Significant Crypto Market Rally: $330B Gain And The Changing US Regulatory Landscape

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Crypto Market Rally: $330B Gain and the Shifting Sands of US Regulation

The cryptocurrency market has experienced a dramatic surge, adding a staggering $330 billion to its total market capitalization in a relatively short period. This significant rally has sent ripples through the industry, sparking renewed optimism and prompting a closer look at the evolving regulatory landscape in the United States. While the reasons behind this upswing are multifaceted, the impact on investors and the future direction of the crypto market are undeniable.

The Surge: A Deeper Dive into the $330 Billion Rally

The recent rally saw Bitcoin (BTC), the leading cryptocurrency, reclaim the crucial $30,000 mark, pushing its dominance above 50%. Ethereum (ETH), the second-largest cryptocurrency, also experienced significant gains, exceeding $2,000. This collective surge wasn't confined to the top two; many altcoins followed suit, contributing to the overall $330 billion increase. Several factors likely fueled this remarkable growth, including:

- Positive Court Rulings: Favorable legal decisions regarding cryptocurrency, particularly concerning the classification of certain tokens, instilled renewed confidence among investors.

- Grayscale's Victory: The successful legal challenge by Grayscale Investments against the SEC's rejection of their Bitcoin ETF application injected significant positive momentum into the market. This decision is seen as a potential catalyst for broader institutional adoption.

- Macroeconomic Factors: Concerns about inflation and traditional financial market volatility are driving some investors to seek alternative assets, leading to increased investment in cryptocurrencies.

- Increased Institutional Interest: Despite regulatory uncertainty, several large institutional investors are increasingly exploring strategic crypto investments, contributing to the market's overall growth.

Navigating the Shifting Sands: US Regulatory Uncertainty

Despite the market's bullish trajectory, the regulatory landscape in the US remains a significant factor influencing investor sentiment. The Securities and Exchange Commission (SEC) continues to aggressively pursue enforcement actions against crypto companies, citing concerns about securities laws and investor protection. This regulatory uncertainty creates both challenges and opportunities for the industry.

H2: The Implications of SEC Actions

The SEC's actions have created a climate of uncertainty, impacting several high-profile crypto exchanges and companies. However, these actions have also spurred the industry to engage more proactively with regulators, demonstrating a commitment to compliance and responsible innovation. The ongoing debate surrounding the classification of cryptocurrencies as securities remains a central point of contention, with significant implications for future regulatory frameworks.

H3: Looking Ahead: Opportunities and Challenges

The recent rally highlights the resilience and potential of the cryptocurrency market. However, navigating the complex regulatory environment in the US remains crucial for sustained growth. The industry needs to:

- Collaborate with Regulators: Engage in constructive dialogue with regulatory bodies to develop clear and comprehensive frameworks.

- Prioritize Transparency and Compliance: Implement robust compliance programs to ensure adherence to evolving regulations.

- Foster Innovation: Continue to develop and implement innovative technologies that address the challenges and opportunities of the crypto space.

The $330 billion surge is a significant development, but the future direction of the crypto market remains intertwined with the evolving regulatory landscape in the US. While uncertainty persists, the recent rally signals a renewed sense of optimism, paving the way for further growth and innovation in the years to come. The interplay between market forces and regulatory action will continue to shape the trajectory of this dynamic and transformative asset class.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Crypto Market Rally: $330B Gain And The Changing US Regulatory Landscape. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Google Vs Amazon The Battle Heats Up With A New Budget Friendly Echo Show

Mar 04, 2025

Google Vs Amazon The Battle Heats Up With A New Budget Friendly Echo Show

Mar 04, 2025 -

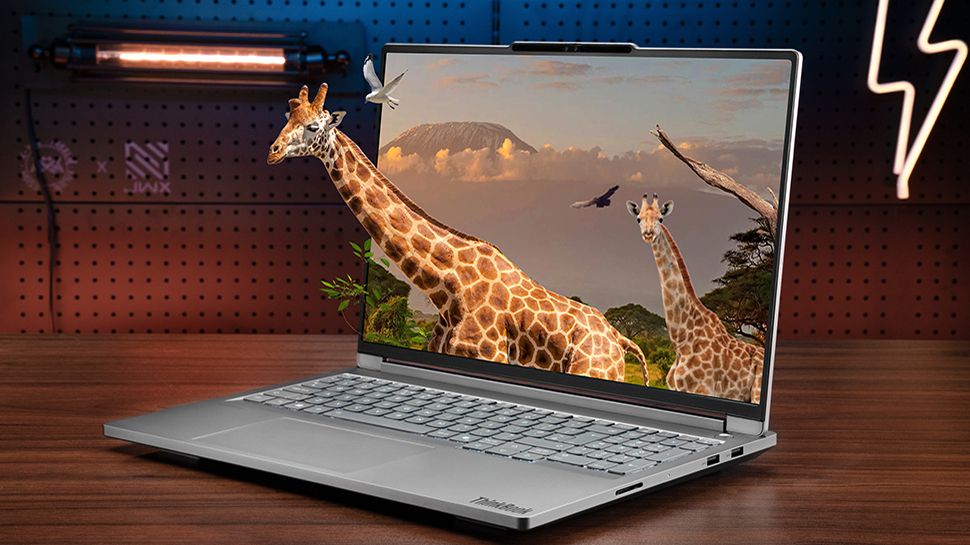

Lenovos Think Book 3 D A Stunning Laptop But Can It Revive A Dying Technology

Mar 04, 2025

Lenovos Think Book 3 D A Stunning Laptop But Can It Revive A Dying Technology

Mar 04, 2025 -

Lenovo Think Book Flip A Stunning Design With A Durability Concern

Mar 04, 2025

Lenovo Think Book Flip A Stunning Design With A Durability Concern

Mar 04, 2025 -

War Zones And Scientific Innovation Episode 3 Discussion

Mar 04, 2025

War Zones And Scientific Innovation Episode 3 Discussion

Mar 04, 2025 -

Xiaomi 15 Ultra A Comprehensive Camera And Design Analysis

Mar 04, 2025

Xiaomi 15 Ultra A Comprehensive Camera And Design Analysis

Mar 04, 2025