Singapore Exchange Delistings Surge: 16 Companies Privatized Or Facing Delisting In 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Singapore Exchange Delistings Surge: 16 Companies Privatized or Facing Delisting in 2024

Singapore's stock market is witnessing an unprecedented wave of delistings in 2024, with a staggering 16 companies either already privatized or currently facing the prospect of removal from the Singapore Exchange (SGX). This surge raises concerns about market liquidity and investor confidence, prompting closer scrutiny of the factors driving this trend.

A Wave of Privatizations and Delistings:

The sheer number of companies leaving the SGX this year marks a significant departure from previous years. This exodus isn't limited to smaller companies; several mid-cap firms are also involved, highlighting a broader shift in the dynamics of the Singaporean market. This trend is fueled by several key factors, including:

-

Private Equity Activity: Increased activity from private equity firms seeking lucrative acquisition opportunities is a major contributor. Private equity offers companies the potential for quicker growth and strategic restructuring outside the often-stricter regulatory environment of a public listing.

-

Low Valuation Concerns: Some companies facing delisting might believe their valuations on the SGX are unfairly low, reflecting a lack of market appreciation for their long-term growth prospects. A private setting may offer better potential for unlocking value.

-

Reduced Regulatory Burden: The complexities and costs associated with maintaining a public listing can be substantial. Going private removes these burdens, allowing companies to focus on operational efficiency and strategic initiatives.

-

Acquisition Offers: Many delistings are driven by attractive acquisition offers from other companies, either public or private, seeking to expand their market share or acquire specific assets.

Impact on the SGX and Investors:

This significant increase in delistings raises several key questions regarding the Singapore Exchange's overall health and investor confidence. The reduced number of listed companies directly impacts market liquidity, potentially leading to:

-

Lower Trading Volumes: Fewer listed companies mean fewer trading opportunities, potentially leading to lower trading volumes and a less vibrant market.

-

Reduced Investment Choices: Investors have a smaller pool of companies to choose from, potentially limiting investment diversification options.

-

Potential for Market Volatility: While not necessarily a direct consequence, fewer listed companies could lead to increased volatility in the remaining stocks, as market sentiment shifts more dramatically with fewer entities to absorb shocks.

Looking Ahead: Regulatory Implications and Future Trends:

The SGX is likely to carefully monitor this trend and may consider adjustments to regulations to encourage listings and counteract the current exodus. Possible measures could include initiatives to improve market valuations, streamline regulatory processes, or offer incentives for new listings. The long-term impact of this delisting wave remains to be seen, but understanding the underlying drivers is crucial for both investors and regulators. Experts will be closely watching the SGX in the coming months for any significant policy changes or further shifts in market dynamics. This situation highlights the ever-evolving nature of the global financial landscape and the importance of adapting to changing market conditions.

Keywords: Singapore Exchange, SGX, delisting, privatization, private equity, market liquidity, investor confidence, stock market, Singapore, acquisition, regulatory burden, valuation, trading volume, market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Singapore Exchange Delistings Surge: 16 Companies Privatized Or Facing Delisting In 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Diddy Faces Abuse Claims Court Hears Testimony Of Violence And Exploitation

May 14, 2025

Diddy Faces Abuse Claims Court Hears Testimony Of Violence And Exploitation

May 14, 2025 -

Cbse 2025 Board Exam Results Guide To Checking Class 10th And 12th Results Online

May 14, 2025

Cbse 2025 Board Exam Results Guide To Checking Class 10th And 12th Results Online

May 14, 2025 -

Game 4 Recap Knicks Victory Over Celtics Marked By Tatum Injury

May 14, 2025

Game 4 Recap Knicks Victory Over Celtics Marked By Tatum Injury

May 14, 2025 -

The Uninvited 2023 Review A Nostalgic Trip Back To 90s Indie Horror

May 14, 2025

The Uninvited 2023 Review A Nostalgic Trip Back To 90s Indie Horror

May 14, 2025 -

Claudia Karvans Emotional Breakdown The Tragic News Revealed

May 14, 2025

Claudia Karvans Emotional Breakdown The Tragic News Revealed

May 14, 2025

Latest Posts

-

Wordle Answer May 13 2025 Tips To Crack Todays Puzzle

May 14, 2025

Wordle Answer May 13 2025 Tips To Crack Todays Puzzle

May 14, 2025 -

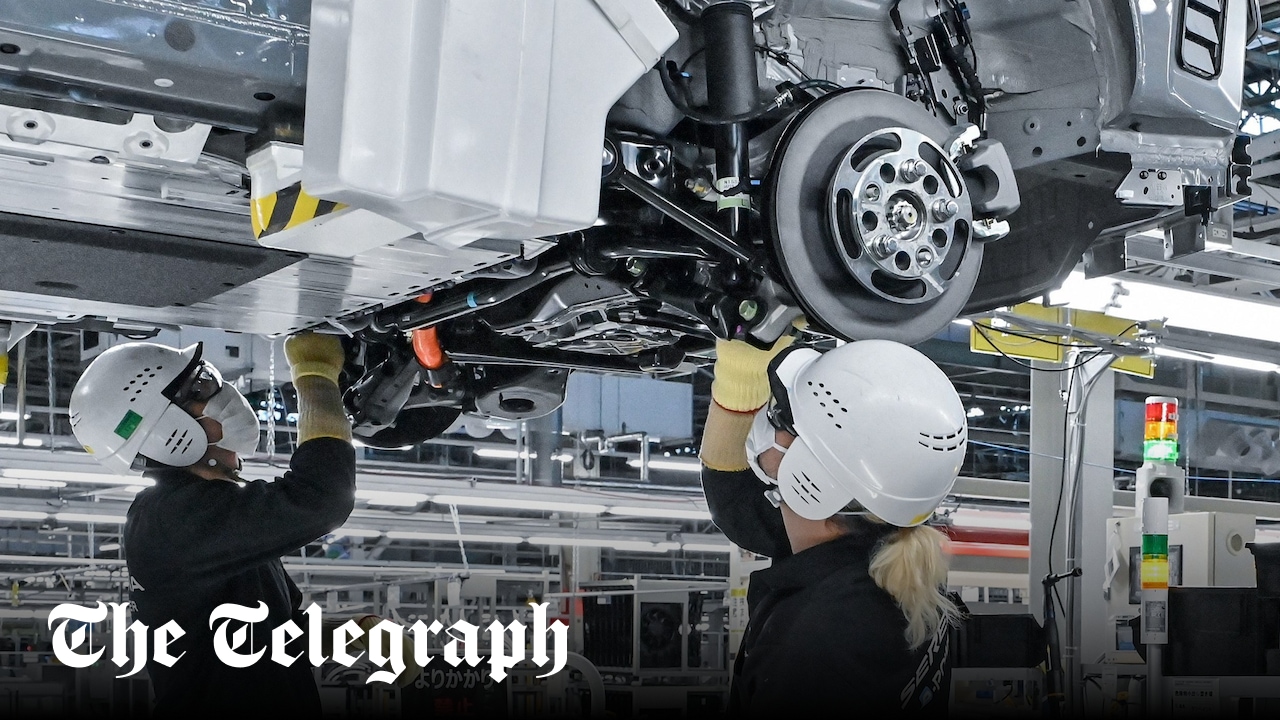

20 000 Job Losses Announced By Nissan Impact On Employees And Global Operations

May 14, 2025

20 000 Job Losses Announced By Nissan Impact On Employees And Global Operations

May 14, 2025 -

Sean Diddy Combs New Allegations Of Forced Participation In Drug Fueled Sex Parties Surface

May 14, 2025

Sean Diddy Combs New Allegations Of Forced Participation In Drug Fueled Sex Parties Surface

May 14, 2025 -

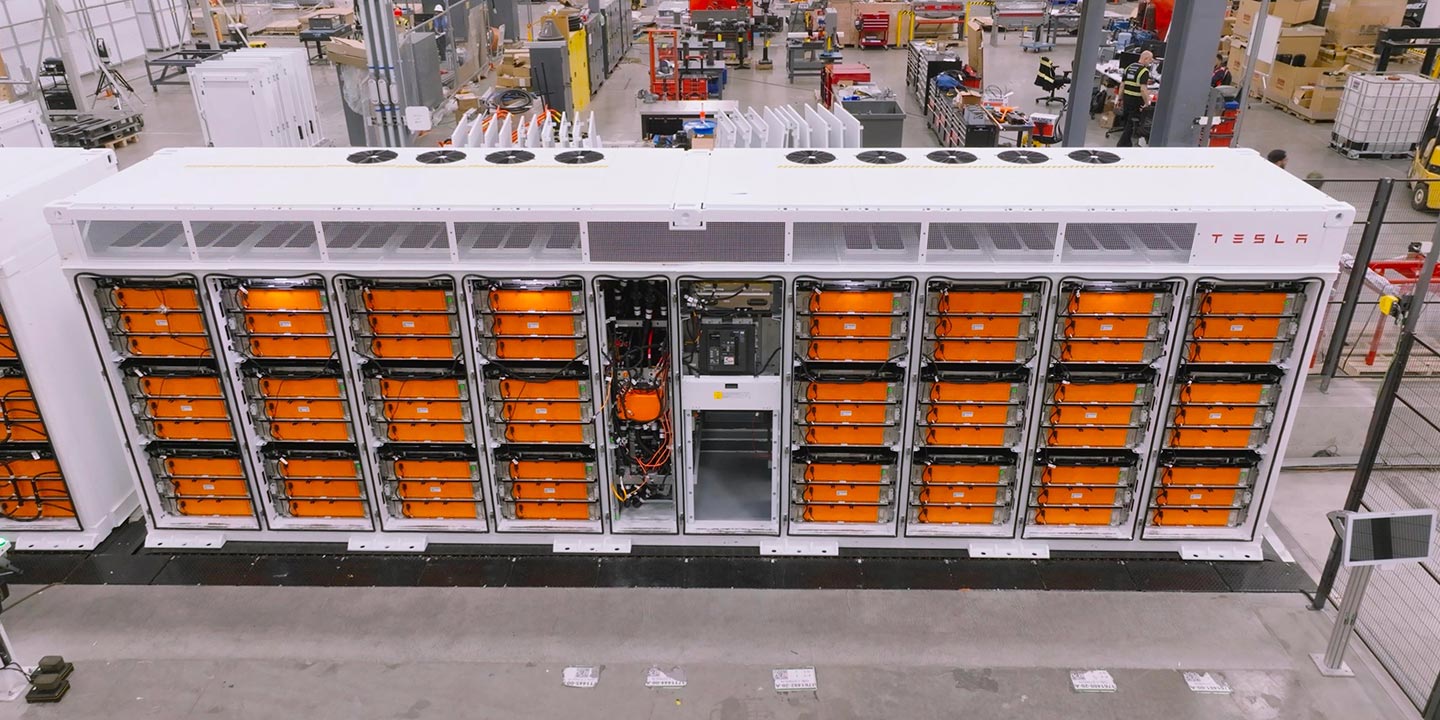

How Tesla Is Tackling Its Ev Battery Supply Chain Challenges

May 14, 2025

How Tesla Is Tackling Its Ev Battery Supply Chain Challenges

May 14, 2025 -

Live Updates Draper Battles Moutet In Italian Open Last 16

May 14, 2025

Live Updates Draper Battles Moutet In Italian Open Last 16

May 14, 2025