Spooked By Tariffs? Buffett's Surprisingly Simple Investment Advice

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Spooked by Tariffs? Buffett's Surprisingly Simple Investment Advice

The global trade war and fluctuating tariffs have left many investors feeling uneasy. Uncertainty reigns supreme, and the question on everyone's mind is: where to turn for reliable investment advice in these turbulent times? Surprisingly, the answer might lie in the surprisingly simple, yet profoundly insightful, approach advocated by the Oracle of Omaha himself, Warren Buffett.

Buffett, renowned for his long-term investment strategy and unwavering focus on value, offers a reassuring counterpoint to the short-term anxieties spurred by tariff anxieties. Instead of panicking over daily market fluctuations driven by trade policy, he urges investors to focus on the fundamentals.

Ignoring the Noise: Buffett's Long-Term Perspective

The recent trade tensions, while significant in the short term, are unlikely to fundamentally alter the long-term prospects of strong, fundamentally sound companies. This is the core of Buffett's message. He emphasizes the importance of ignoring short-term market volatility caused by external factors like tariffs. Instead, he advises focusing on:

- Company fundamentals: Analyze a company's financial health, its competitive advantage, and its long-term growth potential. Is the company profitable? Does it have a strong management team? What is its market share? These are the questions that matter most, according to Buffett.

- Intrinsic value: Invest in companies trading below their intrinsic value – their true worth based on their assets, earnings, and future prospects. This is a key tenet of value investing, a strategy Buffett has championed throughout his career.

- Long-term holding: Buy and hold quality companies for the long haul. Don't be swayed by short-term market fluctuations or news headlines. Patience and discipline are essential components of successful investing.

Beyond Tariffs: Focusing on What You Can Control

While tariffs undeniably impact businesses and the broader economy, Buffett's advice reminds us to focus on what we can control: our investment choices. Instead of trying to time the market based on unpredictable trade policies, concentrate on identifying well-managed companies with strong competitive advantages and a history of profitability.

Practical Steps for the Average Investor:

Applying Buffett's wisdom to your own portfolio might involve:

- Diversification: Don't put all your eggs in one basket. Diversify your investments across different sectors and asset classes to mitigate risk.

- Due Diligence: Thoroughly research any company before investing. Understand its business model, financial performance, and competitive landscape.

- Emotional Discipline: Avoid making impulsive investment decisions based on fear or greed. Stick to your long-term investment plan.

- Index Funds: For those less inclined to individual stock picking, consider investing in low-cost index funds that track the overall market. This provides broad diversification and aligns with Buffett's emphasis on long-term growth.

Conclusion: A Timeless Approach to Investing

In conclusion, while the current trade climate presents challenges, Buffett's surprisingly simple investment advice remains remarkably relevant. By focusing on fundamental analysis, long-term growth, and emotional discipline, investors can navigate the uncertainties of the market and achieve their financial goals, regardless of tariff fluctuations. The key takeaway? Don't be spooked by short-term market noise; focus on the enduring strength of quality companies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Spooked By Tariffs? Buffett's Surprisingly Simple Investment Advice. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dallas Stars Vs Minnesota Wild April 6 2025 Game Preview Predictions And Betting Analysis

Apr 07, 2025

Dallas Stars Vs Minnesota Wild April 6 2025 Game Preview Predictions And Betting Analysis

Apr 07, 2025 -

Two Stocks To Consider As Stock Market Fluctuations Continue

Apr 07, 2025

Two Stocks To Consider As Stock Market Fluctuations Continue

Apr 07, 2025 -

Malmoe Slopar Gratis Tagresor Blir Ganska Krangligt

Apr 07, 2025

Malmoe Slopar Gratis Tagresor Blir Ganska Krangligt

Apr 07, 2025 -

Comm Bank Matildas Vs Korea Republic Your Guide To Watching Live From Mc Donald Jones Stadium

Apr 07, 2025

Comm Bank Matildas Vs Korea Republic Your Guide To Watching Live From Mc Donald Jones Stadium

Apr 07, 2025 -

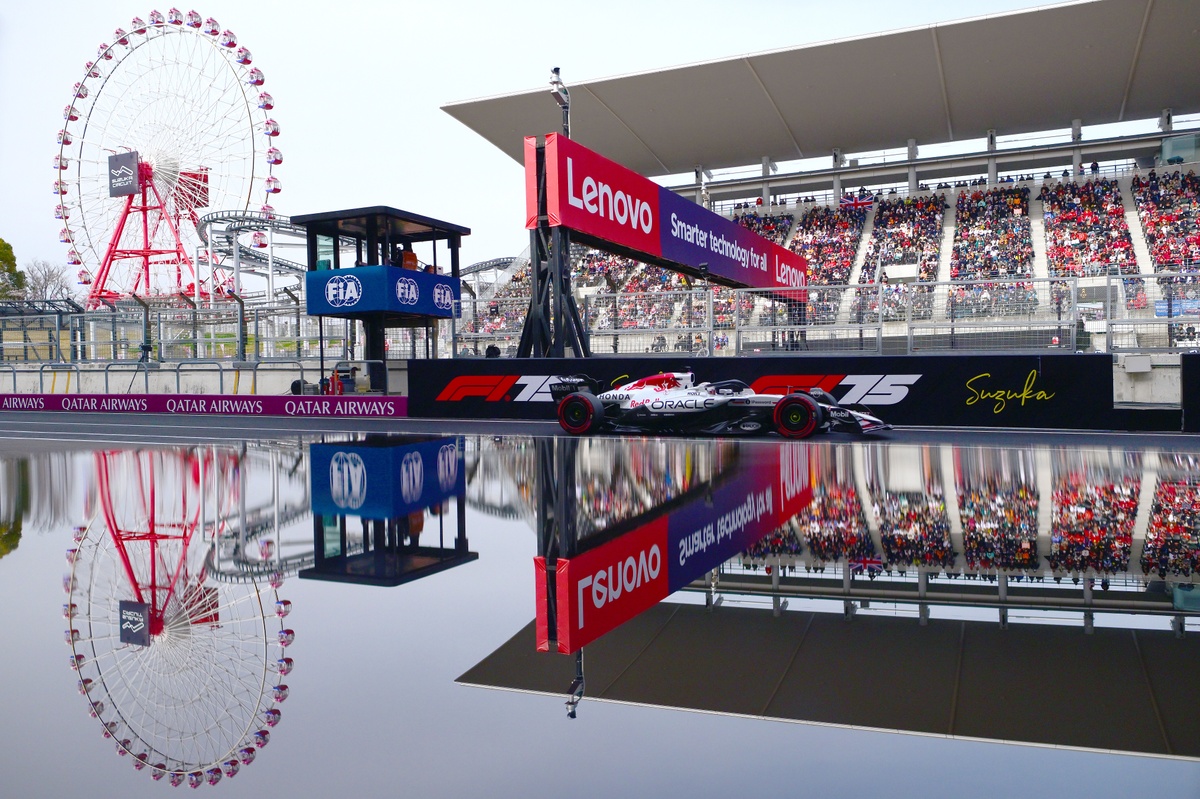

Follow The Action Live F1 Japanese Gp Commentary And Race Day News

Apr 07, 2025

Follow The Action Live F1 Japanese Gp Commentary And Race Day News

Apr 07, 2025