Singapore Stock Market Slump: An In-Depth Commentary

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Singapore Stock Market Slump: An In-Depth Commentary

Singapore's stock market has experienced a significant slump recently, leaving investors concerned and analysts scrambling for explanations. This downturn, impacting the Straits Times Index (STI) and broader market sentiment, demands a closer look at the underlying factors and potential implications. Understanding the causes of this slump is crucial for investors navigating the current volatile landscape.

The Plunge: Key Factors Contributing to the Singapore Stock Market Slump

Several intertwined factors have contributed to the recent decline in the Singapore stock market. These include:

-

Global Economic Uncertainty: The global economic outlook remains clouded by persistent inflation, rising interest rates, and geopolitical tensions. The war in Ukraine, ongoing supply chain disruptions, and concerns about a potential global recession are all weighing heavily on investor confidence. Singapore, being a highly globalized economy, is particularly vulnerable to these external shocks. This uncertainty translates to risk aversion, leading investors to pull back from riskier assets, including stocks.

-

Tech Sector Weakness: The technology sector, a significant component of the Singapore stock market, has been particularly hard hit. Concerns over slowing growth, increased competition, and tighter regulatory scrutiny have led to a sell-off in tech stocks globally, impacting Singapore's tech-heavy companies.

-

Rising Interest Rates: The Monetary Authority of Singapore (MAS)'s efforts to combat inflation through interest rate hikes have increased borrowing costs for businesses and consumers. This dampens economic activity and reduces corporate profitability, impacting stock valuations. Higher interest rates also make bonds, a safer investment, more attractive compared to stocks, diverting investment flows.

-

Regional Economic Slowdown: Economic growth in several key Asian economies has slowed, impacting demand for Singaporean exports and services. This reduced regional economic activity directly translates into lower corporate earnings and consequently, lower stock prices.

-

Inflationary Pressures: Persistent inflationary pressures continue to erode consumer spending power and impact corporate profitability margins. This squeeze on profitability directly affects investor confidence and leads to a downward pressure on stock valuations.

Impact and Potential Implications

The slump in the Singapore stock market has wide-ranging implications:

-

Investor Sentiment: The market downturn has significantly impacted investor sentiment, leading to increased volatility and uncertainty. Many investors are adopting a wait-and-see approach, hesitant to commit further capital until the economic outlook clarifies.

-

Corporate Investments: Companies may postpone or scale back investment plans due to the uncertain economic climate and reduced access to capital. This further impacts economic growth and creates a cyclical downward pressure.

-

Government Response: The Singaporean government may need to implement further fiscal or monetary policies to mitigate the impact of the economic slowdown and support the stock market. These measures could include tax incentives or further adjustments to interest rates.

Navigating the Slump: Strategies for Investors

For investors, this period requires a cautious and strategic approach:

-

Diversification: Diversifying investment portfolios across different asset classes and geographical regions is crucial to mitigate risk.

-

Long-term Perspective: It's essential to maintain a long-term investment strategy and avoid making impulsive decisions based on short-term market fluctuations.

-

Due Diligence: Thorough research and due diligence are crucial before making any investment decisions in this volatile market.

-

Professional Advice: Seeking advice from a qualified financial advisor can help investors navigate the current market complexities and make informed investment decisions.

Conclusion:

The recent slump in the Singapore stock market underscores the interconnectedness of global and regional economies. Understanding the underlying factors driving this downturn is crucial for investors to make informed decisions and navigate this challenging period effectively. While the short-term outlook remains uncertain, a long-term perspective, coupled with careful risk management, will be key to weathering this storm and potentially benefiting from future market recovery.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Singapore Stock Market Slump: An In-Depth Commentary. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Domestic Violence Allegations Queensland Labor Mp Expelled

May 13, 2025

Domestic Violence Allegations Queensland Labor Mp Expelled

May 13, 2025 -

Hong Kong Stock Market Rallies A Years Longest Winning Streak On Improved Us China Ties

May 13, 2025

Hong Kong Stock Market Rallies A Years Longest Winning Streak On Improved Us China Ties

May 13, 2025 -

Cricket Legend Virat Kohli Calls Time On His Test Career At 269

May 13, 2025

Cricket Legend Virat Kohli Calls Time On His Test Career At 269

May 13, 2025 -

Nvidias Dgx Spark Faces New Competition A Clustered Ai Workstation From China

May 13, 2025

Nvidias Dgx Spark Faces New Competition A Clustered Ai Workstation From China

May 13, 2025 -

269 And Out Virat Kohlis Farewell Test Match

May 13, 2025

269 And Out Virat Kohlis Farewell Test Match

May 13, 2025

Latest Posts

-

Mothers Day Tragedy Malaysian Elephants Sorrow In Touching Viral Video

May 13, 2025

Mothers Day Tragedy Malaysian Elephants Sorrow In Touching Viral Video

May 13, 2025 -

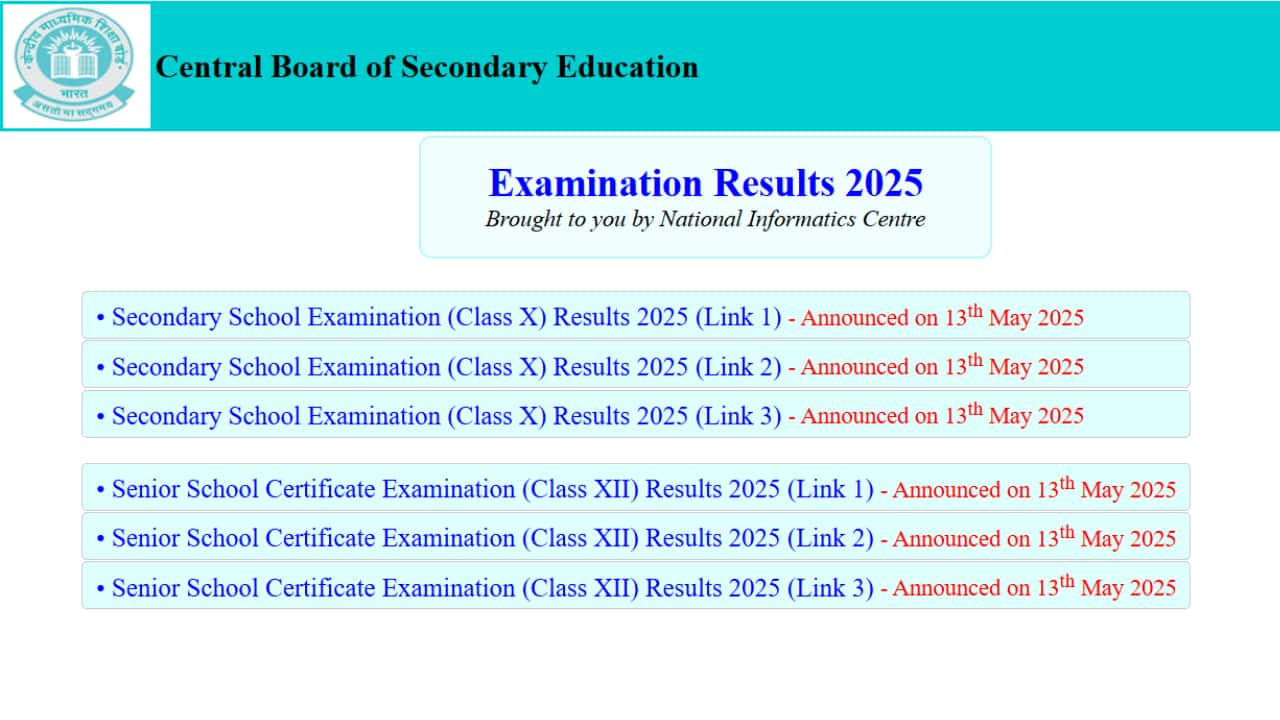

Cbse Results 2025 Declared Class 10th 12th Marks Released Pm Modis Congratulations

May 13, 2025

Cbse Results 2025 Declared Class 10th 12th Marks Released Pm Modis Congratulations

May 13, 2025 -

Thin Is In Samsung Unveils S25 Edge As Apple Preps I Phone Air

May 13, 2025

Thin Is In Samsung Unveils S25 Edge As Apple Preps I Phone Air

May 13, 2025 -

Covid 19 Situation In Singapore Authorities Track Rising Case Numbers Assess Variant Threat

May 13, 2025

Covid 19 Situation In Singapore Authorities Track Rising Case Numbers Assess Variant Threat

May 13, 2025 -

Women Testify Against Diddy Detailing Years Of Abuse And Control

May 13, 2025

Women Testify Against Diddy Detailing Years Of Abuse And Control

May 13, 2025