Solana (SOL) Price Analysis: Correction Incoming Or Further Gains?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Solana (SOL) Price Analysis: Correction Incoming or Further Gains?

The Solana (SOL) price has experienced a rollercoaster ride in recent months, leaving investors wondering: is a correction imminent, or are further gains on the horizon? This analysis delves into the current market conditions, technical indicators, and fundamental factors to provide a comprehensive outlook on the future of SOL.

Recent Price Action and Market Sentiment:

Solana's price has shown significant volatility, mirroring the broader cryptocurrency market's sensitivity to macroeconomic factors and regulatory uncertainty. While recent price increases have fueled optimism among some investors, others remain cautious, citing potential overvaluation and the need for a healthy correction. The current price action is characterized by periods of consolidation punctuated by sharp price swings, indicating a market grappling with conflicting forces. Understanding this dynamic is crucial for navigating the potential risks and rewards associated with investing in SOL.

Technical Indicators Point to Potential Consolidation:

A closer look at key technical indicators reveals a mixed bag. While some suggest further upside potential, others signal a potential for price consolidation or even a minor correction. For example, the Relative Strength Index (RSI) is currently hovering near overbought territory, suggesting a potential pullback. Similarly, moving average convergence divergence (MACD) shows signs of weakening bullish momentum. However, support levels remain relatively strong, indicating potential resilience against significant downward pressure. Experienced traders will be carefully monitoring these indicators for confirmation of any significant price movement.

Fundamental Factors: A Mixed Bag for Solana's Future:

Beyond technical analysis, the fundamental aspects of Solana's ecosystem are also crucial considerations. Solana boasts a high transaction throughput and low transaction fees, making it attractive for decentralized applications (dApps) and non-fungible token (NFT) projects. However, the network has experienced periods of instability in the past, raising concerns about its scalability and reliability. Ongoing development and improvements to the network's infrastructure are vital for maintaining investor confidence and driving future growth. The broader adoption of Solana-based projects and the overall health of the DeFi ecosystem will significantly impact its long-term price prospects.

What to Expect: Potential Scenarios for Solana's Price:

Several scenarios are possible for Solana's price in the near future:

-

Scenario 1: Minor Correction: A temporary pullback is entirely possible, given the recent price surge and overbought conditions indicated by some technical indicators. This correction could provide a valuable buying opportunity for long-term investors.

-

Scenario 2: Continued Gains: If positive developments in the Solana ecosystem and broader crypto market prevail, further price increases are possible. Increased adoption of Solana-based dApps and NFTs could fuel further upward momentum.

-

Scenario 3: Consolidation: The price of SOL might consolidate within a defined range, allowing the market to absorb recent price gains and assess the overall market sentiment before a significant move in either direction.

Conclusion: Cautious Optimism Prevails:

While Solana's potential is undeniable, investors should approach the current market situation with caution. The combination of technical indicators suggesting potential consolidation and the inherent volatility of the cryptocurrency market necessitates a risk-management strategy. Careful monitoring of key technical indicators, ongoing development within the Solana ecosystem, and broader market trends will be crucial in determining the future price trajectory of SOL. It’s a market that demands diligent research and a well-defined investment plan. Remember, this is not financial advice, and conducting thorough research before any investment decision is paramount.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Solana (SOL) Price Analysis: Correction Incoming Or Further Gains?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

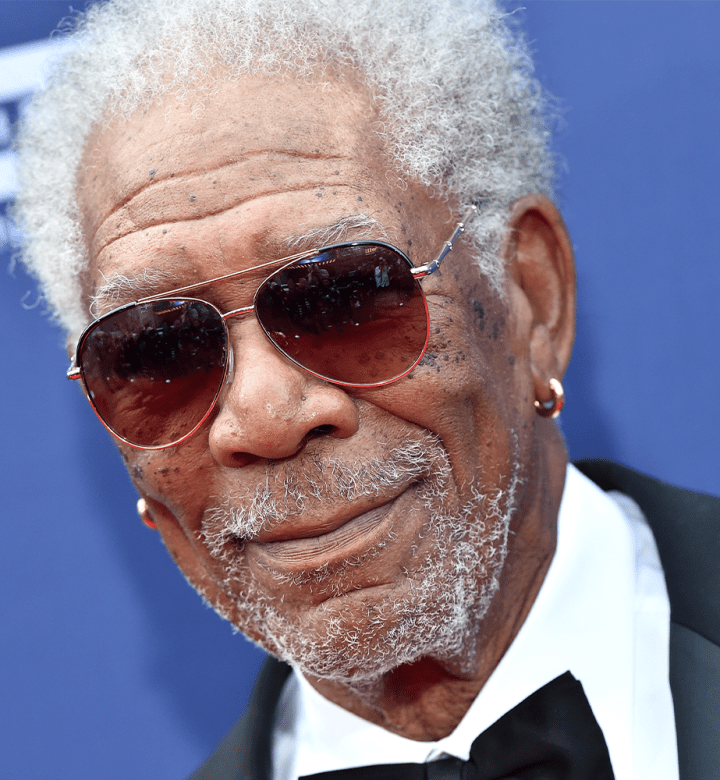

Review Morgan Freeman Stars In A Gripping Psychological Thriller On Netflix

Apr 27, 2025

Review Morgan Freeman Stars In A Gripping Psychological Thriller On Netflix

Apr 27, 2025 -

The High Cost Of Nuclear Power Australias Aluminium Sector At Risk

Apr 27, 2025

The High Cost Of Nuclear Power Australias Aluminium Sector At Risk

Apr 27, 2025 -

Dcs Doom Patrol A Deeper Look At Its Complex Characters And Their Trauma

Apr 27, 2025

Dcs Doom Patrol A Deeper Look At Its Complex Characters And Their Trauma

Apr 27, 2025 -

Will The Peaky Blinders Web3 Game Deliver A Aaa Experience In 2026

Apr 27, 2025

Will The Peaky Blinders Web3 Game Deliver A Aaa Experience In 2026

Apr 27, 2025 -

Human Creativity In The Age Of Ai Insights From Microsofts Design Chief

Apr 27, 2025

Human Creativity In The Age Of Ai Insights From Microsofts Design Chief

Apr 27, 2025