Solana's $200 Target: A Deep Dive Into The Technical Indicators

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Solana's $200 Target: A Deep Dive into the Technical Indicators

Solana (SOL), the high-performance blockchain known for its lightning-fast transaction speeds, has been making headlines lately. With recent price action sparking renewed interest, many investors are wondering: Is a $200 SOL price target realistic? Let's dive deep into the technical indicators to analyze the potential for such a significant rally.

The Current Market Sentiment: Solana has experienced a rollercoaster ride in the past year, mirroring the broader cryptocurrency market volatility. After a significant drop from its all-time high, SOL has shown signs of recovery, prompting renewed optimism among investors. However, caution is warranted, as the crypto market remains susceptible to external factors such as regulatory changes and macroeconomic conditions.

Technical Analysis: Unveiling the Clues

Several technical indicators suggest a potential move towards the $200 mark, but it's crucial to understand the nuances:

-

Moving Averages: The 50-day and 200-day moving averages are key indicators of price trends. A bullish crossover (50-day crossing above the 200-day) often signals a potential uptrend. While this hasn't definitively occurred yet, the closing price is getting increasingly closer, suggesting a potential bullish signal in the near future. Monitoring this closely is crucial for short-term traders.

-

Relative Strength Index (RSI): The RSI, a momentum oscillator, measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A reading below 30 typically indicates an oversold market, potentially signaling a bounce. While the RSI has shown periods of oversold conditions recently, it's important to note that these signals aren't always foolproof.

-

Volume: Trading volume provides crucial context for price movements. Increased volume during an upward trend strengthens the bullish signal, indicating strong buying pressure. Conversely, low volume during an uptrend suggests weak momentum and a potential reversal. Observing volume changes alongside price movements is vital for accurate interpretation.

-

Support and Resistance Levels: Identifying key support and resistance levels is essential. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels, conversely, indicate price points where selling pressure is anticipated to halt further upward movements. Breaking through key resistance levels could pave the way for a run towards $200.

Factors Beyond Technicals:

While technical analysis offers valuable insights, several external factors also influence Solana's price:

-

Network Development: Ongoing developments and upgrades to the Solana network are crucial for attracting developers and users. Positive developments in this area could fuel price appreciation.

-

Adoption and Partnerships: Increased adoption by businesses and strategic partnerships with other companies in the blockchain space would significantly bolster investor confidence and potentially drive up the price.

-

Regulatory Landscape: The regulatory environment for cryptocurrencies remains uncertain globally. Positive regulatory developments or clarity could inject significant optimism into the market, benefiting SOL.

Conclusion: Realistic Expectations?

A $200 Solana price target is certainly ambitious, and whether it’s achievable depends on a confluence of factors. While positive technical indicators and network developments paint a potentially bullish picture, it's crucial to remember the inherent volatility of the cryptocurrency market. Investors should conduct thorough research, diversify their portfolio, and manage risk effectively. The information provided here is for educational purposes and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions. Staying updated on market trends and technical indicators is paramount for navigating the dynamic landscape of Solana and the broader cryptocurrency market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Solana's $200 Target: A Deep Dive Into The Technical Indicators. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigating Henrys Disposal A Case Study

May 25, 2025

Investigating Henrys Disposal A Case Study

May 25, 2025 -

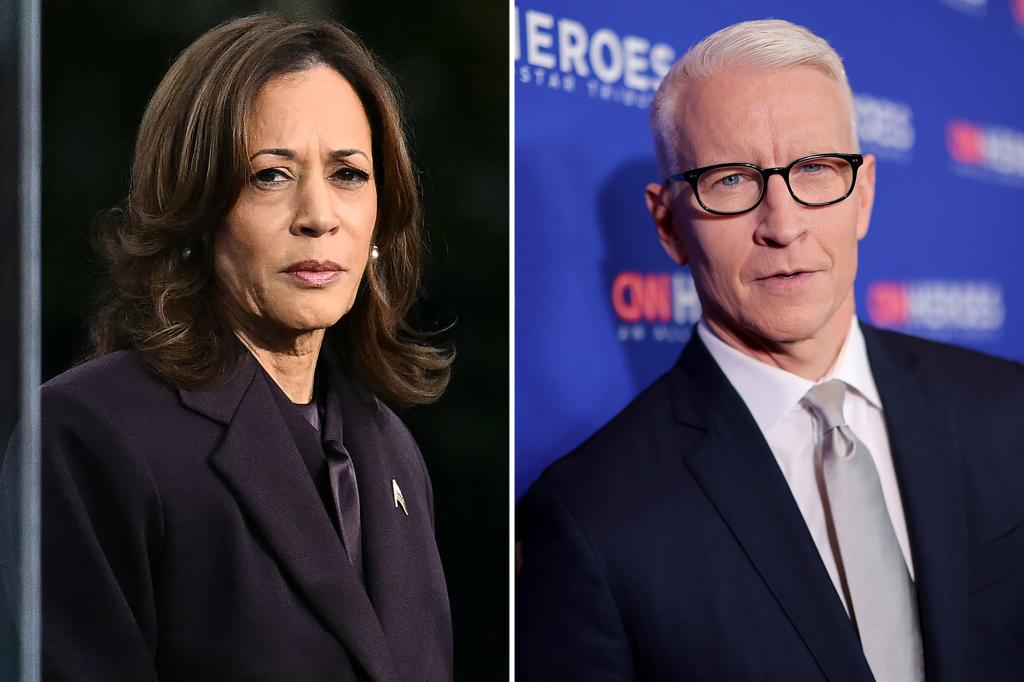

Anderson Cooper Interview Sparks Outrage Kamala Harriss Motherf Er Comment

May 25, 2025

Anderson Cooper Interview Sparks Outrage Kamala Harriss Motherf Er Comment

May 25, 2025 -

Labubus The Viral Internet Sensation Explained

May 25, 2025

Labubus The Viral Internet Sensation Explained

May 25, 2025 -

Horrifying Crime Against James Martin Exposes Londons Security Flaws Under Khan

May 25, 2025

Horrifying Crime Against James Martin Exposes Londons Security Flaws Under Khan

May 25, 2025 -

A League Semi Finals Betting Tips And Match Analysis For Leg Two

May 25, 2025

A League Semi Finals Betting Tips And Match Analysis For Leg Two

May 25, 2025

Latest Posts

-

Slam Dunk 2025 The Top 10 Bands You Need To Witness

May 25, 2025

Slam Dunk 2025 The Top 10 Bands You Need To Witness

May 25, 2025 -

Computex 2025 In Taipei Innovation And Technology On Display

May 25, 2025

Computex 2025 In Taipei Innovation And Technology On Display

May 25, 2025 -

Dont Miss These Top 10 Bands At Slam Dunk Festival 2025

May 25, 2025

Dont Miss These Top 10 Bands At Slam Dunk Festival 2025

May 25, 2025 -

James Martin London Crime Victim Blasts Sadiq Khans Broken Capital

May 25, 2025

James Martin London Crime Victim Blasts Sadiq Khans Broken Capital

May 25, 2025 -

As Decisoes De Investimento Da Berkshire Hathaway Agora Estao Nas Maos De Greg Abel

May 25, 2025

As Decisoes De Investimento Da Berkshire Hathaway Agora Estao Nas Maos De Greg Abel

May 25, 2025