Should You Invest In Broadcom (AVGO)? Wall Street Analysts Weigh In.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in Broadcom (AVGO)? Wall Street Analysts Weigh In.

Broadcom (AVGO), a semiconductor giant, has seen its stock price fluctuate recently, leaving investors wondering: is now the time to buy, sell, or hold? The tech sector is notoriously volatile, and understanding the expert opinions is crucial before making any investment decisions. This article delves into the current Wall Street sentiment surrounding Broadcom, examining analyst ratings, price targets, and the factors driving their opinions.

Broadcom's Recent Performance and Future Outlook:

Broadcom's success hinges on its diverse portfolio, spanning infrastructure software, semiconductor solutions, and networking equipment. Recent quarterly earnings reports have shown a mixed bag, with some exceeding expectations and others falling slightly short. This inconsistency contributes to the divergence in analyst opinions. Key factors influencing these reports include the global chip shortage, increasing demand for 5G infrastructure, and the ongoing competition within the semiconductor industry.

What the Analysts Say:

The consensus among Wall Street analysts is cautiously optimistic. While there's no unanimous "buy" recommendation, a significant portion of analysts maintain a "buy" or "overweight" rating on AVGO stock. However, the price targets vary considerably, reflecting the uncertainty surrounding future growth.

-

Positive Sentiment: Many analysts highlight Broadcom's strong market position, diverse revenue streams, and potential for future growth driven by the ongoing expansion of 5G networks and cloud computing. The company's consistent dividend payouts are also a significant draw for income-seeking investors. They see the recent dips as potential buying opportunities for long-term investors.

-

Cautious Outlook: Conversely, some analysts express concern about the cyclical nature of the semiconductor industry and the potential impact of geopolitical factors and economic slowdowns. Concerns about competition from other chipmakers and the possibility of future supply chain disruptions also contribute to their more reserved outlook.

Key Factors Influencing Analyst Ratings:

Several key factors are shaping the analyst community's perspective on Broadcom:

- Revenue Growth: Sustained revenue growth is paramount. Analysts are closely monitoring Broadcom's ability to maintain its market share and expand into new markets.

- Profit Margins: Maintaining healthy profit margins is crucial in a competitive environment. Analysts are scrutinizing Broadcom's cost structure and pricing strategies.

- Innovation: Continuous innovation is key to staying ahead of the competition. Analysts assess Broadcom's research and development efforts and its ability to bring new products to market.

- Global Economic Conditions: The overall economic climate significantly impacts the semiconductor industry. Analysts consider macroeconomic factors when formulating their forecasts.

- Geopolitical Risks: Geopolitical instability can disrupt supply chains and impact demand. Analysts are mindful of these external risks.

Should You Invest? A Balanced Perspective:

The decision of whether or not to invest in Broadcom (AVGO) is ultimately a personal one. While Wall Street analysts offer valuable insights, they are not guarantees of future performance. Before making any investment decisions, consider your own risk tolerance, investment timeline, and diversification strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Keywords: Broadcom, AVGO, stock, investment, Wall Street, analysts, semiconductor, technology, 5G, cloud computing, revenue, profit, market share, risk, buy, sell, hold, price target, financial advice, investment strategy, earnings report.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In Broadcom (AVGO)? Wall Street Analysts Weigh In.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Panama Ports Did Li Ka Shings Retirement Mask A Larger Controversy

May 12, 2025

Panama Ports Did Li Ka Shings Retirement Mask A Larger Controversy

May 12, 2025 -

Jasmine Rices Emotional Journey Personal Loss Before Britains Got Talent Audition

May 12, 2025

Jasmine Rices Emotional Journey Personal Loss Before Britains Got Talent Audition

May 12, 2025 -

Arne Slot Addresses Trent Alexander Arnold And Liverpools Right Back Situation

May 12, 2025

Arne Slot Addresses Trent Alexander Arnold And Liverpools Right Back Situation

May 12, 2025 -

Wolfspeed Issues Going Concern Warning Shares Crash 26

May 12, 2025

Wolfspeed Issues Going Concern Warning Shares Crash 26

May 12, 2025 -

Shavkat Rakhmonovs Title Shot Delayed Della Maddalenas Argument For Makhachev

May 12, 2025

Shavkat Rakhmonovs Title Shot Delayed Della Maddalenas Argument For Makhachev

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

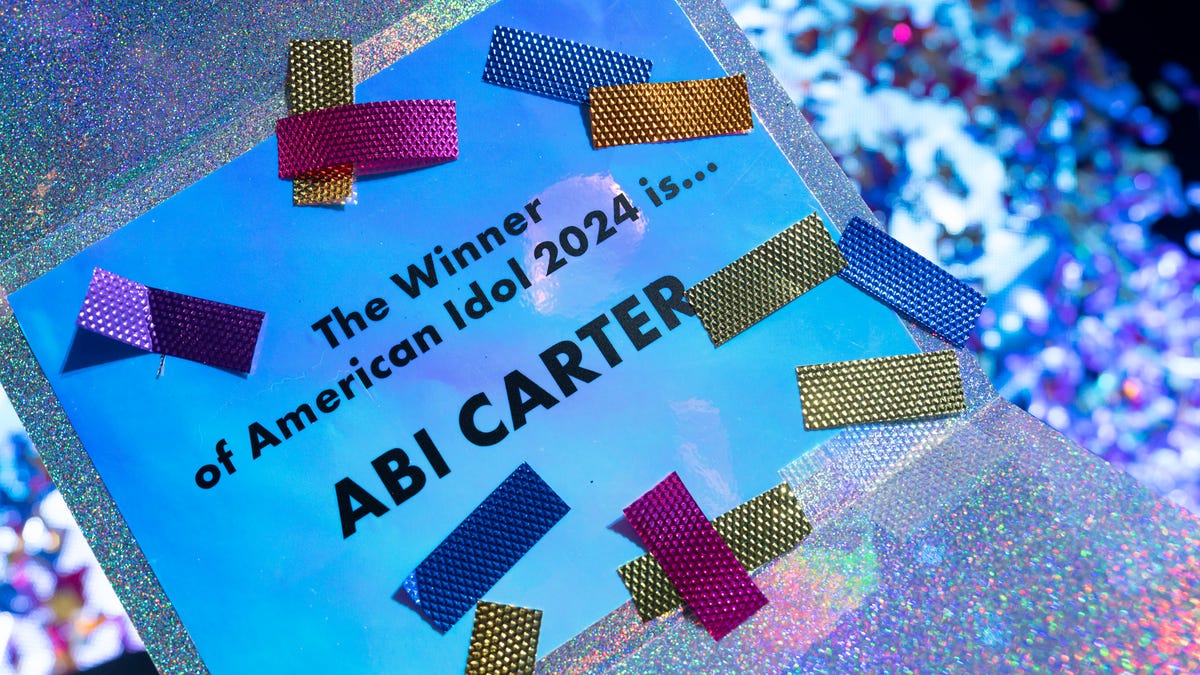

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025