Should You Buy Palo Alto Networks Or Nvidia After The Nasdaq Sell-Off?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Palo Alto Networks or Nvidia After the Nasdaq Sell-Off?

The recent Nasdaq sell-off has left many investors wondering where to put their money. Two tech giants, Palo Alto Networks (PANW) and Nvidia (NVDA), have emerged as potential buys, but which one offers a better investment opportunity in this volatile market? This analysis will delve into both companies, comparing their strengths, weaknesses, and future prospects to help you make an informed decision.

The Nasdaq Dip: A Buying Opportunity or a Warning Sign?

The recent downturn in the Nasdaq has created a complex investment landscape. While fear reigns supreme for some, others see it as a chance to snatch up undervalued stocks. Both Palo Alto Networks and Nvidia, though significantly impacted by the sell-off, represent different sectors within the tech industry, offering distinct risk-reward profiles.

Palo Alto Networks (PANW): Cybersecurity Strength in a Turbulent World

Palo Alto Networks is a leading cybersecurity company, providing a wide range of solutions for businesses of all sizes. Their strong position in the ever-growing cybersecurity market is a significant advantage.

Strengths of Palo Alto Networks:

- Strong Market Position: PANW holds a leading position in the enterprise cybersecurity market, benefiting from the increasing demand for robust security solutions.

- Recurring Revenue Model: A substantial portion of PANW's revenue comes from subscription-based services, providing predictable cash flow and reducing reliance on one-time sales.

- Consistent Growth: The company has demonstrated consistent growth in revenue and earnings, showcasing its resilience even amidst market fluctuations.

- Focus on Innovation: PANW continually invests in research and development, ensuring it stays at the forefront of cybersecurity innovation.

Weaknesses of Palo Alto Networks:

- Valuation: Even after the recent sell-off, PANW's valuation might still be considered high by some investors.

- Competition: The cybersecurity market is competitive, with numerous established players and emerging startups vying for market share.

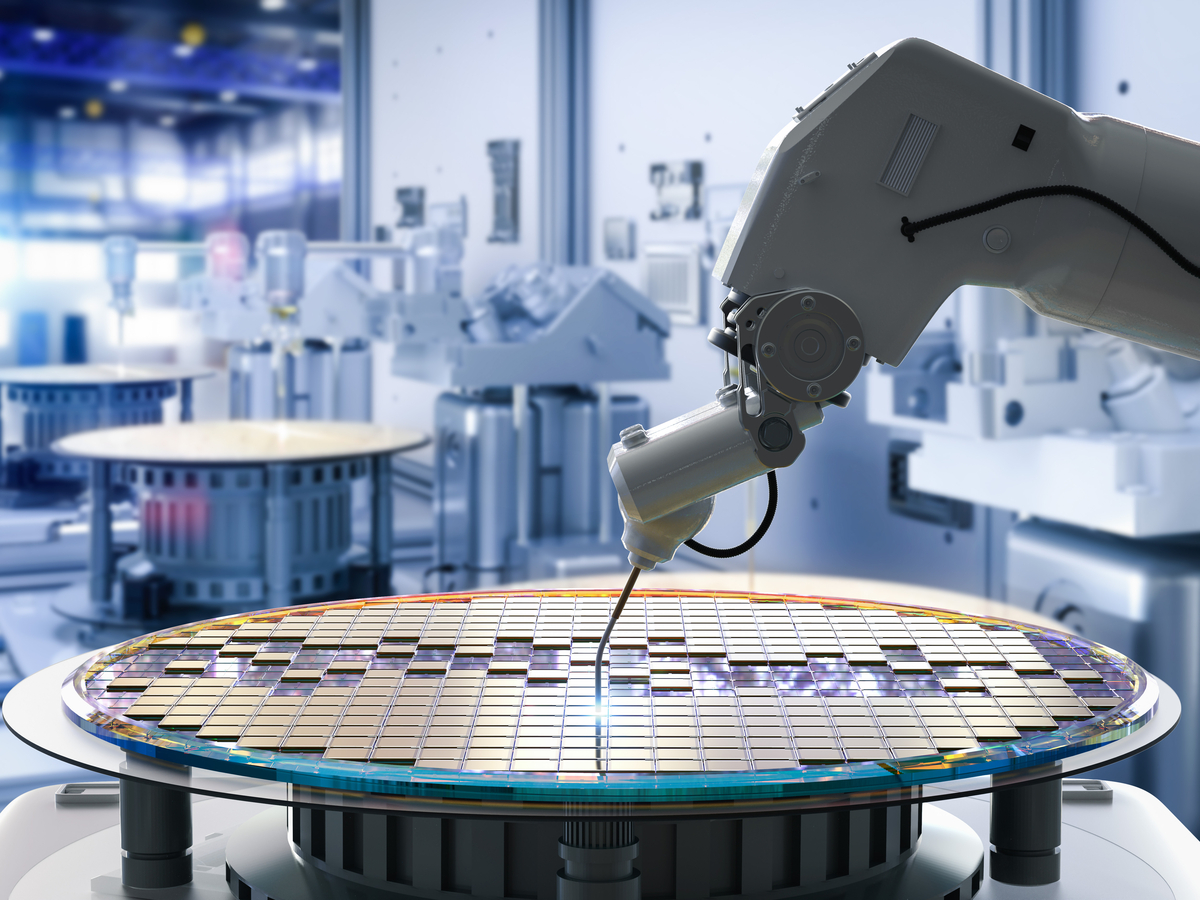

Nvidia (NVDA): The AI Powerhouse

Nvidia, on the other hand, is a dominant player in the artificial intelligence (AI) revolution. Its GPUs are crucial for powering AI and machine learning applications, placing it at the heart of this rapidly expanding technological field.

Strengths of Nvidia:

- AI Dominance: NVDA's GPUs are essential for training and deploying AI models, giving it a strong foothold in the booming AI market.

- Data Center Growth: The increasing demand for high-performance computing in data centers fuels NVDA's growth.

- Diversified Revenue Streams: NVDA's revenue streams extend beyond gaming, encompassing data centers, automotive, and other high-growth sectors.

Weaknesses of Nvidia:

- Overreliance on AI: While AI is a massive market, over-reliance on a single sector presents a degree of risk.

- Supply Chain Challenges: Like many tech companies, NVDA faces potential supply chain disruptions that can impact production and sales.

- Valuation Concerns: Similar to PANW, NVDA's valuation remains a point of discussion amongst investors.

Which Stock to Choose? A Comparative Analysis

The choice between PANW and NVDA depends heavily on your risk tolerance and investment horizon. PANW offers a more stable, albeit potentially slower-growth, investment in a mature market. NVDA, on the other hand, represents a higher-risk, higher-reward opportunity in a rapidly expanding sector.

- Lower Risk, Slower Growth: Investors seeking stability and predictable returns might prefer Palo Alto Networks.

- Higher Risk, Higher Potential Reward: Those with a higher risk tolerance and a longer investment horizon might favor Nvidia's growth potential.

Conclusion: Due Diligence is Key

Ultimately, the decision of whether to buy Palo Alto Networks or Nvidia after the Nasdaq sell-off requires thorough due diligence. Consider your personal investment goals, risk tolerance, and a comprehensive analysis of both companies' financial performance and future prospects before making any investment decisions. Consult with a financial advisor if needed to determine which stock best aligns with your individual circumstances. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Palo Alto Networks Or Nvidia After The Nasdaq Sell-Off?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Microsoft Survived And Thrived For 50 Years A Business Case Study

Apr 07, 2025

How Microsoft Survived And Thrived For 50 Years A Business Case Study

Apr 07, 2025 -

Digital Markets Act X Apple And Meta Hit With Record Eu Fines For Anti Competitive Practices

Apr 07, 2025

Digital Markets Act X Apple And Meta Hit With Record Eu Fines For Anti Competitive Practices

Apr 07, 2025 -

Jiri Lehecka Vs Sebastian Korda Monte Carlo Masters 2025 Preview And Prediction

Apr 07, 2025

Jiri Lehecka Vs Sebastian Korda Monte Carlo Masters 2025 Preview And Prediction

Apr 07, 2025 -

Tariff Impact Analyzing The Decline Of 3 Major Tech Stocks

Apr 07, 2025

Tariff Impact Analyzing The Decline Of 3 Major Tech Stocks

Apr 07, 2025 -

Trump Tariffs And Market Crash Rs 20 16 Lakh Crore Investor Wealth Lost

Apr 07, 2025

Trump Tariffs And Market Crash Rs 20 16 Lakh Crore Investor Wealth Lost

Apr 07, 2025