Singapore Stock Market Performance: An In-Depth Commentary And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Singapore Stock Market Performance: An In-Depth Commentary and Analysis

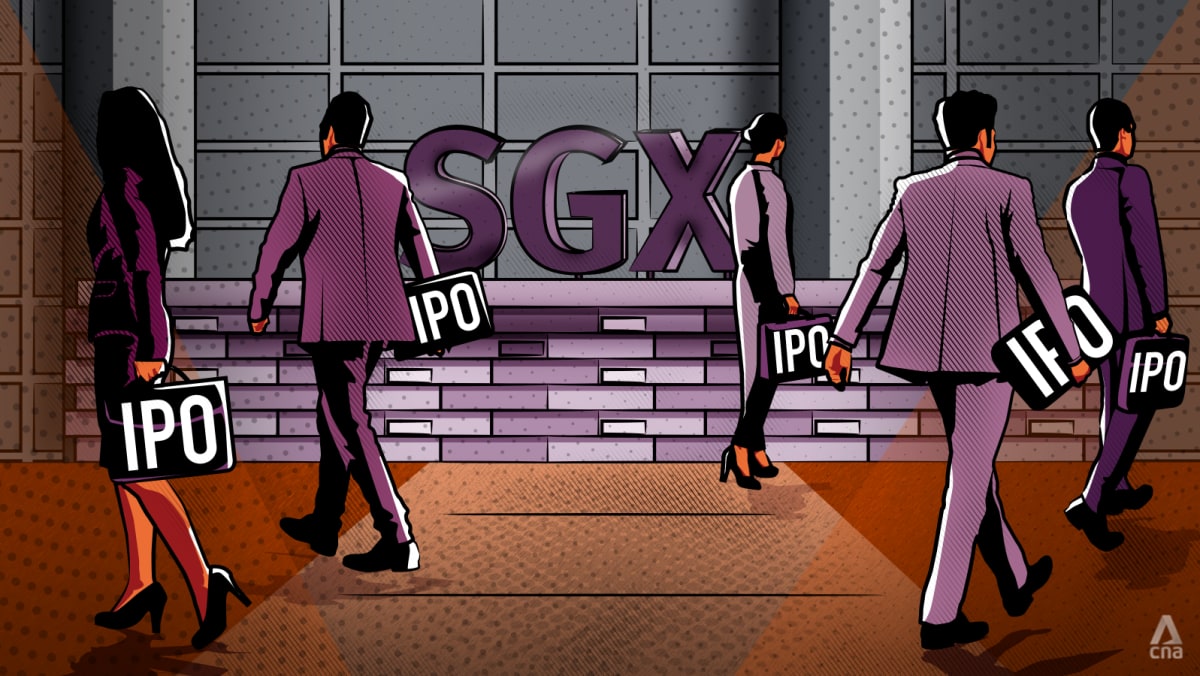

Singapore's stock market, primarily represented by the Straits Times Index (STI), has experienced a rollercoaster ride in recent years, influenced by a complex interplay of global and domestic factors. This in-depth analysis delves into the key performance drivers, recent trends, and future prospects of this important Asian market.

Recent Market Trends: A Rollercoaster Year

The Singapore stock market, like many global markets, has faced significant headwinds in 2023. Geopolitical instability, persistent inflation, and rising interest rates have all contributed to increased market volatility. While the STI showed periods of growth, fueled by strong corporate earnings in certain sectors, overall performance has been less robust than in previous years. The tech sector, a significant component of the STI, experienced a particularly challenging period, mirroring global trends.

Key Factors Influencing Performance:

Several key factors have significantly impacted the Singapore stock market's performance:

-

Global Economic Outlook: The global economic slowdown, coupled with the ongoing war in Ukraine and its impact on energy prices and supply chains, has cast a shadow over investor sentiment. Concerns about a potential recession in major economies have led to increased risk aversion.

-

Interest Rate Hikes: The aggressive interest rate hikes implemented by central banks worldwide, including the Monetary Authority of Singapore (MAS), have increased borrowing costs for businesses and dampened investment activity. Higher interest rates make bonds more attractive relative to equities, diverting investment flows.

-

Inflationary Pressures: Persistent inflationary pressures erode consumer purchasing power and impact corporate profitability, leading to cautious investor behavior and potentially lower stock valuations.

-

US-China Relations: The ongoing geopolitical tensions between the US and China continue to create uncertainty in the global economy, indirectly affecting Singapore's export-oriented economy and its stock market.

-

Domestic Economic Growth: Singapore's own economic growth prospects remain a critical factor. The performance of key sectors like manufacturing, tourism, and finance directly influences the performance of listed companies and, consequently, the STI.

Sectoral Performance: Winners and Losers

While the overall market has shown mixed results, certain sectors have outperformed others. The healthcare sector has shown relative resilience, driven by strong demand and technological advancements. Conversely, the technology sector, heavily impacted by global headwinds and decreased investor appetite for risk, has underperformed. The financial sector has shown mixed results, reflecting the complexities of the macroeconomic environment.

Future Outlook: Cautious Optimism

The outlook for the Singapore stock market remains uncertain in the short-term. However, Singapore's robust fundamentals, its strategic geographic location, and its commitment to economic diversification offer a degree of resilience. Long-term prospects remain positive, particularly for companies focused on sustainable development and technological innovation.

Investing in the Singapore Stock Market:

Investors considering the Singapore stock market should adopt a long-term perspective and diversify their portfolio. Thorough due diligence, understanding the underlying risks, and seeking professional financial advice are crucial before making any investment decisions.

Conclusion:

The Singapore stock market's performance reflects the global economic climate and the interplay of various domestic and international factors. While short-term volatility is expected, Singapore's strong economic fundamentals and strategic position suggest a positive long-term outlook. However, careful analysis and a well-diversified investment strategy are crucial for navigating the complexities of this dynamic market. Stay informed about economic developments and sector-specific trends to make informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Singapore Stock Market Performance: An In-Depth Commentary And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Transicao Na Berkshire Buffett Entrega Decisoes De Investimento A Greg Abel

May 13, 2025

Transicao Na Berkshire Buffett Entrega Decisoes De Investimento A Greg Abel

May 13, 2025 -

Oswaldo Cabrera Injured At Home Plate Details On His Ambulance Transport

May 13, 2025

Oswaldo Cabrera Injured At Home Plate Details On His Ambulance Transport

May 13, 2025 -

Digital Voting A Source Of Distrust For Filipino Voters Abroad

May 13, 2025

Digital Voting A Source Of Distrust For Filipino Voters Abroad

May 13, 2025 -

Positive China Us Signals Fuel Hong Kong Stock Markets Extended Rally

May 13, 2025

Positive China Us Signals Fuel Hong Kong Stock Markets Extended Rally

May 13, 2025 -

Analise O Custo Bilionario Das Greves Para Empresas E Setores

May 13, 2025

Analise O Custo Bilionario Das Greves Para Empresas E Setores

May 13, 2025

Latest Posts

-

The White Lotuss Walton Goggins Family Resilience And Overcoming Challenges

May 14, 2025

The White Lotuss Walton Goggins Family Resilience And Overcoming Challenges

May 14, 2025 -

Moodeng Hits New High Binance Listing Fuels 600 Price Surge

May 14, 2025

Moodeng Hits New High Binance Listing Fuels 600 Price Surge

May 14, 2025 -

Eu Data Strategy Why Decentralization Trumps Hyperscaler Control

May 14, 2025

Eu Data Strategy Why Decentralization Trumps Hyperscaler Control

May 14, 2025 -

James Fan Challenges Ai With A New Physical Turing Test

May 14, 2025

James Fan Challenges Ai With A New Physical Turing Test

May 14, 2025 -

Singapore Exchange Delistings Surge 16 Companies Privatized Or Facing Delisting In 2024

May 14, 2025

Singapore Exchange Delistings Surge 16 Companies Privatized Or Facing Delisting In 2024

May 14, 2025