Should You Buy This AI Stock After Its Significant Price Drop?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy This AI Stock After its Significant Price Drop?

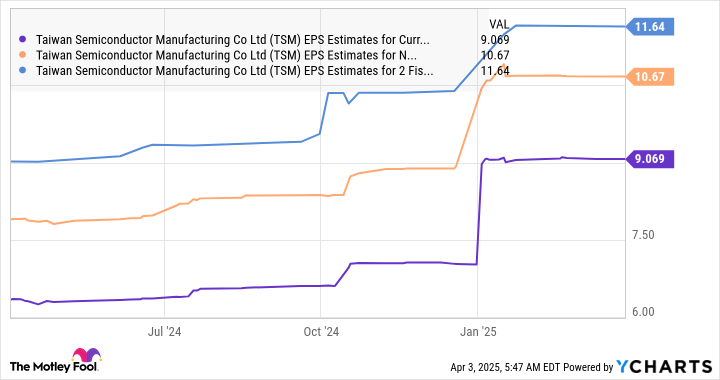

The artificial intelligence (AI) sector is booming, but recent market volatility has sent shockwaves through even the most promising AI stocks. Many investors are now asking: is this a buying opportunity, or a sign of deeper trouble? One company in particular has seen a significant price drop, sparking intense debate among analysts and retail investors alike. Let's delve into the factors to consider before deciding whether to jump in.

The AI Stock in Question: [Insert Company Name Here]

[Insert Company Name Here] (Ticker Symbol: [Insert Ticker Symbol Here]) has experienced a notable price decline in recent weeks/months, dropping [Percentage]% from its peak. This drop has been attributed to a variety of factors, including [mention specific reasons, e.g., investor concerns about future earnings, broader market downturn, competition from other AI companies, etc.]. However, understanding the underlying reasons is crucial before making any investment decisions.

Reasons for the Price Drop:

- Market Sentiment: The overall market's performance significantly impacts individual stocks, especially in volatile sectors like AI. A broader market downturn can lead to sell-offs, regardless of a company's individual performance.

- Profitability Concerns: Investors are closely scrutinizing the profitability of AI companies. While many show strong revenue growth, concerns about achieving sustainable profitability in the long term can trigger price drops.

- Competitive Landscape: The AI sector is incredibly competitive. New entrants and advancements from established players can quickly shift market share and investor sentiment.

- Specific Company Challenges: [Insert Company Name Here] may be facing unique challenges, such as supply chain issues, regulatory hurdles, or internal restructuring. Thoroughly researching these specific factors is vital.

Is it a Buying Opportunity? A Deeper Dive:

While the price drop presents a potentially attractive entry point, investors must proceed cautiously. Before considering a purchase, you should:

- Analyze the Fundamentals: Go beyond the headline price drop and scrutinize the company's financial statements, including revenue growth, profit margins, and debt levels.

- Evaluate the Long-Term Vision: Does the company have a clear and compelling long-term strategy? Are its products or services poised for continued growth and adoption?

- Assess the Competitive Advantage: What sets [Insert Company Name Here] apart from its competitors? Does it possess a sustainable competitive advantage that will ensure its continued success?

- Consider the Risk Tolerance: Investing in AI stocks inherently carries a higher degree of risk. Ensure the investment aligns with your overall risk tolerance and investment portfolio.

Expert Opinions & Analyst Ratings:

Several financial analysts have weighed in on [Insert Company Name Here]'s recent performance. [Summarize key analyst opinions and ratings, citing reputable sources. Include a range of perspectives, both bullish and bearish].

Conclusion: Proceed with Caution and Due Diligence

The significant price drop in [Insert Company Name Here]'s stock presents a complex situation. While it might offer a compelling buying opportunity for some, it's crucial to conduct thorough due diligence before making any investment decisions. Understanding the underlying reasons for the price drop, assessing the company's long-term prospects, and considering your own risk tolerance are all critical factors to evaluate. Remember, investing in the stock market always carries risk, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Keywords: AI stock, AI investment, [Insert Company Name Here], [Insert Ticker Symbol Here], stock market, price drop, buying opportunity, investment strategy, artificial intelligence, technology stock, market analysis, financial analysis, risk assessment, due diligence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy This AI Stock After Its Significant Price Drop?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gather Round Doubt For Key Crows Midfielder

Apr 08, 2025

Gather Round Doubt For Key Crows Midfielder

Apr 08, 2025 -

East Enders Stars Unexpected Exit Its Not A Big Thing

Apr 08, 2025

East Enders Stars Unexpected Exit Its Not A Big Thing

Apr 08, 2025 -

Benarkah Ikn Diserbu Tikus Saat Libur Lebaran Otorita Jelaskan

Apr 08, 2025

Benarkah Ikn Diserbu Tikus Saat Libur Lebaran Otorita Jelaskan

Apr 08, 2025 -

Controversy Erupts Dmitry Bivols Lawyers Justification For Vacating Belt Questioned

Apr 08, 2025

Controversy Erupts Dmitry Bivols Lawyers Justification For Vacating Belt Questioned

Apr 08, 2025 -

From Walford To Louisa Lytton On Leaving East Enders And Whats Next

Apr 08, 2025

From Walford To Louisa Lytton On Leaving East Enders And Whats Next

Apr 08, 2025