Singapore: New Hub For Sea's Growing Digital Finance Business

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

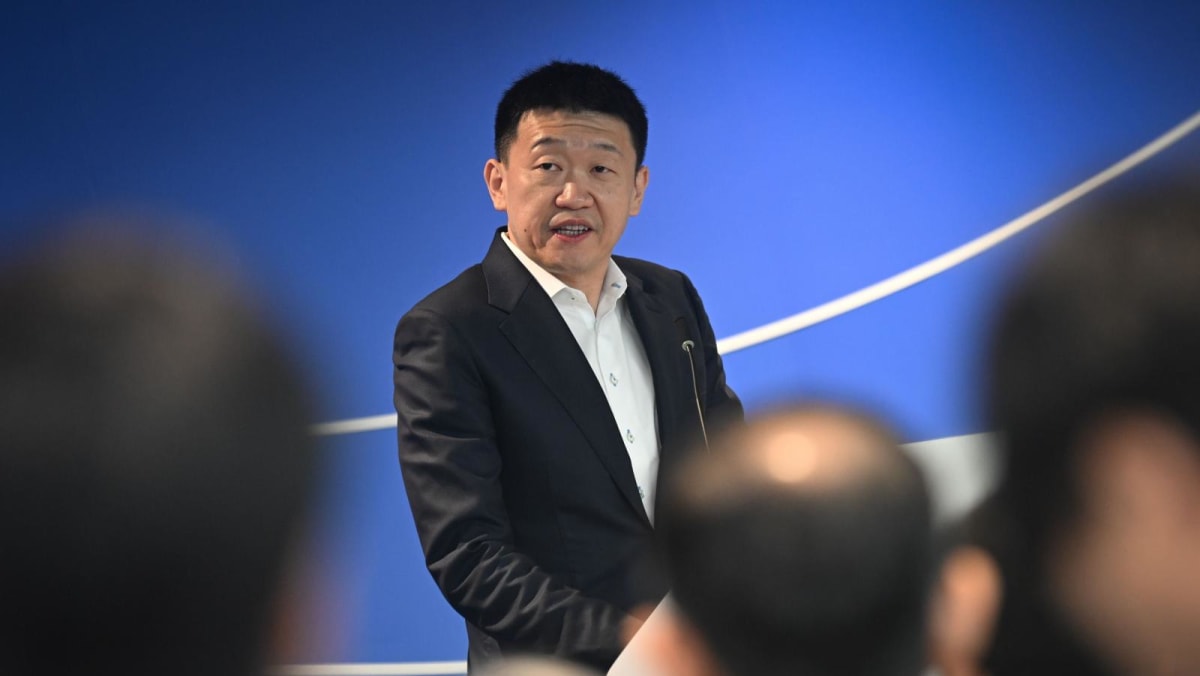

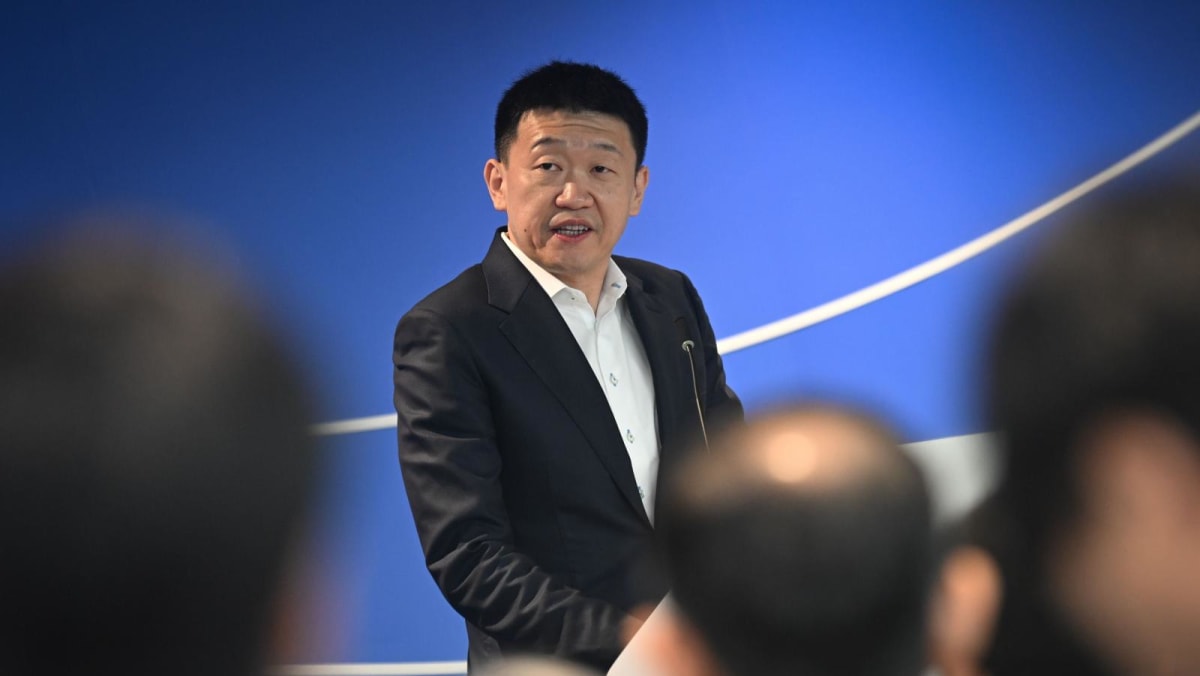

Singapore: The Emerging Fintech Hub for Sea's Expanding Digital Finance Empire

Singapore is rapidly solidifying its position as a key strategic hub for Sea Limited's (SE) burgeoning digital finance arm, SeaMoney. This isn't just a regional expansion; it's a significant global play, leveraging Singapore's robust regulatory environment, skilled workforce, and strategic location to fuel SeaMoney's ambitious growth trajectory. The move signals a major shift in the fintech landscape, with far-reaching implications for both Sea and the broader Southeast Asian economy.

SeaMoney's Singapore Strategy: A Multi-Pronged Approach

SeaMoney, already a dominant force in digital payments across Southeast Asia, is using Singapore as a springboard for several key initiatives:

-

Talent Acquisition: Singapore's highly skilled and international workforce provides a crucial pool of talent for SeaMoney's expansion. The company is aggressively recruiting top engineers, financial experts, and regulatory specialists to bolster its operations.

-

Regulatory Compliance: Singapore's sophisticated and transparent regulatory framework offers a stable and predictable environment for SeaMoney to operate and scale its services responsibly. This is especially crucial as the company expands its financial offerings.

-

Innovation and R&D: Singapore's thriving fintech ecosystem fosters innovation and collaboration, providing SeaMoney with access to cutting-edge technologies and partnerships crucial for future growth. This includes exploring areas like embedded finance and open banking.

-

Strategic Partnerships: The city-state's strategic location and strong network of international financial institutions allows SeaMoney to forge crucial partnerships to expand its reach beyond Southeast Asia.

Beyond Payments: SeaMoney's Expanding Portfolio

SeaMoney's ambitions extend far beyond basic digital payments. The company is actively developing a range of financial services including:

-

Digital Lending: Offering loans to consumers and small businesses, leveraging its vast data insights and understanding of the Southeast Asian market.

-

Investment Services: Exploring opportunities in wealth management and investment products, catering to the growing affluent class in the region.

-

Insurance Products: Expanding into insurance offerings, providing a comprehensive suite of financial protection solutions to its user base.

The Implications for Singapore's Fintech Scene

SeaMoney's significant investment in Singapore is a boon for the nation's thriving fintech sector. It not only creates high-skilled jobs but also elevates Singapore's profile as a global fintech leader. The presence of such a major player attracts further investment and accelerates innovation within the ecosystem.

Challenges and Opportunities Ahead

While the opportunities are significant, SeaMoney faces challenges. Maintaining regulatory compliance across diverse markets, managing risks associated with lending and investment products, and navigating the competitive fintech landscape will be crucial to its continued success. However, with its strong foundation and strategic focus on Singapore, SeaMoney is well-positioned to overcome these obstacles and achieve its ambitious growth targets.

Conclusion: Singapore – A Strategic Fortress for SeaMoney's Global Ambitions

Sea Limited's decision to establish Singapore as a central hub for SeaMoney represents a strategic masterstroke. By leveraging the city-state's strengths, SeaMoney is not only solidifying its dominance in Southeast Asia but also positioning itself for significant global expansion in the rapidly evolving digital finance landscape. The future looks bright for both SeaMoney and Singapore's burgeoning fintech ecosystem.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Singapore: New Hub For Sea's Growing Digital Finance Business. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unbeatable May 2025 Deals On Cheap Beats Headphones

May 09, 2025

Unbeatable May 2025 Deals On Cheap Beats Headphones

May 09, 2025 -

National Crypto Payment System Bhutans Innovative Tourism Strategy

May 09, 2025

National Crypto Payment System Bhutans Innovative Tourism Strategy

May 09, 2025 -

Celebrity Zara Outfits Inspiration And Affordable Fashion Finds

May 09, 2025

Celebrity Zara Outfits Inspiration And Affordable Fashion Finds

May 09, 2025 -

Spy Cloud Report Shockingly High Percentage Of Fortune 500 Companies Suffer Employee Data Breaches Via Phishing

May 09, 2025

Spy Cloud Report Shockingly High Percentage Of Fortune 500 Companies Suffer Employee Data Breaches Via Phishing

May 09, 2025 -

May 2025 Find The Lowest Go Pro Prices Here

May 09, 2025

May 2025 Find The Lowest Go Pro Prices Here

May 09, 2025