Spooked By Tariffs? Buffett's Timeless Advice For Troubled Times

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Spooked by Tariffs? Buffett's Timeless Advice for Troubled Times

The global economy is a rollercoaster, and right now, many investors feel a stomach-churning drop. Tariffs, inflation, and geopolitical uncertainty have created a volatile market, leaving even seasoned investors wondering what to do. But amidst the chaos, a beacon of wisdom shines: Warren Buffett's timeless investment philosophy. His approach, built on patience, value, and long-term vision, offers a powerful antidote to the anxieties of today's turbulent times.

Buffett's Core Principles: A Shield Against Market Volatility

Buffett's success isn't built on short-term market swings. He famously advocates for a "buy-and-hold" strategy, emphasizing the importance of investing in fundamentally strong companies and holding them for the long haul. This approach significantly reduces the impact of short-term market fluctuations caused by events like tariff disputes.

Here are some key tenets of Buffett's philosophy that are particularly relevant in the current climate:

-

Focus on Value, Not Hype: Buffett consistently seeks undervalued companies with strong fundamentals, regardless of market trends. He looks beyond the daily noise and focuses on a company's long-term earning power and competitive advantage. In times of tariff uncertainty, this focus becomes even more critical, helping investors avoid impulsive decisions based on fear.

-

Patience is a Virtue: The Oracle of Omaha isn't known for impulsive trading. He emphasizes the importance of patience, urging investors to resist the temptation to panic sell during market downturns. Tariffs might create temporary headwinds, but a strong company will eventually weather the storm.

-

Invest in What You Understand: Buffett famously advises investors to stick to what they know. Don't chase the latest trendy investments; instead, invest in companies whose businesses you understand and whose long-term prospects you believe in. This reduces risk considerably, especially in uncertain economic times.

-

Long-Term Perspective: Buffett's investment horizon is decades, not days or weeks. He views market volatility as an opportunity, not a threat. A long-term perspective helps investors ride out short-term fluctuations and benefit from the power of compounding over time.

Navigating Tariff Uncertainty with the Buffett Approach

The imposition of tariffs creates uncertainty, impacting both businesses and investors. However, Buffett's principles offer a roadmap for navigating this uncertainty:

-

Identify Companies with Strong Moats: Look for companies with strong competitive advantages (economic moats) that can withstand external pressures like tariffs. These companies are less likely to be severely impacted by trade disputes.

-

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification across different sectors and asset classes reduces the overall risk of your portfolio.

-

Avoid Emotional Investing: Fear and greed are the worst enemies of a successful investor. Stick to your investment plan and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion: A Timeless Strategy for Modern Times

While the global economic landscape may appear daunting, Warren Buffett's investment philosophy offers a reliable compass. By focusing on value, patience, and a long-term perspective, investors can navigate the complexities of tariffs and market volatility with confidence. Remember, successful investing is a marathon, not a sprint. Embrace Buffett's wisdom, and you'll be better prepared to weather any storm.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Spooked By Tariffs? Buffett's Timeless Advice For Troubled Times. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Myanmar Earthquake A Week On The Scale Of The Tragedy Becomes Clear

Apr 07, 2025

Myanmar Earthquake A Week On The Scale Of The Tragedy Becomes Clear

Apr 07, 2025 -

Study Smarter Not Harder Claudes College Study Guide

Apr 07, 2025

Study Smarter Not Harder Claudes College Study Guide

Apr 07, 2025 -

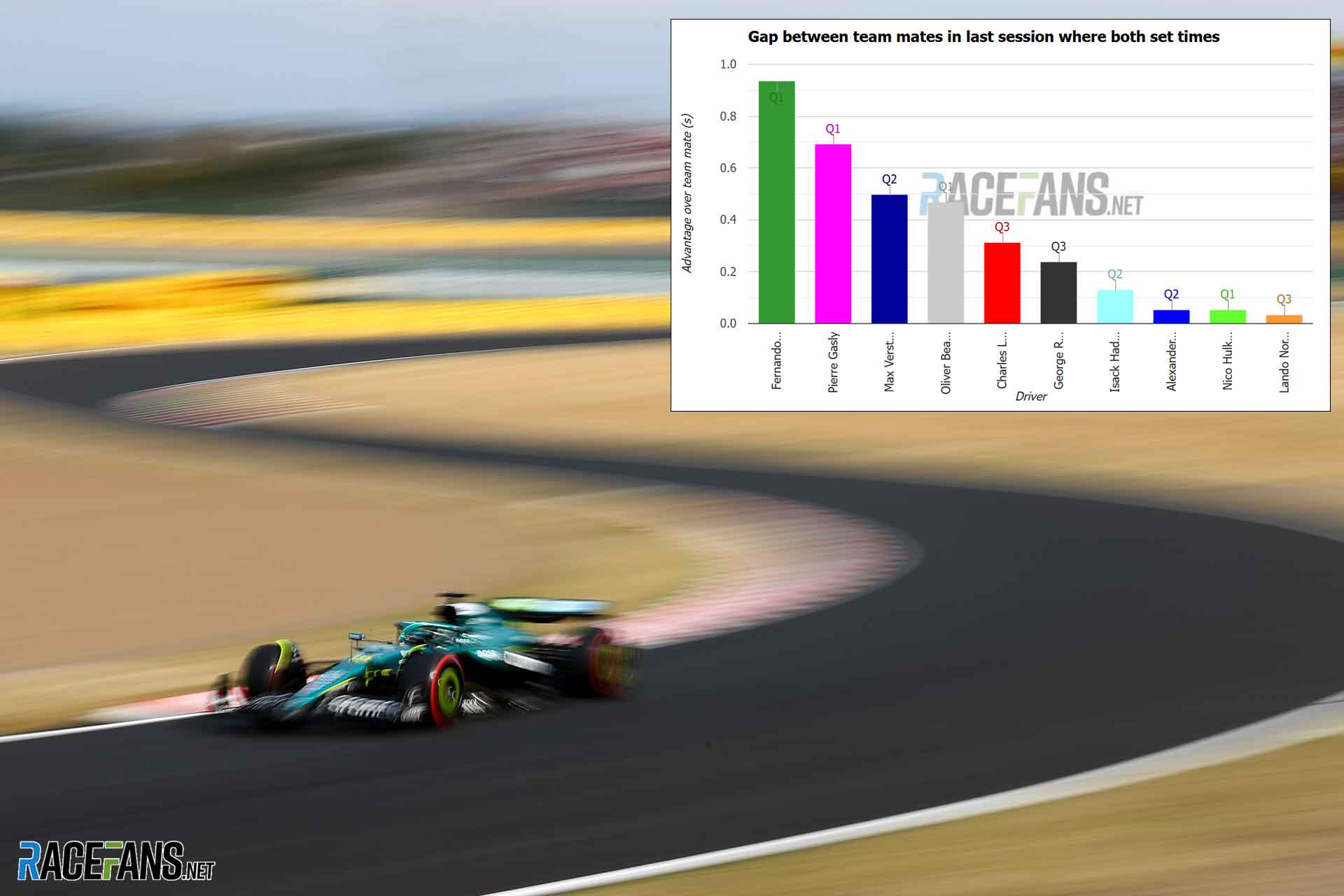

Qualifying Data Reveals 12kph Wind Spike Correlated With Strolls 15th Consecutive Loss

Apr 07, 2025

Qualifying Data Reveals 12kph Wind Spike Correlated With Strolls 15th Consecutive Loss

Apr 07, 2025 -

2025 Japanese Gp Live Piastris Birthday Battle Against Dominant Verstappen

Apr 07, 2025

2025 Japanese Gp Live Piastris Birthday Battle Against Dominant Verstappen

Apr 07, 2025 -

Verstappen Vows Tough Fight Against Norris And Piastri At Rain Threatened Japanese Gp

Apr 07, 2025

Verstappen Vows Tough Fight Against Norris And Piastri At Rain Threatened Japanese Gp

Apr 07, 2025