Should You Buy This Promising AI Stock After Its 25% Fall? (Before April 17)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy This Promising AI Stock After its 25% Fall? (Before April 17)

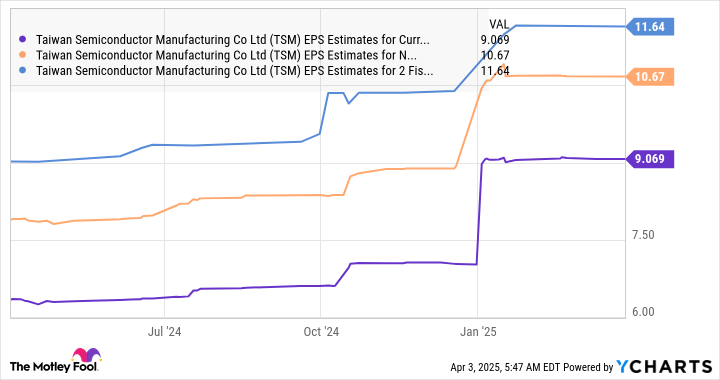

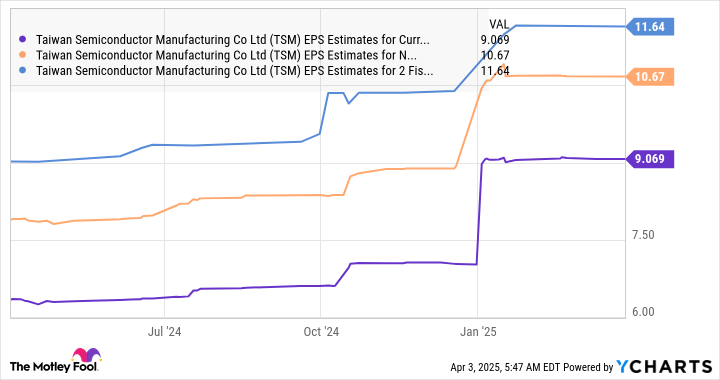

Artificial intelligence (AI) is booming, and investors are scrambling to get a piece of the action. One particular AI stock has recently experienced a significant 25% drop, leaving many wondering: is this a buying opportunity, or a sign of trouble ahead? Before April 17th, let's delve into the factors you should consider before making a decision.

The recent downturn has sparked considerable debate amongst financial analysts and individual investors alike. While some see this as a temporary setback, others are more cautious. Understanding the underlying reasons for the price drop is crucial before making any investment decisions.

Understanding the Market Volatility

The tech sector, and particularly AI stocks, has been experiencing heightened volatility in recent months. Several factors contribute to this instability:

- Rising Interest Rates: The Federal Reserve's efforts to combat inflation have led to increased interest rates, making borrowing more expensive for companies and impacting investor sentiment across the board.

- Geopolitical Uncertainty: Global events, such as the ongoing conflict in Ukraine, contribute to market uncertainty and risk aversion, impacting even the most promising growth stocks.

- Profit-Taking: After a period of significant growth, some investors may choose to take profits, leading to a sell-off that can amplify market fluctuations.

- Specific Company Challenges: It's vital to analyze the specific challenges faced by the company in question. Did they miss earnings expectations? Are there concerns about their product development roadmap? A thorough due diligence is essential.

Analyzing the AI Stock's Fundamentals

Before jumping into any investment decision, you must perform a thorough analysis of the company's fundamentals. This includes:

- Revenue Growth: Is the company showing consistent and substantial revenue growth? A strong track record indicates a healthy business model.

- Market Position: What is the company's competitive landscape? Does it hold a significant market share, or is it facing fierce competition?

- Innovation: Is the company continually innovating and developing new AI technologies? Staying ahead of the curve is crucial in the fast-paced AI industry.

- Financial Health: Examine the company's balance sheet, looking at metrics like debt levels and cash flow. A strong financial position provides a buffer against economic downturns.

Note: While we're discussing a hypothetical AI stock, remember to always perform your own thorough research before investing. This article serves as a general guide and not specific financial advice. Consult with a qualified financial advisor before making any investment decisions.

The Case for Buying the Dip

Despite the recent downturn, there are reasons to believe this AI stock could represent a compelling investment opportunity. The 25% drop might present a compelling entry point for long-term investors with a high-risk tolerance. The underlying technology remains promising, and the long-term growth potential of the AI market remains significant.

The Case for Caution

However, it's essential to proceed with caution. The recent price drop might indicate deeper underlying issues. Thorough due diligence is critical to assess the company's long-term viability and its ability to navigate the current market challenges.

Conclusion: Weigh the Risks and Rewards

The decision of whether or not to buy this AI stock after its 25% fall depends on your individual risk tolerance, investment horizon, and a comprehensive analysis of the company's fundamentals and the broader market conditions. Remember, investing in the stock market always carries risk, and there's no guarantee of future returns. Before April 17th, and beyond, make informed decisions based on thorough research and a clear understanding of your own investment goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy This Promising AI Stock After Its 25% Fall? (Before April 17). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Top New Movies On Hulu In April 2025 Your Streaming Guide

Apr 07, 2025

Top New Movies On Hulu In April 2025 Your Streaming Guide

Apr 07, 2025 -

Bybit Hack Investigation The Role Of De Fis Enhanced Transparency

Apr 07, 2025

Bybit Hack Investigation The Role Of De Fis Enhanced Transparency

Apr 07, 2025 -

Mediocre Botin Para El Barca Insuficiente Para Sus Aspiraciones

Apr 07, 2025

Mediocre Botin Para El Barca Insuficiente Para Sus Aspiraciones

Apr 07, 2025 -

Kenan Thompson Discusses Future With Saturday Night Live

Apr 07, 2025

Kenan Thompson Discusses Future With Saturday Night Live

Apr 07, 2025 -

No Federal Funding For Illegal Alien Shelter Hud Secretarys Statement

Apr 07, 2025

No Federal Funding For Illegal Alien Shelter Hud Secretarys Statement

Apr 07, 2025