Should You Buy Or Sell QUBT Stock Ahead Of Its Upcoming Earnings Report?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

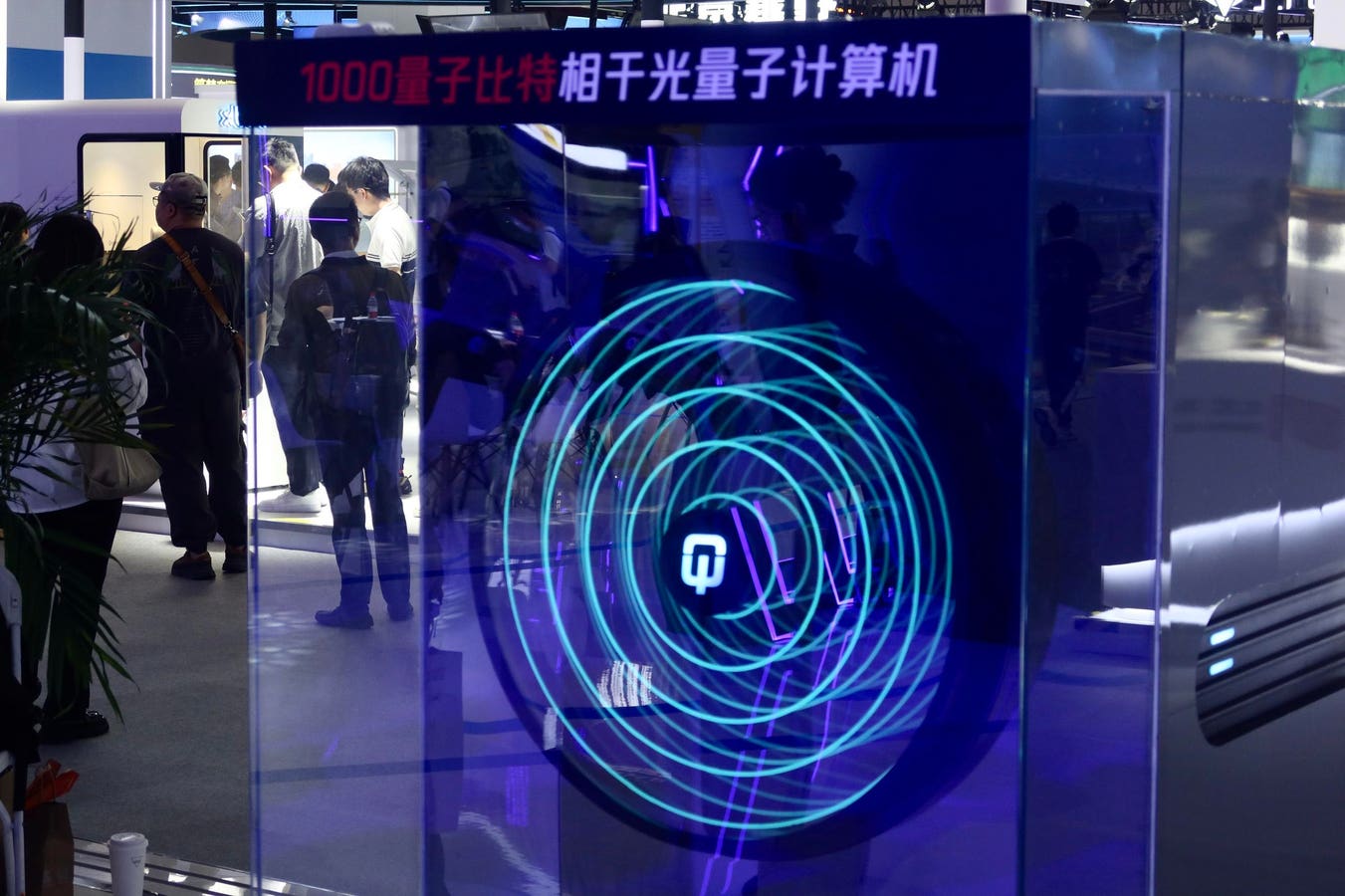

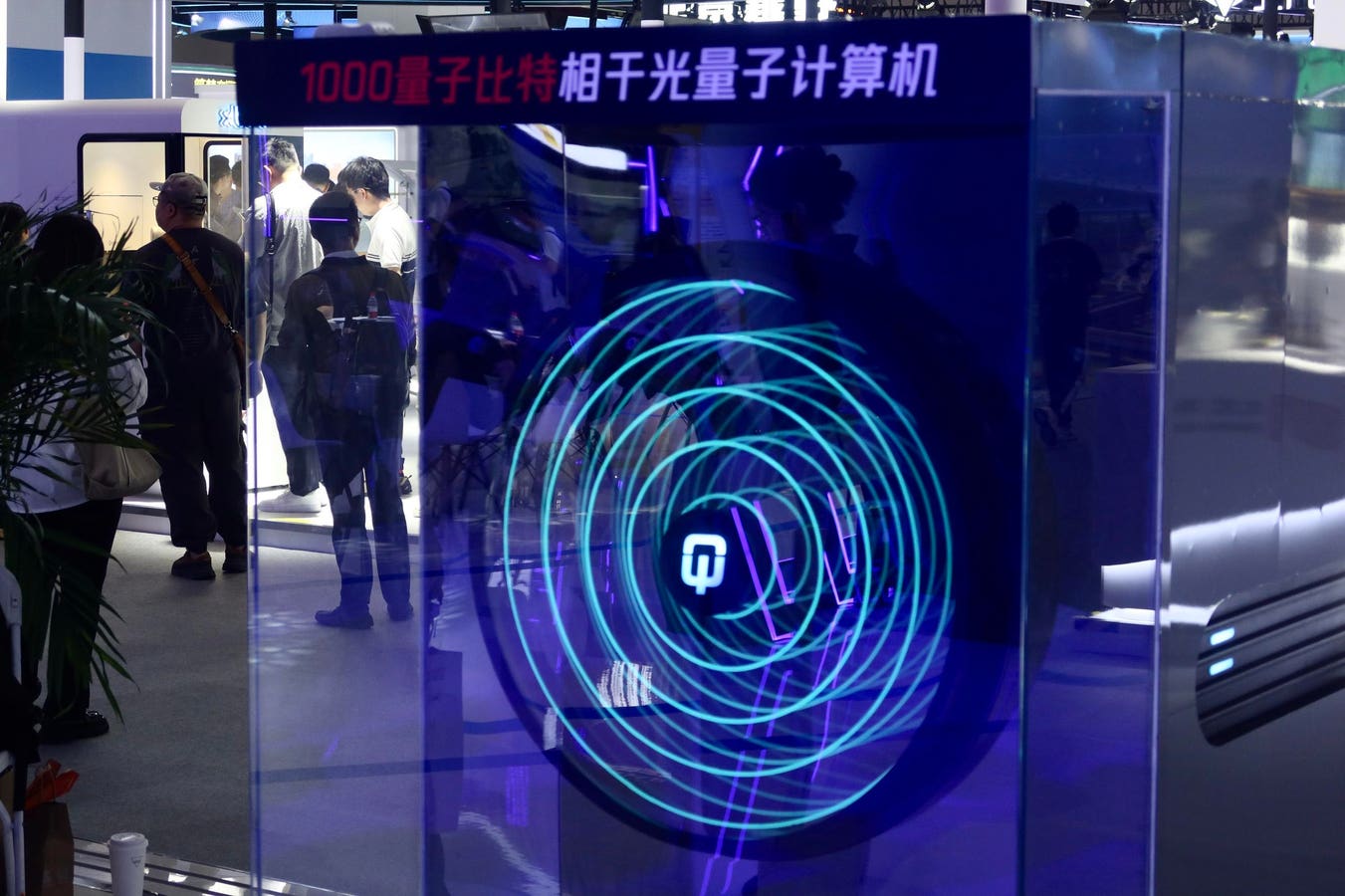

Should You Buy or Sell QUBT Stock Ahead of its Upcoming Earnings Report?

The upcoming earnings report for QUBT (assuming QUBT represents a publicly traded company; replace with the actual company name and ticker if different) has investors buzzing. Should you buy, sell, or hold onto your shares? Navigating the pre-earnings period can be tricky, but understanding the factors at play can significantly improve your investment strategy. This article analyzes QUBT's recent performance, upcoming catalysts, and potential market reactions to help you make an informed decision.

QUBT's Recent Performance: A Mixed Bag

QUBT (replace with the actual company name and ticker if different) has shown a mixed performance in recent months. While [mention specific positive developments, e.g., successful product launch, strategic partnership, positive industry trends], the company has also faced headwinds such as [mention specific challenges, e.g., increased competition, supply chain issues, macroeconomic concerns]. Analyzing these factors is crucial in predicting the market's reaction to the upcoming earnings report. Key performance indicators (KPIs) to watch include revenue growth, earnings per share (EPS), and gross margins. Any significant deviation from analysts' expectations could trigger substantial price volatility.

Analyzing Analyst Expectations and Price Targets

Before making any investment decisions, it's crucial to review the consensus estimates from financial analysts. Currently, the average price target for QUBT is [insert average price target from reputable sources], ranging from [insert lowest price target] to [insert highest price target]. Understanding the range of expectations helps gauge the potential upside and downside risks. Pay close attention to any recent revisions to these targets, as they may signal shifts in analyst sentiment. Remember that analyst predictions are not guarantees, and the actual results may differ significantly.

Potential Catalysts and Risks

Several factors could influence QUBT's stock price after the earnings release. Positive catalysts include:

- Exceeding Earnings Expectations: Surpassing analysts' predictions on revenue, EPS, and other key metrics could send the stock price soaring.

- Positive Guidance: An optimistic outlook for future quarters can boost investor confidence and drive up the share price.

- New Product Announcements or Partnerships: Strategic initiatives could signal future growth potential and positively impact the stock.

Conversely, several risks could lead to a decline in the stock price:

- Missing Earnings Expectations: Failing to meet analyst estimates could trigger a sell-off.

- Negative Guidance: A pessimistic outlook for future quarters could significantly dampen investor sentiment.

- Unexpected Challenges: Unforeseen obstacles, such as regulatory hurdles or increased competition, could negatively impact the stock's performance.

How to Approach Your Investment Decision

The decision to buy, sell, or hold QUBT stock before the earnings report depends on your individual risk tolerance and investment goals.

- Conservative Investors: Consider holding your existing position or even slightly reducing your exposure to mitigate potential losses if the earnings report disappoints.

- Aggressive Investors: If you believe QUBT is undervalued and has significant growth potential, the pre-earnings dip could present a buying opportunity. However, be prepared for potential volatility.

- Risk-Neutral Investors: Maintain your current position and wait for the earnings report before making any significant changes to your portfolio.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions. The stock market is inherently risky, and past performance is not indicative of future results. The information provided here is based on publicly available data and may not be completely accurate or up-to-date. Remember to invest wisely and responsibly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Or Sell QUBT Stock Ahead Of Its Upcoming Earnings Report?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Health Risks Associated With Obesity Insights From Queen Latifah

May 17, 2025

Health Risks Associated With Obesity Insights From Queen Latifah

May 17, 2025 -

Space X Starship Nine Days Until Next Launch Attempt

May 17, 2025

Space X Starship Nine Days Until Next Launch Attempt

May 17, 2025 -

Salman Rushdie Attack Attacker Sentenced Key Details And Aftermath

May 17, 2025

Salman Rushdie Attack Attacker Sentenced Key Details And Aftermath

May 17, 2025 -

Tsunoda Rues Stupid Mistake After Disappointing Imola Qualifying

May 17, 2025

Tsunoda Rues Stupid Mistake After Disappointing Imola Qualifying

May 17, 2025 -

Liverpool Crystal Palace Community Shield Fixture Confirmed For 2025

May 17, 2025

Liverpool Crystal Palace Community Shield Fixture Confirmed For 2025

May 17, 2025