigating the inherent uncertainty. Remember that past performance is not indicative of future results, and investing in the volatile cryptocurrency sector always carries significant risk. Always invest responsibly and only with capital you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Or Sell QUBT Stock Ahead Of Earnings Report?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Panthers 6 Goal Outburst Pushes Maple Leafs To The Brink Of Elimination

May 17, 2025

Panthers 6 Goal Outburst Pushes Maple Leafs To The Brink Of Elimination

May 17, 2025 -

Analyzing The Trump Swift Connection A Look At Her Career Trajectory

May 17, 2025

Analyzing The Trump Swift Connection A Look At Her Career Trajectory

May 17, 2025 -

Space X Starship Nine Days Until Next Launch Attempt

May 17, 2025

Space X Starship Nine Days Until Next Launch Attempt

May 17, 2025 -

Wh 1000 Xm 6 Review Do Sonys New Headphones Beat Bose

May 17, 2025

Wh 1000 Xm 6 Review Do Sonys New Headphones Beat Bose

May 17, 2025 -

Chelsea Vs United Team News And Predicted Lineups

May 17, 2025

Chelsea Vs United Team News And Predicted Lineups

May 17, 2025