SSE Composite Index Falls 6.06%: Causes, Consequences, And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SSE Composite Index Plunges 6.06%: Unpacking the Causes, Consequences, and Future Outlook

The Shanghai Stock Exchange Composite Index (SSE Composite) experienced a significant downturn, plummeting 6.06% in a single session. This dramatic fall sent shockwaves through global markets, prompting urgent questions about the underlying causes, immediate consequences, and future prospects for Chinese equities. This article delves into the factors contributing to this sharp decline and explores the potential implications for investors.

Understanding the Dramatic Drop: Key Contributing Factors

Several interconnected factors contributed to the SSE Composite's steep fall. While pinpointing a single cause is overly simplistic, a confluence of events likely triggered the sell-off:

-

Regulatory Concerns: Increased regulatory scrutiny over various sectors, particularly technology and education, continues to unsettle investors. The ongoing crackdown on monopolistic practices and data security concerns has created uncertainty and risk aversion.

-

Economic Slowdown Fears: Concerns about China's slowing economic growth, fueled by weakening property markets and supply chain disruptions, are weighing heavily on investor sentiment. Data suggesting a potential slowdown in manufacturing and consumer spending has exacerbated these fears.

-

Global Market Volatility: The broader global economic landscape is also playing a role. Rising inflation globally, potential interest rate hikes in major economies, and ongoing geopolitical tensions contribute to a risk-off environment, impacting even relatively stable markets.

-

Evergrande's Lingering Impact: The ongoing debt crisis surrounding Evergrande, a major Chinese real estate developer, continues to cast a long shadow over the market. While the immediate fallout may have subsided, the lingering uncertainty about the company's future and the wider implications for the property sector remain a significant concern.

-

Profit-Taking: After a period of relative strength, some investors may have engaged in profit-taking, contributing to the downward pressure on the index.

Consequences of the SSE Composite's Decline

The sharp drop in the SSE Composite has several immediate and potential long-term consequences:

-

Investor Confidence Eroded: The decline significantly erodes investor confidence, both domestically and internationally. This can lead to further capital flight and increased volatility.

-

Ripple Effect on Global Markets: The interconnectedness of global financial markets means that the downturn in the SSE Composite can trigger negative sentiment and ripple effects across other Asian and global markets.

-

Impact on Chinese Companies: Chinese companies listed on the SSE Composite will experience a decrease in their market capitalization, potentially impacting their ability to raise capital and invest in future growth.

Future Outlook: Navigating Uncertainty

Predicting the future trajectory of the SSE Composite is challenging, given the complex interplay of factors at play. However, several key considerations will shape the market's performance in the coming months:

-

Government Intervention: The Chinese government's response to the market downturn will be crucial. Government intervention, aimed at boosting investor confidence and stabilizing the market, could potentially mitigate the negative impact.

-

Economic Data: Future economic data releases will be closely scrutinized by investors. Positive economic indicators could help to restore confidence, while negative data could exacerbate the downturn.

-

Regulatory Clarity: Increased clarity and predictability regarding future regulations would significantly reduce uncertainty and improve investor sentiment.

Conclusion:

The 6.06% plunge in the SSE Composite Index highlights the significant challenges facing the Chinese economy and its stock market. While the immediate future remains uncertain, the government's response, upcoming economic data, and the resolution of key issues like the Evergrande crisis will be critical factors determining the market's recovery. Investors should carefully monitor these developments and consider diversifying their portfolios to mitigate risk. The situation warrants close attention and strategic adjustments in investment strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SSE Composite Index Falls 6.06%: Causes, Consequences, And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Itzulia Cycling Race An In Depth Preview And Analysis

Apr 08, 2025

2025 Itzulia Cycling Race An In Depth Preview And Analysis

Apr 08, 2025 -

Public Outrage Explodes Millions Protest Trump And Musks Actions

Apr 08, 2025

Public Outrage Explodes Millions Protest Trump And Musks Actions

Apr 08, 2025 -

This Bitcoin Metric A False Buy Signal Could Be Imminent

Apr 08, 2025

This Bitcoin Metric A False Buy Signal Could Be Imminent

Apr 08, 2025 -

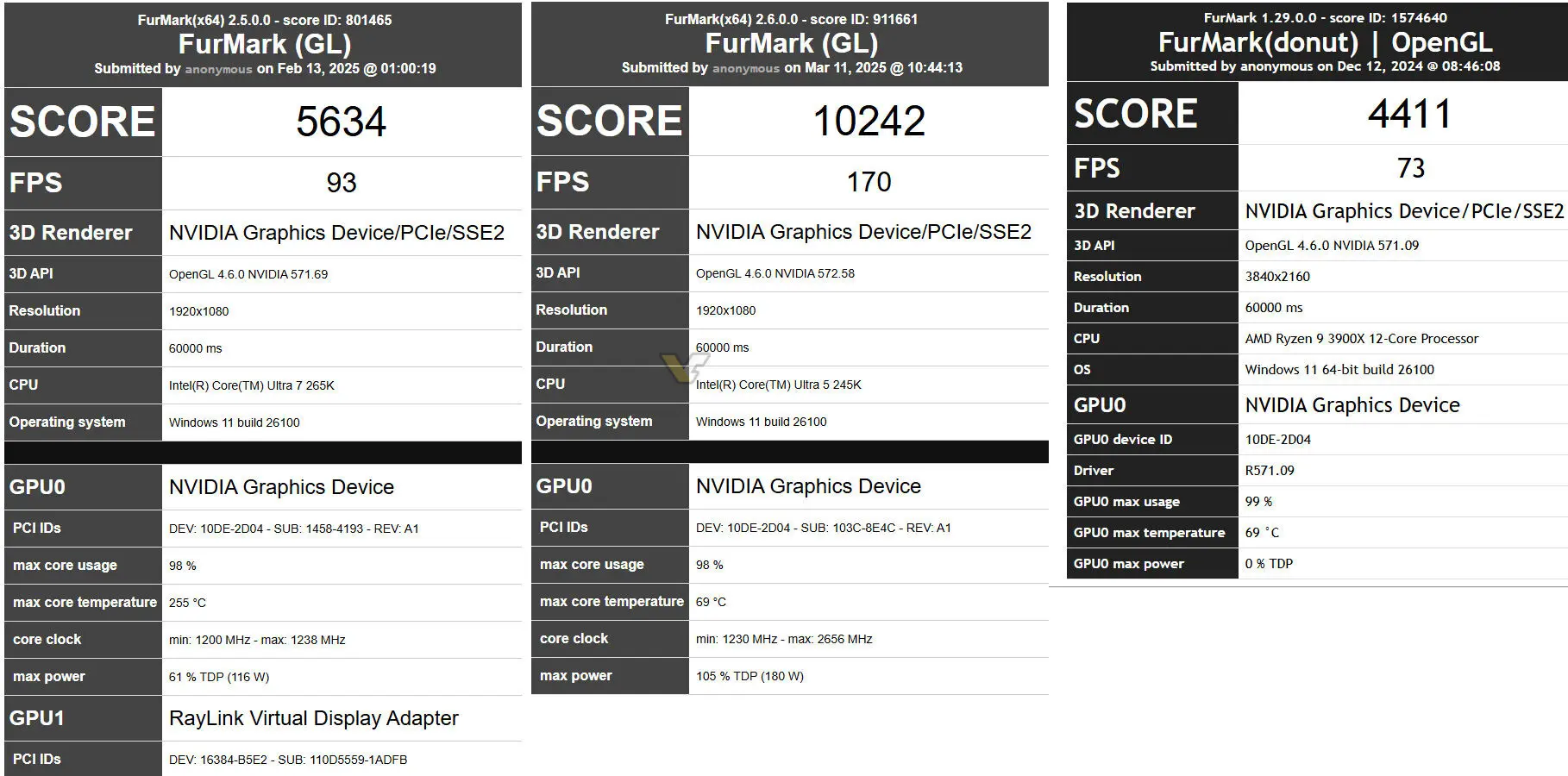

Nvidia Rtx 5060 Ti 180 W Tdp Fur Mark Benchmark Results Surface

Apr 08, 2025

Nvidia Rtx 5060 Ti 180 W Tdp Fur Mark Benchmark Results Surface

Apr 08, 2025 -

What To Watch On Prime Video April 2025 Movie Lineup

Apr 08, 2025

What To Watch On Prime Video April 2025 Movie Lineup

Apr 08, 2025