Singapore GE2025: Debate Heats Up Over Opposition's GST Reduction Plans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Singapore GE2025: Debate Heats Up Over Opposition's GST Reduction Plans

Singapore's political landscape is heating up as the 2025 General Election draws closer, with the proposed reduction of the Goods and Services Tax (GST) by the opposition parties becoming a central point of contention. The debate isn't just about numbers; it's a clash of economic philosophies and promises that are shaping the narrative leading up to the polls.

The ruling People's Action Party (PAP) has maintained its stance on the current GST rate, highlighting the need for fiscal prudence and responsible spending to fund crucial social programs and infrastructure development. They argue that drastic reductions could jeopardize Singapore's financial stability and long-term economic prospects. This position is backed by their consistent emphasis on a sustainable budget and careful management of national resources.

Conversely, several opposition parties have pledged significant GST reductions as key components of their election platforms. These promises resonate with voters facing rising living costs, particularly those in lower-income brackets. The proposals vary in their degree of reduction, but the core message remains consistent: easing the financial burden on Singaporeans.

<h3>Analyzing the Opposition's Proposals</h3>

The opposition's GST reduction plans vary significantly in their approach and feasibility. Some propose a phased reduction, while others advocate for a more immediate, substantial cut. However, a critical element missing from many of these proposals is a clear articulation of how these reductions will be financed without impacting essential government services.

-

Funding Concerns: The lack of detailed financial plans raises concerns about the potential impact on government revenue and the sustainability of social programs. Critics argue that such reductions could lead to cuts in healthcare, education, or infrastructure development – areas vital to Singapore's continued progress.

-

Economic Impact: Economists have weighed in, suggesting that substantial GST reductions could have unpredictable consequences on Singapore's economy. While a reduction might boost consumer spending in the short term, it could also lead to inflation and potentially weaken the Singapore dollar.

-

Public Sentiment: Public opinion on the issue is divided. While many welcome the prospect of lower taxes and relief from rising costs, others express reservations about the potential long-term economic consequences of a drastic GST reduction. This highlights the complexity of the issue and the need for a nuanced discussion.

<h3>The PAP's Counter-Argument and Alternative Solutions</h3>

The PAP has consistently emphasized its commitment to providing robust social safety nets and targeted assistance to vulnerable groups. Instead of a broad-based GST reduction, they've highlighted various existing and planned initiatives aimed at mitigating the impact of rising costs on lower-income families. These include:

- Increased social assistance programs: Expanding existing schemes like the ComCare assistance program and introducing new initiatives to provide direct financial support to those in need.

- Targeted subsidies: Providing subsidies for essential goods and services, such as healthcare and housing, to help offset rising costs for vulnerable segments of the population.

- Progressive taxation: Ensuring that the tax system remains progressive, meaning higher earners contribute a larger proportion of their income in taxes.

<h3>The Road Ahead: A Crucial Election Issue</h3>

The debate surrounding GST reduction is likely to dominate the pre-election period. The opposition's proposals, while popular with some segments of the population, face significant scrutiny regarding their financial sustainability and potential economic repercussions. The PAP's counter-arguments, focusing on targeted assistance and fiscal responsibility, represent a different approach to addressing the cost-of-living concerns. The upcoming election will be a crucial test of which approach resonates most strongly with the electorate. The outcome will significantly shape Singapore's economic policies and social welfare programs for years to come. This ongoing debate underscores the importance of informed public discourse and critical engagement with the competing proposals presented by both the ruling party and the opposition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Singapore GE2025: Debate Heats Up Over Opposition's GST Reduction Plans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

London Marathon 2025 Route Map Registration Details And Key Information

Apr 28, 2025

London Marathon 2025 Route Map Registration Details And Key Information

Apr 28, 2025 -

Isabela Merced Beyond The Last Of Us A Look At Her Diverse Acting Roles

Apr 28, 2025

Isabela Merced Beyond The Last Of Us A Look At Her Diverse Acting Roles

Apr 28, 2025 -

Perplexity Vs Google A Ceos Perspective On The Emerging Ai Browser War

Apr 28, 2025

Perplexity Vs Google A Ceos Perspective On The Emerging Ai Browser War

Apr 28, 2025 -

Singapores Ge 2025 Foreign Interference And Religious Division Concerns

Apr 28, 2025

Singapores Ge 2025 Foreign Interference And Religious Division Concerns

Apr 28, 2025 -

Ge 2025 Punggol Grc Key Battleground For Upcoming Elections

Apr 28, 2025

Ge 2025 Punggol Grc Key Battleground For Upcoming Elections

Apr 28, 2025

Latest Posts

-

Tuesdays Calgary Forecast Cloudy Skies High Winds And Thunderstorm Potential

Apr 29, 2025

Tuesdays Calgary Forecast Cloudy Skies High Winds And Thunderstorm Potential

Apr 29, 2025 -

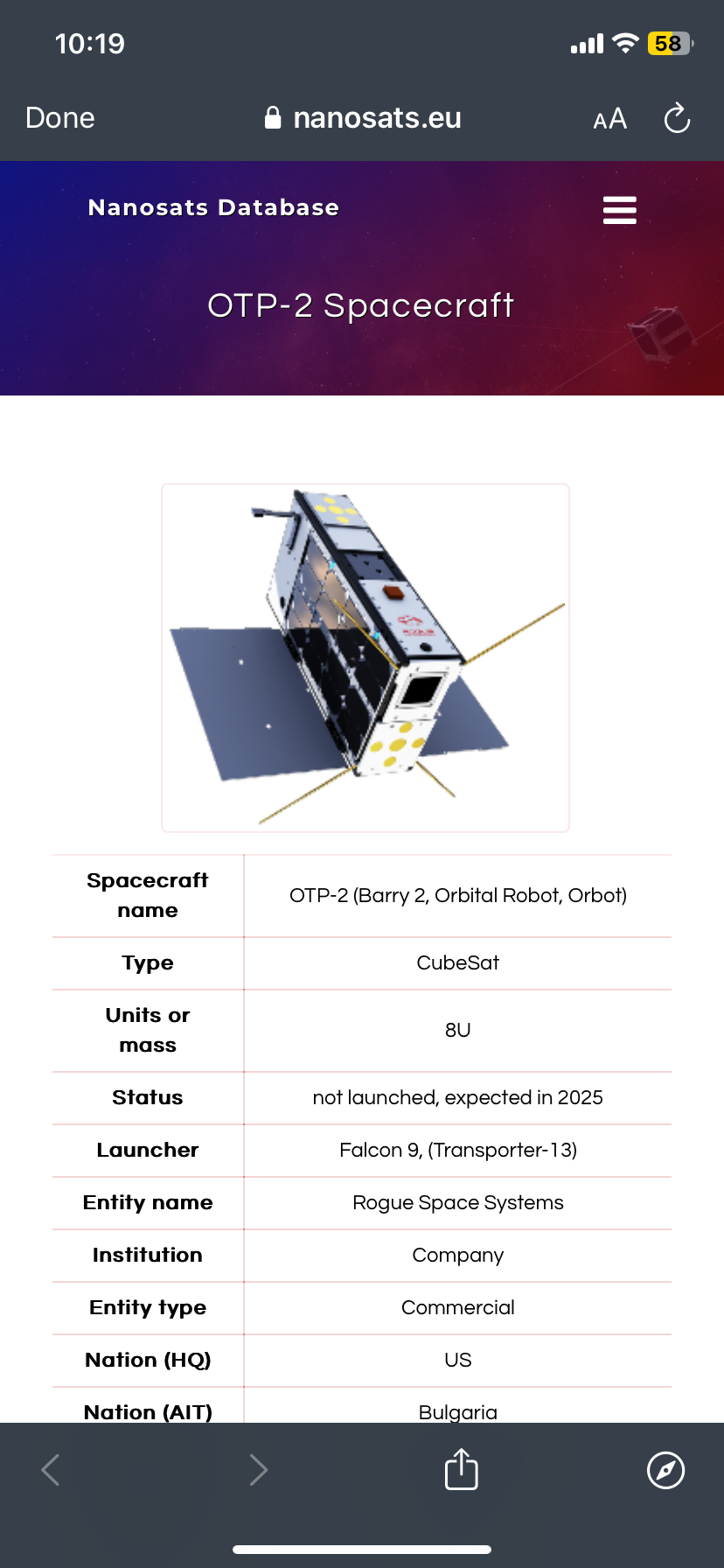

Otp 2 Propulsion Experiments Two Key Tests Detailed

Apr 29, 2025

Otp 2 Propulsion Experiments Two Key Tests Detailed

Apr 29, 2025 -

Us Uk Trade Deal Trump Tariffs Remain A Hurdle Pending Parliamentary Vote

Apr 29, 2025

Us Uk Trade Deal Trump Tariffs Remain A Hurdle Pending Parliamentary Vote

Apr 29, 2025 -

Axar Patels Death Bowling Choices Right Or Wrong

Apr 29, 2025

Axar Patels Death Bowling Choices Right Or Wrong

Apr 29, 2025 -

Regardez Arsenal Psg En Direct Ligue Des Champions 2024 2025

Apr 29, 2025

Regardez Arsenal Psg En Direct Ligue Des Champions 2024 2025

Apr 29, 2025