Solana Spot ETF Approval: Examining Franklin Templeton's SEC Application And The Future Of Crypto ETFs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Solana Spot ETF Approval: Examining Franklin Templeton's SEC Application and the Future of Crypto ETFs

The cryptocurrency investment landscape is buzzing with anticipation following Franklin Templeton's filing of a spot Bitcoin ETF application with the Securities and Exchange Commission (SEC). While not specifically a Solana ETF, this pivotal move significantly impacts the future prospects of all crypto ETFs, including a potential future Solana spot ETF. The SEC's decision on this application, and others like it, will likely pave the way for a wave of crypto ETF approvals, potentially including those focused on altcoins like Solana.

Franklin Templeton's Bold Move and its Implications

Franklin Templeton, a renowned asset management firm, has thrown its considerable weight behind the push for a Bitcoin spot ETF. Their application, meticulously crafted and backed by robust infrastructure, represents a significant leap forward in the SEC's consideration of crypto-related investment vehicles. The success of this application could signal a green light for other firms seeking approval for various crypto ETFs, including those focused on alternative cryptocurrencies like Solana.

The key difference between a spot Bitcoin ETF and a futures-based ETF lies in the underlying asset. A spot ETF holds the actual cryptocurrency, offering more direct exposure to price fluctuations. This direct exposure is what many investors have been clamoring for and is crucial for the success of future altcoin ETFs, such as a hypothetical Solana spot ETF.

The Solana Factor: Why a Spot ETF Could Be Transformative

Solana, a high-performance blockchain known for its speed and scalability, has a dedicated and growing community. A Solana spot ETF would offer investors a regulated and accessible way to gain exposure to this burgeoning ecosystem. This would likely increase institutional investment in Solana, boosting its price and overall market capitalization. Such an ETF could also attract a wider range of retail investors, furthering Solana's mainstream adoption.

What the SEC's Decision Means for the Future

The SEC's scrutiny of crypto ETFs has been intense, primarily due to concerns about market manipulation and investor protection. However, the increasing maturity of the crypto market and the robust applications submitted by firms like Franklin Templeton may sway the regulatory body's stance.

A positive decision on Franklin Templeton's application would likely trigger a domino effect, opening the floodgates for numerous other crypto ETF applications. This would include potential applications for Solana and other altcoins, potentially reshaping the landscape of crypto investing.

Key Factors influencing SEC approval:

- Market Surveillance: Robust mechanisms to detect and prevent market manipulation are crucial.

- Custodian Security: Secure storage and management of crypto assets are paramount.

- Regulatory Compliance: Adherence to all relevant securities laws and regulations.

The Road Ahead for Solana and Crypto ETFs

While a Solana spot ETF is not yet a reality, Franklin Templeton's application provides a clear pathway. The success of this and similar applications hinges on the SEC's willingness to embrace the growing maturity of the crypto market and its potential to offer regulated investment opportunities. The coming months will be crucial in shaping the future of crypto ETFs and the role of altcoins like Solana in the broader financial system. Keep an eye on the SEC's decisions and the evolving regulatory landscape for the latest updates on this exciting development. The approval of a Solana spot ETF could significantly impact the cryptocurrency market, attracting further institutional and retail investment and driving widespread adoption.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Solana Spot ETF Approval: Examining Franklin Templeton's SEC Application And The Future Of Crypto ETFs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Monte Morris Back Injury Point Guard Expected Back Monday

Mar 18, 2025

Monte Morris Back Injury Point Guard Expected Back Monday

Mar 18, 2025 -

Pacers Clutch Overtime Performance Secures Victory Against Timberwolves

Mar 18, 2025

Pacers Clutch Overtime Performance Secures Victory Against Timberwolves

Mar 18, 2025 -

Buddy Hield For John Collins Analyzing The Potential Warriors Trade

Mar 18, 2025

Buddy Hield For John Collins Analyzing The Potential Warriors Trade

Mar 18, 2025 -

Proposed Lakers Raptors Trade A Centerpiece Deal And Its Grade

Mar 18, 2025

Proposed Lakers Raptors Trade A Centerpiece Deal And Its Grade

Mar 18, 2025 -

Doncic Ankle Probable Will He Play Monday Night

Mar 18, 2025

Doncic Ankle Probable Will He Play Monday Night

Mar 18, 2025

Latest Posts

-

Secondary School Student Faces Charges After Attacking Teacher With Penknife

Apr 30, 2025

Secondary School Student Faces Charges After Attacking Teacher With Penknife

Apr 30, 2025 -

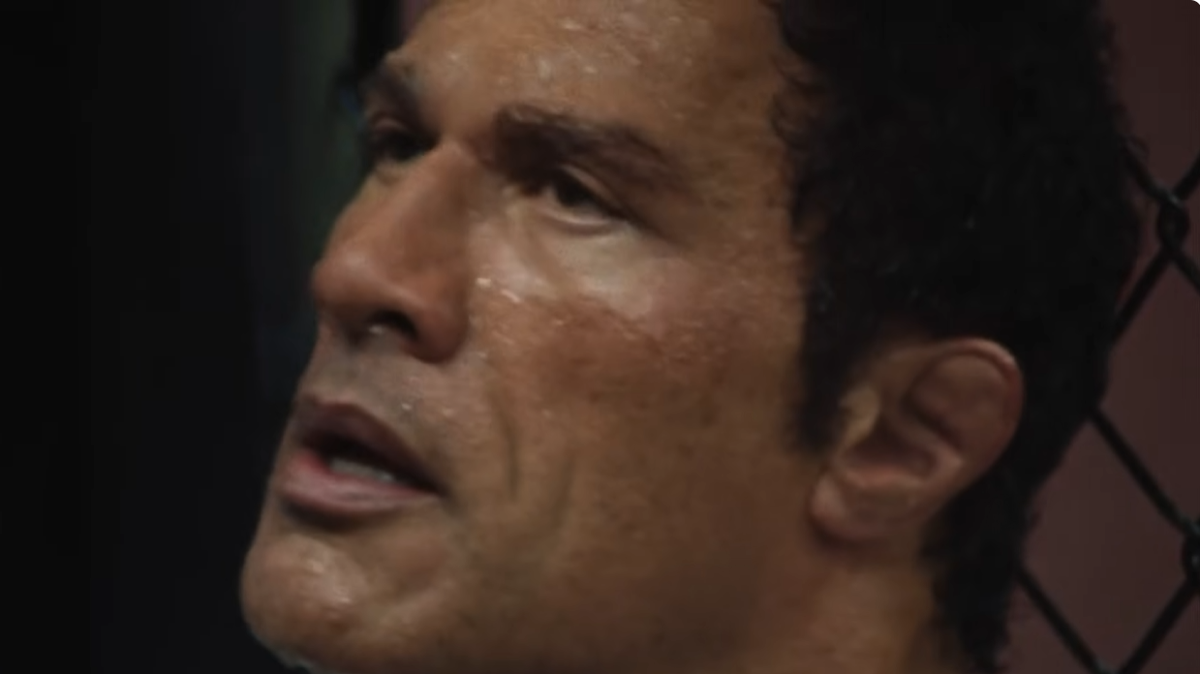

Smashing Machine Trailer Dwayne The Rock Johnsons Ufc Fight Revealed

Apr 30, 2025

Smashing Machine Trailer Dwayne The Rock Johnsons Ufc Fight Revealed

Apr 30, 2025 -

Thunderbolts Review Florence Pughs Performance Redeems Marvels Flawed Film

Apr 30, 2025

Thunderbolts Review Florence Pughs Performance Redeems Marvels Flawed Film

Apr 30, 2025 -

Arsenal Psg Champions League Semifinal Live Score And Match Report

Apr 30, 2025

Arsenal Psg Champions League Semifinal Live Score And Match Report

Apr 30, 2025 -

In Depth Match Report Key Moments And Player Performances

Apr 30, 2025

In Depth Match Report Key Moments And Player Performances

Apr 30, 2025