SMCI Stock Soars: Analyzing Super Micro Computer's Tuesday Price Jump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SMCI Stock Soars: Analyzing Super Micro Computer's Tuesday Price Jump

Super Micro Computer, Inc. (SMCI) experienced a significant surge in its stock price on Tuesday, leaving investors and analysts scrambling to understand the driving forces behind this unexpected jump. The rally marks a significant positive shift for the company, known for its high-performance computing solutions, and raises questions about the future trajectory of SMCI stock. This article delves into the potential reasons behind the surge and offers an analysis of what it could mean for investors.

Tuesday's Market Reaction: A Deep Dive into SMCI's Price Surge

SMCI stock saw a dramatic increase, closing [Insert Percentage Increase]% higher than the previous day's close. This substantial gain followed [mention any specific news or events that preceded the jump, e.g., an earnings report, a product announcement, or analyst upgrades]. The trading volume also experienced a notable increase, suggesting significant investor activity and heightened interest in the company. This volatility highlights the importance of understanding the underlying factors contributing to such market fluctuations.

Potential Catalysts Behind the SMCI Stock Rally:

Several factors could have contributed to this impressive surge in SMCI's stock price. Let's examine the most likely candidates:

-

Strong Earnings Report (If Applicable): If SMCI released positive earnings results on Tuesday or shortly before, this would be the most significant driver. Analysts would have scrutinized key metrics like revenue growth, earnings per share (EPS), and forward guidance. Exceeding expectations in these areas would likely fuel investor confidence and drive up the stock price.

-

Positive Analyst Upgrades: A change in analyst ratings from neutral or negative to buy or outperform could influence investor sentiment and trigger buying pressure. Increased price targets set by analysts often lead to increased investor interest and higher share prices.

-

New Product Announcements or Partnerships: The launch of innovative products or strategic partnerships could significantly boost investor confidence. News of a breakthrough technology or a collaboration with a major industry player could justify the positive market reaction.

-

Overall Market Sentiment: The broader market environment also plays a crucial role. A generally positive market trend often lifts even individual stocks, and SMCI could have benefited from such a positive sentiment.

-

Short Squeeze: While less likely, a short squeeze could have contributed to the price increase. This occurs when investors who bet against the stock (short sellers) are forced to buy shares to cover their positions, driving up the price.

Analyzing the Future Trajectory of SMCI Stock:

While Tuesday's price jump is undoubtedly positive news for SMCI investors, it's crucial to approach future predictions with caution. The sustainability of this surge will depend on the underlying reasons for the increase and the company's continued performance.

-

Fundamental Analysis: Investors should carefully examine SMCI's financial statements, growth prospects, and competitive landscape. A thorough fundamental analysis is essential to assess the long-term viability and potential for future growth.

-

Technical Analysis: Analyzing chart patterns and technical indicators can provide insights into potential price movements. However, technical analysis should be used in conjunction with fundamental analysis for a comprehensive assessment.

-

Risk Assessment: Investors should always be aware of the inherent risks associated with investing in the stock market. No investment is guaranteed, and SMCI stock is subject to market volatility.

Conclusion:

The significant increase in SMCI stock price on Tuesday presents both an opportunity and a challenge for investors. While the reasons behind the surge require further analysis, understanding the potential catalysts and conducting thorough due diligence is crucial for making informed investment decisions. Staying informed about SMCI's financial performance, industry trends, and market sentiment will be essential for navigating the future trajectory of this high-growth technology stock. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SMCI Stock Soars: Analyzing Super Micro Computer's Tuesday Price Jump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

College Students Using Chat Gpt For Life Decisions Sam Altmans Observations On Generational Tech Use

May 15, 2025

College Students Using Chat Gpt For Life Decisions Sam Altmans Observations On Generational Tech Use

May 15, 2025 -

Wout Van Aert Poised For Stage 5 Win At Giro D Italia Matera 151km Route

May 15, 2025

Wout Van Aert Poised For Stage 5 Win At Giro D Italia Matera 151km Route

May 15, 2025 -

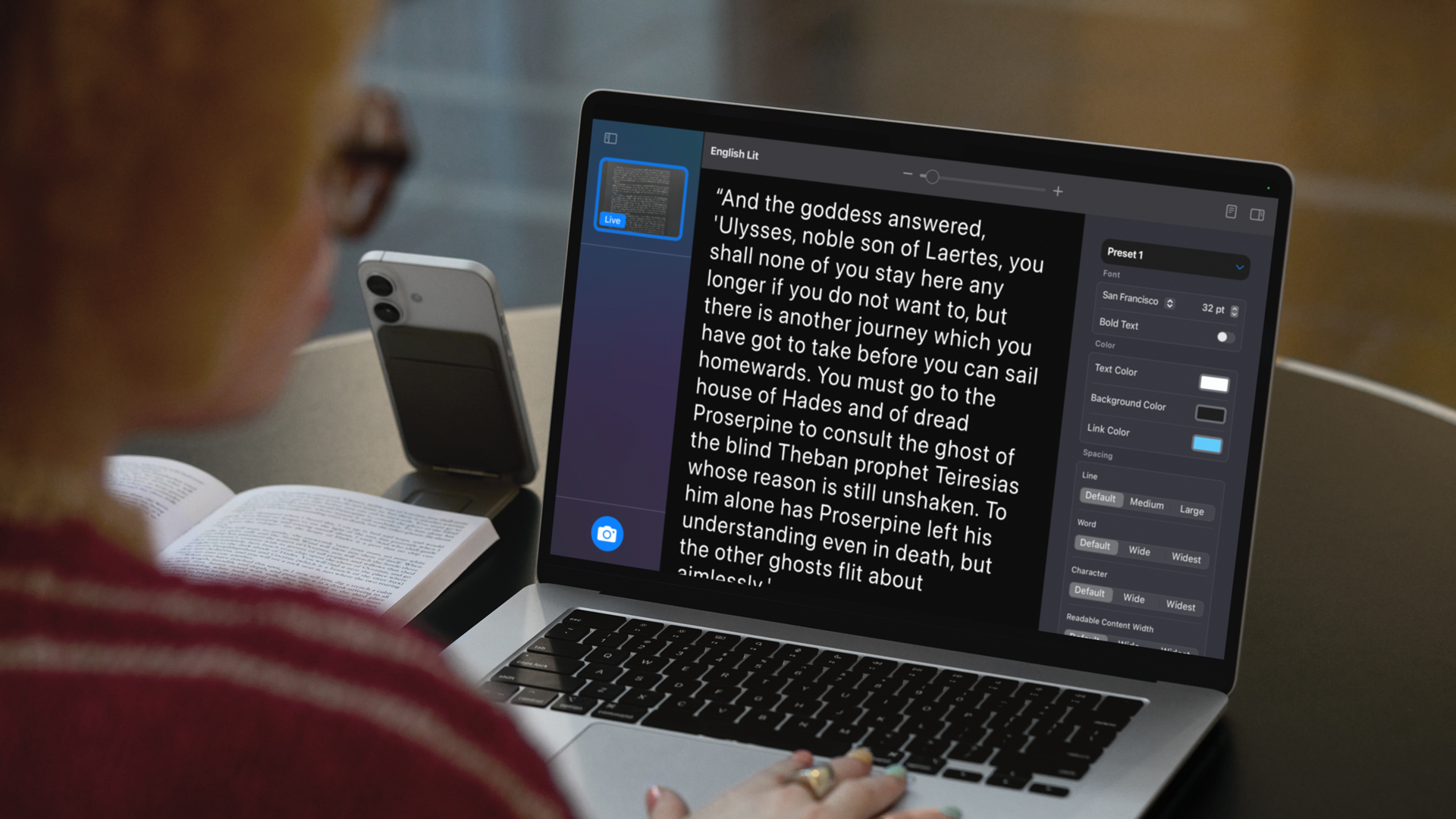

Apples Accessibility Update Insanely Fast Personal Voice And More

May 15, 2025

Apples Accessibility Update Insanely Fast Personal Voice And More

May 15, 2025 -

Navigating The Future Of Stablecoins The Us Genius Acts Defining Role

May 15, 2025

Navigating The Future Of Stablecoins The Us Genius Acts Defining Role

May 15, 2025 -

Super Micro A Deep Dive Into The Biggest Threat To Its Stock Price

May 15, 2025

Super Micro A Deep Dive Into The Biggest Threat To Its Stock Price

May 15, 2025

Latest Posts

-

Is Solana The Next Ethereum A Data Driven Analysis Of Its Performance

May 15, 2025

Is Solana The Next Ethereum A Data Driven Analysis Of Its Performance

May 15, 2025 -

Fact Check Trump And Musks Allegations Of White Farmer Genocide In South Africa

May 15, 2025

Fact Check Trump And Musks Allegations Of White Farmer Genocide In South Africa

May 15, 2025 -

Digital Journaling A Lofi Kit For Modern Self Care

May 15, 2025

Digital Journaling A Lofi Kit For Modern Self Care

May 15, 2025 -

The India Pakistan Aerial Conflict Claims And Realities

May 15, 2025

The India Pakistan Aerial Conflict Claims And Realities

May 15, 2025 -

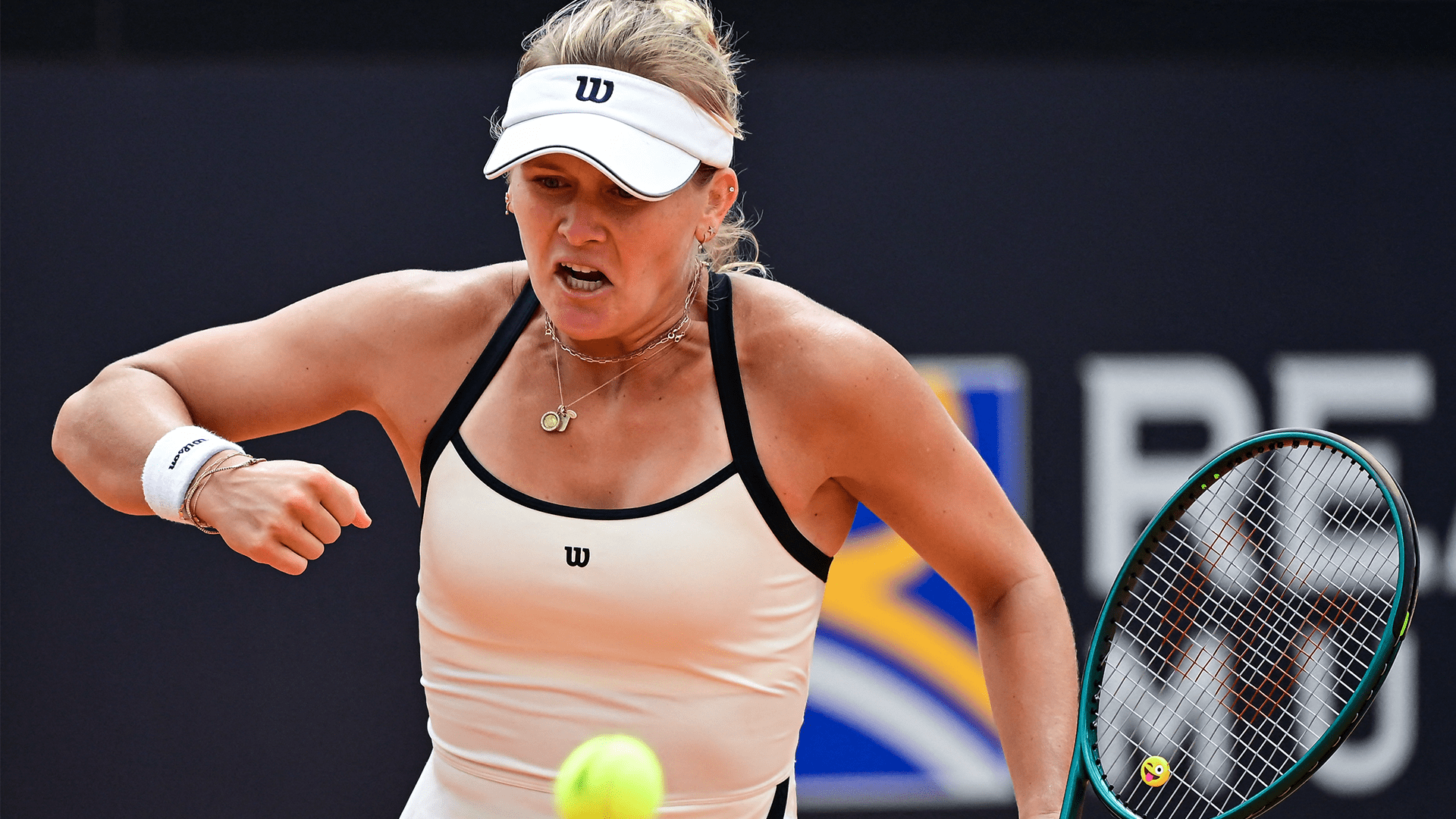

Peyton Stearns No Regrets Over Public Coaching Change Tweet

May 15, 2025

Peyton Stearns No Regrets Over Public Coaching Change Tweet

May 15, 2025