Spending Crypto Made Easy: The Rise Of Stablecoin Debit Cards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Spending Crypto Made Easy: The Rise of Stablecoin Debit Cards

The world of cryptocurrency is constantly evolving, and one of the most exciting developments is the emergence of stablecoin debit cards. These innovative financial tools are bridging the gap between the digital and traditional financial worlds, making it easier than ever to spend your crypto holdings in everyday life. But what exactly are they, and why are they experiencing such a surge in popularity?

What are Stablecoin Debit Cards?

Stablecoin debit cards are prepaid cards linked to a stablecoin account. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, stablecoins maintain a relatively stable value, typically pegged to a fiat currency like the US dollar (USD). This stability makes them ideal for everyday spending, eliminating the risk of significant price fluctuations impacting your purchases. Think of it as a bridge: you hold your crypto assets in a stable form, and the card allows you to seamlessly convert and spend them at any merchant that accepts Visa or Mastercard (depending on the card provider).

The Benefits of Using Stablecoin Debit Cards:

-

Easy Spending: The biggest advantage is the ease of use. You can use your card anywhere that accepts debit cards, transforming your crypto holdings into readily spendable cash. No more complicated exchanges or waiting for transactions to confirm.

-

Security and Privacy: Many providers prioritize security features, including fraud protection and advanced encryption. While not entirely anonymous, they offer a higher degree of privacy compared to traditional bank debit cards, particularly for users who value their financial independence.

-

Global Accessibility: With the right provider, you can often use these cards worldwide, making international travel and spending far more convenient for crypto holders.

-

Flexibility and Convenience: Many stablecoin cards offer features like mobile apps for tracking balances, managing spending, and receiving notifications. This level of convenience is comparable to, or even surpasses, that of traditional banking apps.

-

Reduced Transaction Fees: Compared to traditional international money transfers, stablecoin debit cards can offer significantly lower transaction fees, especially when spending overseas.

The Growing Popularity of Stablecoin Debit Cards:

The adoption rate of stablecoin debit cards is increasing rapidly, driven by several factors:

-

Increased Crypto Adoption: The overall growth in cryptocurrency adoption is fueling demand for more user-friendly ways to spend digital assets.

-

Improved User Experience: The ease and convenience of using these cards are attracting both seasoned crypto users and newcomers alike.

-

Technological Advancements: Constant improvements in blockchain technology and payment processing infrastructure are making these cards more secure and efficient.

-

Expansion of Partnerships: Collaborations between stablecoin issuers, payment processors, and card providers are expanding the reach and accessibility of these financial tools.

Choosing the Right Stablecoin Debit Card:

Before choosing a stablecoin debit card, consider these factors:

- Supported Stablecoins: Ensure the card supports the stablecoin you prefer to use (e.g., USDC, USDT, BUSD).

- Fees and Charges: Compare fees for card issuance, monthly maintenance, and international transactions.

- Security Features: Look for cards with robust security measures, such as two-factor authentication and fraud protection.

- Customer Support: Choose a provider with reliable and responsive customer support.

The Future of Stablecoin Debit Cards:

The future looks bright for stablecoin debit cards. As cryptocurrency adoption continues to grow and technology advances, we can expect even more innovative features, wider acceptance, and increased competition within the market. These cards are not merely a niche product; they represent a significant step towards mainstream cryptocurrency adoption and the integration of digital assets into our daily lives. They're making the crypto world more accessible and easier to navigate, one transaction at a time.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Spending Crypto Made Easy: The Rise Of Stablecoin Debit Cards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Western Conference Semifinals Stuart Skinner To Start Game 4 For Edmonton Oilers

May 13, 2025

Western Conference Semifinals Stuart Skinner To Start Game 4 For Edmonton Oilers

May 13, 2025 -

Two Womens Allegations Lead To Gerard Depardieus Sexual Assault Conviction

May 13, 2025

Two Womens Allegations Lead To Gerard Depardieus Sexual Assault Conviction

May 13, 2025 -

Ripple Sec Settlement In Sight Xrp Price Rallies 27

May 13, 2025

Ripple Sec Settlement In Sight Xrp Price Rallies 27

May 13, 2025 -

West Brom Faces Setback In Bid To Appoint Ryan Mason As Manager

May 13, 2025

West Brom Faces Setback In Bid To Appoint Ryan Mason As Manager

May 13, 2025 -

3 Ton Stonehenge Parts A Case For The Recycling Of Megalithic Building Materials

May 13, 2025

3 Ton Stonehenge Parts A Case For The Recycling Of Megalithic Building Materials

May 13, 2025

Latest Posts

-

A League Brisbane Roar Appoints Michael Valkanis As Head Coach

May 14, 2025

A League Brisbane Roar Appoints Michael Valkanis As Head Coach

May 14, 2025 -

Horoscope Quotidien Bruno Vous Dit Tout 13 Mai 2025

May 14, 2025

Horoscope Quotidien Bruno Vous Dit Tout 13 Mai 2025

May 14, 2025 -

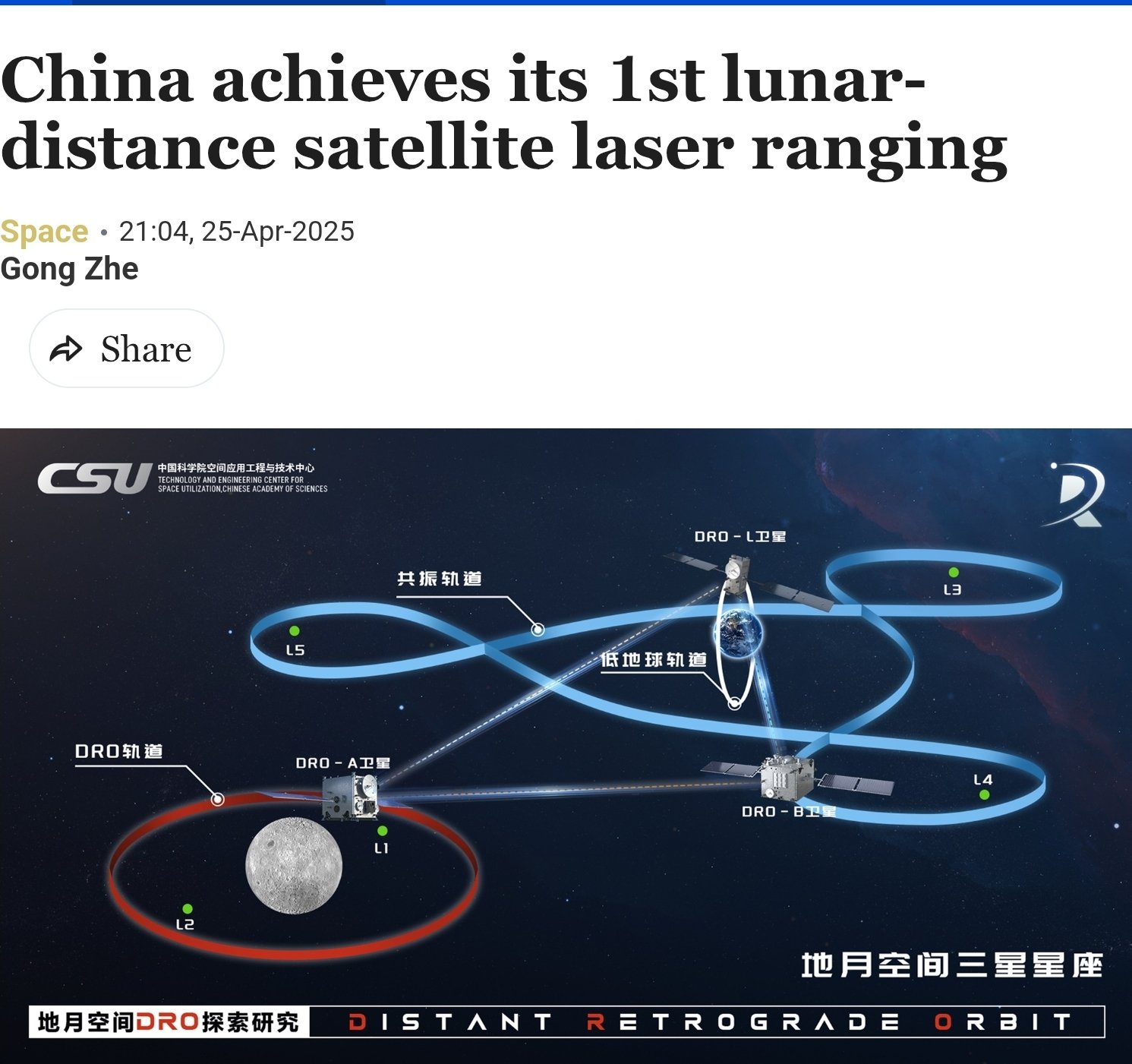

Chinas Lunar Laser Ranging Technology A New Milestone

May 14, 2025

Chinas Lunar Laser Ranging Technology A New Milestone

May 14, 2025 -

Mag 7 Stocks Lead Market Surge With Massive Value Gains

May 14, 2025

Mag 7 Stocks Lead Market Surge With Massive Value Gains

May 14, 2025 -

Open Ai Stargate Project Massive Phase 1 Construction Underway

May 14, 2025

Open Ai Stargate Project Massive Phase 1 Construction Underway

May 14, 2025