Should You Buy Or Sell QUBT Stock? Pre-Earnings Quantum Computing Investment Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy or Sell QUBT Stock? Pre-Earnings Quantum Computing Investment Guide

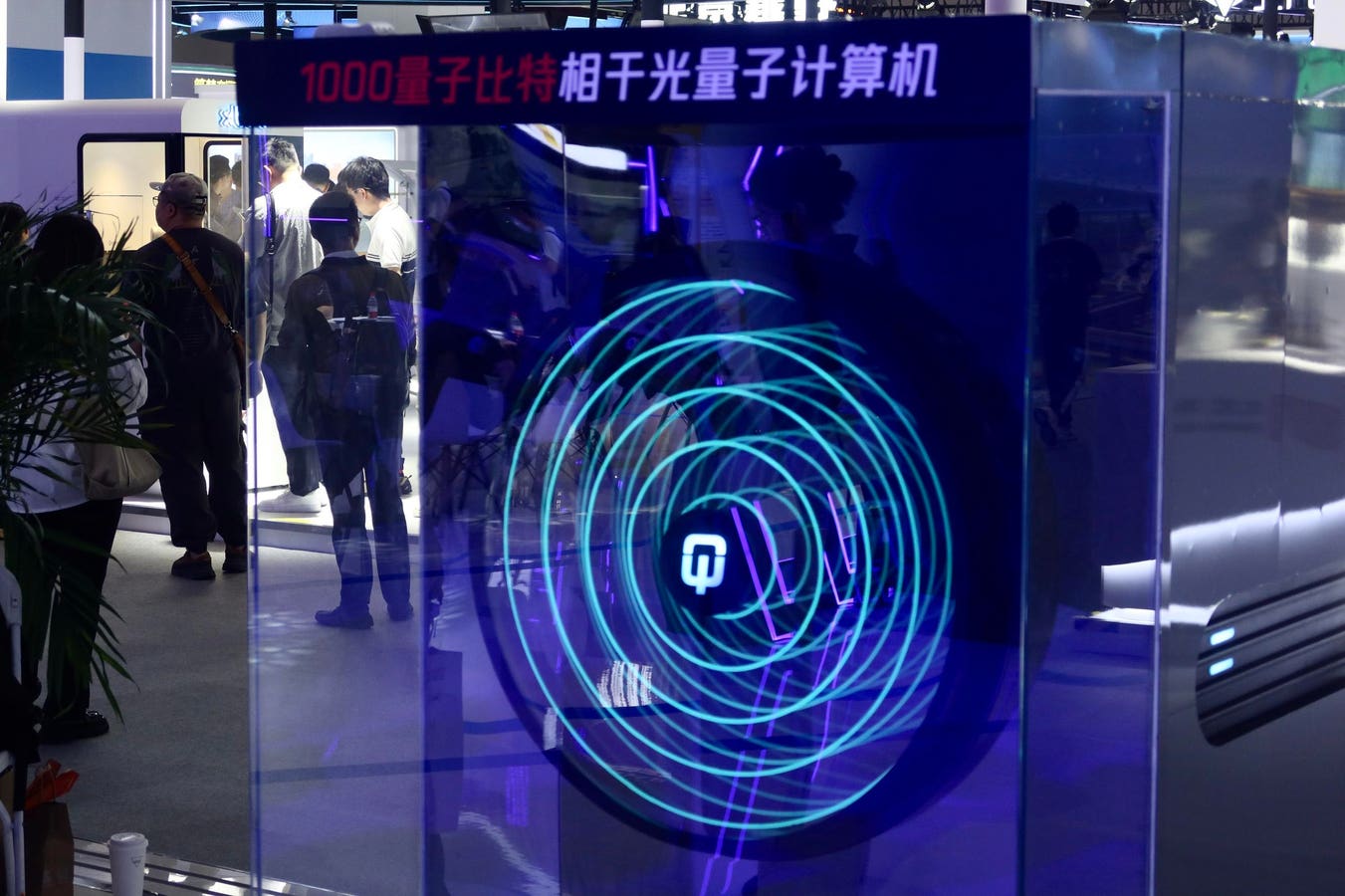

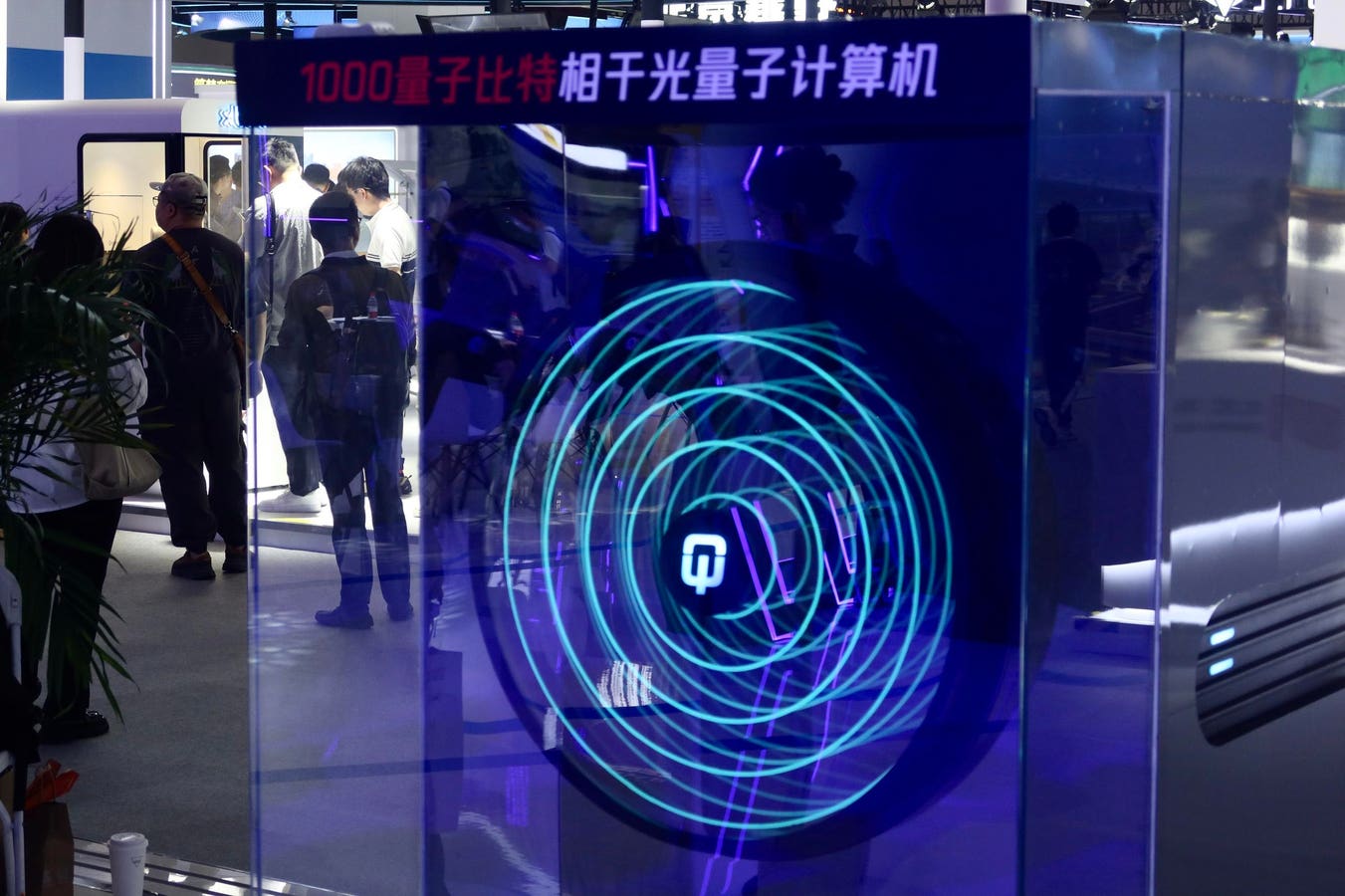

The quantum computing sector is buzzing with potential, and QUBT stock, a prominent player in this burgeoning field, is attracting significant investor attention. But with the company's earnings announcement looming, the question on everyone's mind is: should you buy, sell, or hold? This pre-earnings guide dives deep into the factors influencing QUBT's stock price and helps you make an informed investment decision.

Understanding QUBT's Position in the Quantum Computing Market

Before we delve into the buy/sell dilemma, it's crucial to understand QUBT's place within the competitive landscape of quantum computing. The company [insert QUBT's core business and technology here - e.g., focuses on developing cutting-edge quantum algorithms, specializes in quantum software development, is a leading provider of quantum computing hardware]. This specialization positions them [positively or negatively, depending on your research - e.g., uniquely within the market, as a strong competitor, with challenges to overcome]. Analyzing their competitive advantages and disadvantages is key to evaluating their future prospects.

Key Factors Influencing QUBT Stock Price Before Earnings

Several factors significantly impact QUBT's stock price in the lead-up to earnings announcements. These include:

- Market Sentiment: The overall investor sentiment towards the quantum computing sector significantly influences QUBT's performance. Positive news about advancements in quantum computing technology generally boosts investor confidence, while negative news or setbacks can lead to price declines.

- Industry News and Developments: Major breakthroughs or setbacks in quantum computing research from competitors or within the broader industry will directly impact QUBT's stock. Keep an eye on news concerning rival companies and technological advancements.

- Financial Performance Expectations: Analysts' predictions and consensus estimates for QUBT's earnings play a vital role. Any significant deviation from these expectations, either positive or negative, can lead to substantial price fluctuations.

- Technological Advancements: Any announcements regarding QUBT's own technological breakthroughs or milestones will likely cause a surge in its stock value. Keep an eye on press releases and company updates.

Analyzing QUBT's Financials: Key Metrics to Watch

To make a sound investment decision, carefully scrutinize QUBT's financial performance in the following areas:

- Revenue Growth: Is QUBT demonstrating consistent revenue growth? This is a crucial indicator of the company's ability to generate income and attract customers.

- Profitability: Is QUBT profitable, or is it operating at a loss? While losses are common in early-stage technology companies, understanding the trajectory of profitability is important.

- Cash Flow: A strong cash flow indicates financial stability. Analyze QUBT's ability to generate positive cash flow from its operations.

- Debt Levels: High levels of debt can pose risks. Assess QUBT's debt-to-equity ratio to gauge its financial health.

Should You Buy, Sell, or Hold? A Cautious Approach

The decision to buy, sell, or hold QUBT stock before earnings is highly dependent on your personal risk tolerance and investment goals. There's inherent risk in investing in the quantum computing sector, a rapidly evolving and still relatively nascent field.

- Buy: Consider buying QUBT stock if you have a long-term investment horizon, a high risk tolerance, and believe in QUBT's long-term potential. Positive pre-earnings sentiment and strong financial projections could strengthen this case.

- Sell: Consider selling if you're concerned about the risks associated with the quantum computing sector or if you need to reduce your exposure to high-growth, high-risk investments.

- Hold: If you already own QUBT stock and are comfortable with the risks, holding might be a viable strategy. Monitor the market closely and be prepared to react based on the actual earnings announcement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Or Sell QUBT Stock? Pre-Earnings Quantum Computing Investment Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ine Security Alert Bridging The Gap Between Vulnerability Alerts And Effective Defense

May 16, 2025

Ine Security Alert Bridging The Gap Between Vulnerability Alerts And Effective Defense

May 16, 2025 -

Priyanka Chopra And Nick Jonass Met Gala 2024 A Hat Tastic Moment And A Husbands Subtle Reaction

May 16, 2025

Priyanka Chopra And Nick Jonass Met Gala 2024 A Hat Tastic Moment And A Husbands Subtle Reaction

May 16, 2025 -

Political Fallout Trumps Taylor Swift Hotness Remark Fuels Controversy

May 16, 2025

Political Fallout Trumps Taylor Swift Hotness Remark Fuels Controversy

May 16, 2025 -

Ai Takes Center Stage Ilms Experimental Star Wars Short Film

May 16, 2025

Ai Takes Center Stage Ilms Experimental Star Wars Short Film

May 16, 2025 -

Ryder Cup 2023 Deciphering Jon Rahms Cryptic Its Not Up To Me Remark

May 16, 2025

Ryder Cup 2023 Deciphering Jon Rahms Cryptic Its Not Up To Me Remark

May 16, 2025