Singapore Bank Q1 2024 Financial Report: Analysis Of Net Interest Margins, Wealth, And Trade Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Singapore Bank Q1 2024 Financial Report: Net Interest Margins, Wealth, and Trade Performance Analyzed

Singapore's banking sector, a cornerstone of the nation's robust economy, released its Q1 2024 financial reports, revealing a mixed bag of performance across key indicators. While net interest margins saw a welcome boost, the wealth management segment showed signs of softening, and trade finance performance varied depending on the individual bank. This article delves into a detailed analysis of these key areas, providing insights into the overall health of Singapore's banking landscape.

Net Interest Margins: A Positive Uptick

One of the most significant takeaways from the Q1 2024 reports is the improvement in net interest margins (NIMs). Several major banks reported increased NIMs, primarily driven by the ongoing global rise in interest rates. This positive trend reflects the banks' ability to effectively manage their asset and liability portfolios in a rising rate environment. However, the extent of the increase varied, with some banks outperforming others, highlighting differing strategies in managing interest rate risk. Further analysis suggests that the impact of rising rates is likely to continue influencing NIMs in the coming quarters.

- Key Factors Contributing to NIM Growth: Increased lending rates, effective asset-liability management, and strategic pricing adjustments.

- Banks with Notable NIM Improvements: [Insert Specific Bank Names and Percentage Increases, citing the source of this data].

Wealth Management: Navigating a Challenging Landscape

The wealth management sector, a significant contributor to Singapore's banking revenue, faced a more complex picture in Q1 2024. While some banks reported stable performance, others experienced a slight decline in assets under management (AUM). This softening could be attributed to several factors, including global economic uncertainty, volatility in equity markets, and cautious investor sentiment. However, the long-term outlook for wealth management in Singapore remains positive, given its strategic location and growing high-net-worth individual (HNWI) population.

- Challenges Facing Wealth Management: Geopolitical risks, market volatility, and increased competition.

- Strategies for Future Growth: Focus on digitalization, personalized services, and expansion into new markets.

Trade Finance: A Divergent Performance

The performance of trade finance activities varied considerably among different banks. Some banks reported strong growth in trade finance volumes, driven by increased global trade activity in specific sectors. Others, however, experienced a slowdown, reflecting the impact of global supply chain disruptions and reduced demand in certain markets. This disparity highlights the sector-specific nature of trade finance and the importance of strategic diversification for banks operating in this space.

- Factors Influencing Trade Finance Performance: Global trade volumes, supply chain dynamics, and geopolitical events.

- Opportunities for Growth: Focus on digital trade finance solutions and expansion into high-growth markets.

Overall Outlook: Cautious Optimism

The Q1 2024 financial reports paint a picture of cautious optimism for Singapore's banking sector. While the improvement in net interest margins provides a solid foundation, the challenges faced by the wealth management and trade finance sectors require careful attention. The ongoing global economic uncertainty necessitates proactive risk management and strategic adaptation. However, Singapore's strong regulatory environment, its position as a leading financial hub, and the resilience of its banking institutions suggest a positive long-term outlook. Further analysis of subsequent quarterly reports will be crucial in assessing the sustainability of the current trends.

Keywords: Singapore banks, Q1 2024 financial report, net interest margins, NIMs, wealth management, assets under management, AUM, trade finance, Singapore economy, banking sector, financial performance, economic outlook, interest rates, global economy, high-net-worth individuals, HNWI.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Singapore Bank Q1 2024 Financial Report: Analysis Of Net Interest Margins, Wealth, And Trade Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

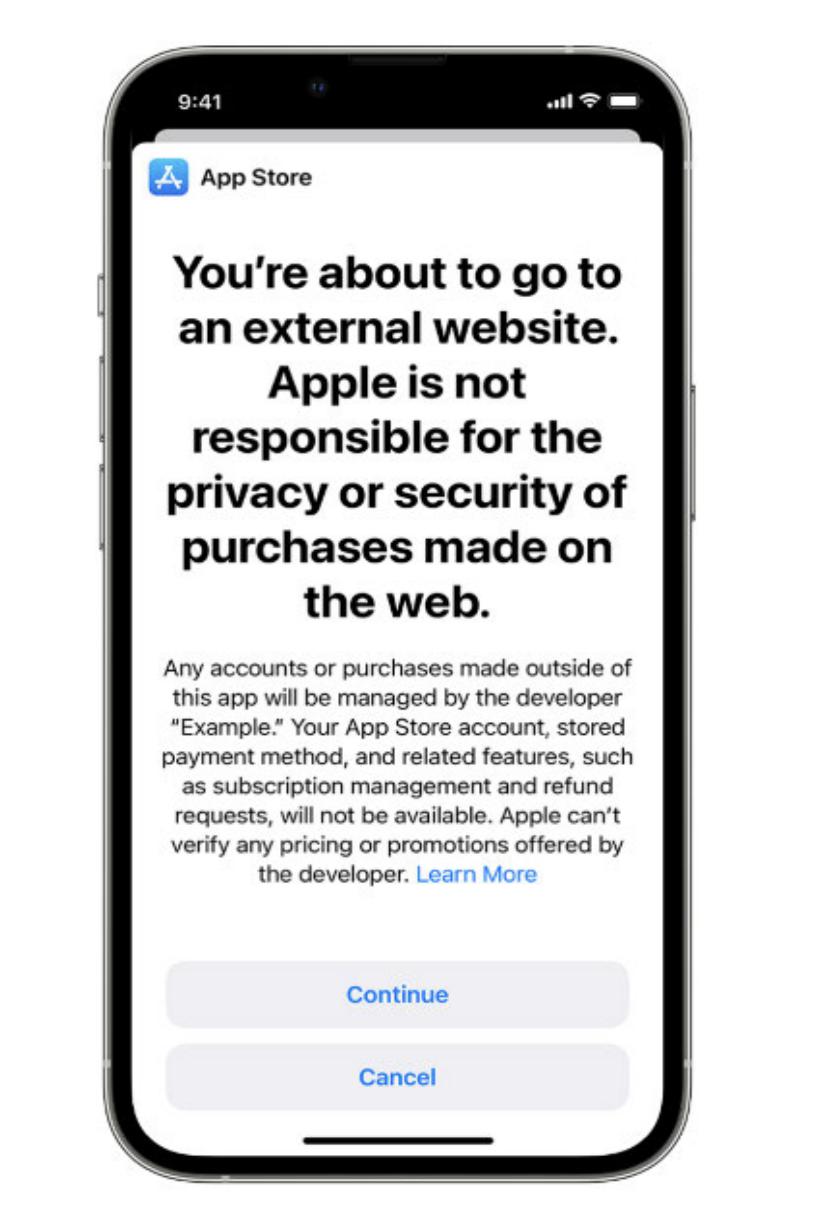

Is Apples Dominance Over Examining The Latest Antitrust Case

May 05, 2025

Is Apples Dominance Over Examining The Latest Antitrust Case

May 05, 2025 -

Accused In Sycamore Gap Tree Damage Case Testimony Reveals Motive

May 05, 2025

Accused In Sycamore Gap Tree Damage Case Testimony Reveals Motive

May 05, 2025 -

Singapore Banks Q1 2024 Strong Wealth Management And Trade Offset Mixed Net Interest Income

May 05, 2025

Singapore Banks Q1 2024 Strong Wealth Management And Trade Offset Mixed Net Interest Income

May 05, 2025 -

Wordle 1415 Answer May 4th Nyt Wordle Hints And Solution

May 05, 2025

Wordle 1415 Answer May 4th Nyt Wordle Hints And Solution

May 05, 2025 -

India Women Dominate Sri Lanka Womens Challenge In 4th Odi

May 05, 2025

India Women Dominate Sri Lanka Womens Challenge In 4th Odi

May 05, 2025