Should You Buy Or Sell QUBT Stock Ahead Of Its Next Earnings Report?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy or Sell QUBT Stock Ahead of its Next Earnings Report?

Navigating the Uncertainties Surrounding QuBit's Upcoming Financials

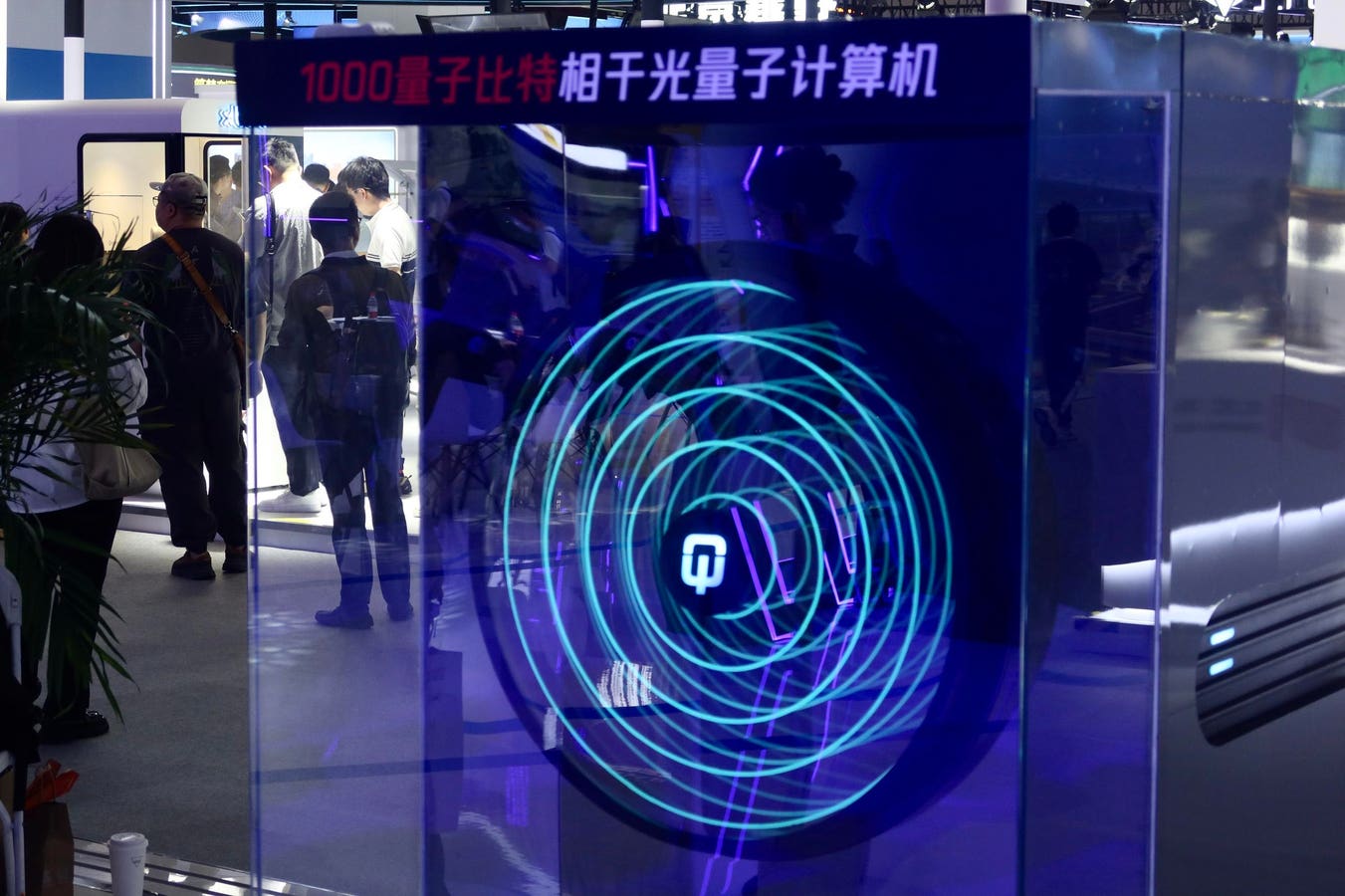

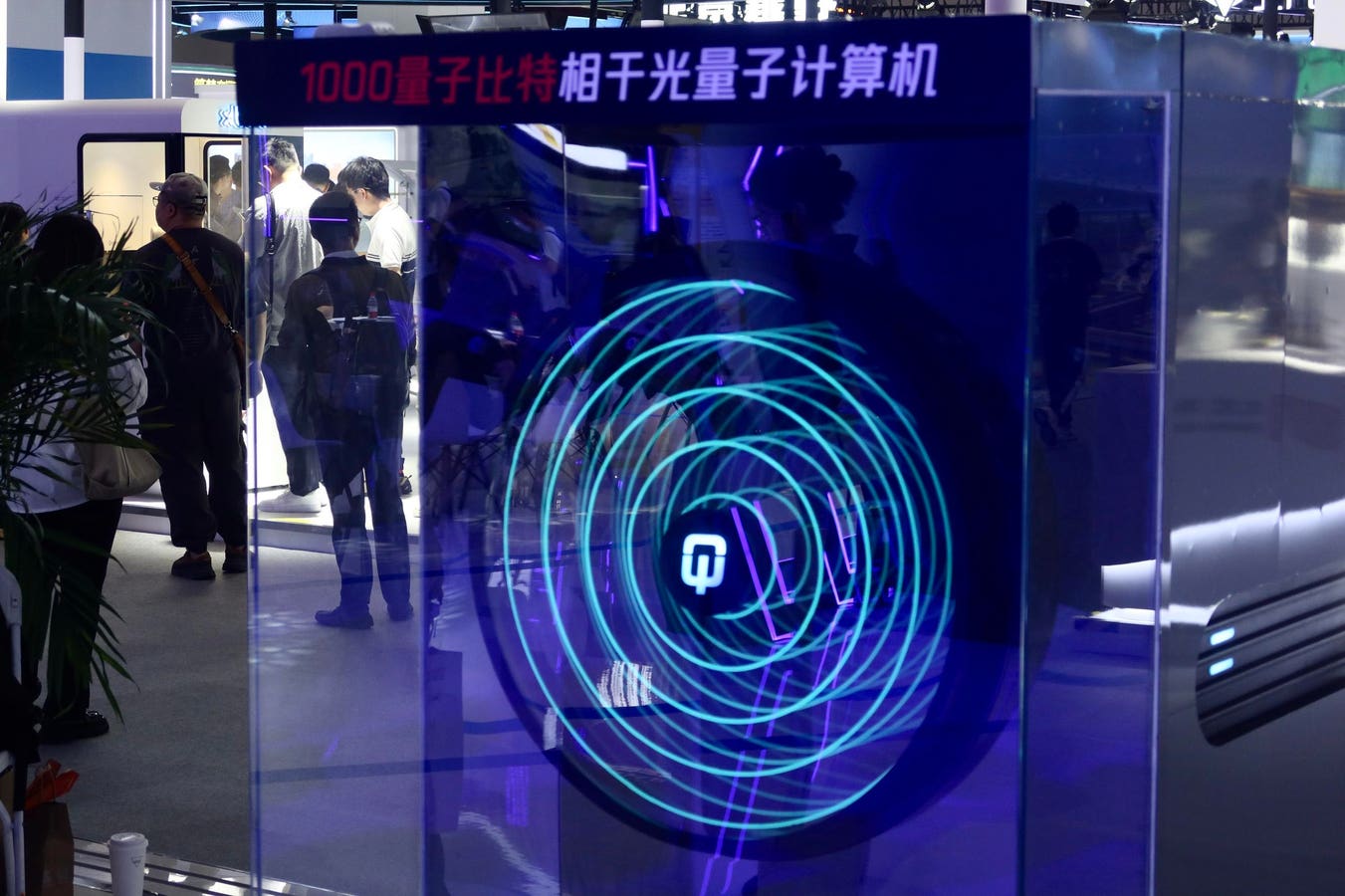

QuBit (QUBT), a prominent player in the [insert industry, e.g., customer data platform] sector, is gearing up for its next earnings report, leaving investors wondering: is it a buy, a sell, or a hold? The upcoming announcement carries significant weight, potentially influencing QUBT's stock price significantly. This article delves into the key factors investors should consider before making any decisions.

Analyzing QUBT's Recent Performance and Market Trends:

QUBT's recent performance has been [describe recent performance – e.g., a rollercoaster, showing strong growth, experiencing a downturn, etc.]. Several factors have contributed to this, including [mention key contributing factors, e.g., market competition, new product launches, macroeconomic conditions, etc.]. The overall market sentiment towards [mention relevant industry sector] stocks is currently [describe market sentiment – e.g., bullish, bearish, uncertain]. This broader context is crucial when evaluating QUBT's potential.

Key Factors to Consider Before the Earnings Report:

-

Analyst Expectations: Examining analyst ratings and price targets provides valuable insight. A consensus of positive predictions could suggest a potential upward trend following the earnings release, while overwhelmingly negative forecasts may point towards a price decline. Check reputable financial news sources for the latest analyst consensus.

-

Recent News and Developments: Any significant announcements—new partnerships, product launches, acquisitions, or regulatory changes—could dramatically impact QUBT's stock price. Stay updated on company news releases and relevant industry publications.

-

Historical Earnings Performance: Analyzing QUBT's past earnings reports can reveal patterns and trends. Comparing year-over-year growth and identifying any consistent strengths or weaknesses can help predict future performance. Look for trends in revenue growth, profitability, and expense management.

-

Competitive Landscape: QUBT's position within its industry is critical. Analyzing the performance of its competitors can provide context for understanding QUBT's relative strength and potential for future growth. Are competitors gaining market share? Are there innovative disruptions in the industry?

-

Financial Health: A thorough examination of QUBT's financial statements—including balance sheet, income statement, and cash flow statement—is essential. Key metrics such as debt levels, profitability margins, and cash reserves should be carefully evaluated.

Strategies for Informed Decision-Making:

Instead of solely reacting to the immediate impact of the earnings report, consider a long-term investment strategy. This may involve:

-

Diversification: Don't put all your eggs in one basket. Diversifying your portfolio across different asset classes and sectors mitigates risk.

-

Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of the stock price, can help reduce the impact of volatility.

-

Seeking Professional Advice: If unsure about your investment decisions, consult a qualified financial advisor.

Conclusion:

Predicting the precise impact of QUBT's next earnings report on its stock price is inherently challenging. However, by meticulously analyzing the aforementioned factors and employing a well-informed investment strategy, investors can significantly improve their chances of making sound decisions. Remember that investing always involves risk, and past performance is not indicative of future results. Stay informed, stay cautious, and invest wisely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Or Sell QUBT Stock Ahead Of Its Next Earnings Report?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Singapore Airlines Announces 7 45 Month Bonus For Fy 2025

May 16, 2025

Singapore Airlines Announces 7 45 Month Bonus For Fy 2025

May 16, 2025 -

Sinner Vs Alcaraz El Duelo Que Definira Una Final En Roma 2025

May 16, 2025

Sinner Vs Alcaraz El Duelo Que Definira Una Final En Roma 2025

May 16, 2025 -

Sony Wh 1000 Xm 6 Performance And Design Evaluation

May 16, 2025

Sony Wh 1000 Xm 6 Performance And Design Evaluation

May 16, 2025 -

Retour Sur Scene Guylaine Tremblay Et Denis Bouchard Dans La Piece Fallait Pas Dire Ca Cet Ete

May 16, 2025

Retour Sur Scene Guylaine Tremblay Et Denis Bouchard Dans La Piece Fallait Pas Dire Ca Cet Ete

May 16, 2025 -

Lck 2025 Co Streaming Soop Platform Grants Player Access

May 16, 2025

Lck 2025 Co Streaming Soop Platform Grants Player Access

May 16, 2025