SSE Composite Index Plunges 6.06%: Market Analysis And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SSE Composite Index Plunges 6.06%: Market Analysis and Implications

The Shanghai Stock Exchange Composite Index (SSE Composite) experienced a dramatic 6.06% plunge today, sending shockwaves through global markets. This sharp decline, the most significant single-day drop in several months, has sparked intense speculation about the underlying causes and potential implications for both Chinese and international investors. Understanding the reasons behind this downturn is crucial for navigating the current market volatility.

What Triggered the SSE Composite's Steep Fall?

Several factors contributed to today's significant drop in the SSE Composite:

-

Concerns over China's Economic Growth: Slowing economic growth in China, coupled with weaker-than-expected manufacturing data and persistent property sector woes, fueled investor anxieties. The recent Evergrande crisis continues to cast a long shadow over market confidence.

-

Global Market Uncertainty: The broader global economic uncertainty, including rising inflation in many developed economies and the ongoing war in Ukraine, contributed to a risk-off sentiment amongst investors. This global nervousness directly impacted the already fragile Chinese market.

-

Regulatory Crackdowns: Continued regulatory crackdowns on various sectors within the Chinese economy, particularly technology and education, remain a significant source of uncertainty for investors. This regulatory pressure contributes to a climate of apprehension and discourages further investment.

-

Tech Sector Weakness: The technology sector, a major component of the SSE Composite, experienced a particularly harsh sell-off. This highlights the ongoing challenges faced by Chinese tech companies amidst regulatory scrutiny and slowing global demand.

Analyzing the Implications:

The implications of this significant market drop are far-reaching:

-

Short-Term Volatility: Investors should expect increased market volatility in the short term. The sharp decline indicates a potential period of uncertainty and instability, requiring cautious investment strategies.

-

Long-Term Outlook: The long-term outlook for the Chinese economy remains a subject of debate. While the current downturn is concerning, China's massive market and long-term growth potential cannot be ignored. However, effective policy responses from the government will be critical to restoring investor confidence.

-

Global Market Ripple Effects: The SSE Composite's plunge is likely to have ripple effects on global markets. Increased interconnectedness means that significant movements in one major market can quickly impact others, potentially triggering further sell-offs in other regions.

-

Opportunities for Cautious Investors: While the current situation presents significant risks, it also offers potential opportunities for long-term, value-oriented investors willing to withstand short-term volatility. Careful analysis and due diligence are crucial for identifying such opportunities.

Moving Forward: Strategies for Investors

Given the current market climate, investors should consider the following strategies:

-

Diversification: Maintaining a well-diversified portfolio across different asset classes and geographies is crucial to mitigate risk.

-

Risk Management: Implementing robust risk management strategies, including stop-loss orders and careful position sizing, is vital to protect capital.

-

Long-Term Perspective: Maintaining a long-term investment horizon can help investors ride out short-term market fluctuations.

-

Professional Advice: Seeking advice from qualified financial professionals can provide valuable insights and guidance during periods of market uncertainty.

The 6.06% plunge in the SSE Composite Index is a significant event with potentially wide-ranging consequences. While the short-term outlook remains uncertain, a careful assessment of the underlying factors and a well-defined investment strategy are essential for navigating this challenging market environment. Continuous monitoring of economic indicators and government policy responses will be key to understanding future market movements.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SSE Composite Index Plunges 6.06%: Market Analysis And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nico Harrison A Fans Report Of A Pointed Comment At The Clippers Mavericks Game

Apr 07, 2025

Nico Harrison A Fans Report Of A Pointed Comment At The Clippers Mavericks Game

Apr 07, 2025 -

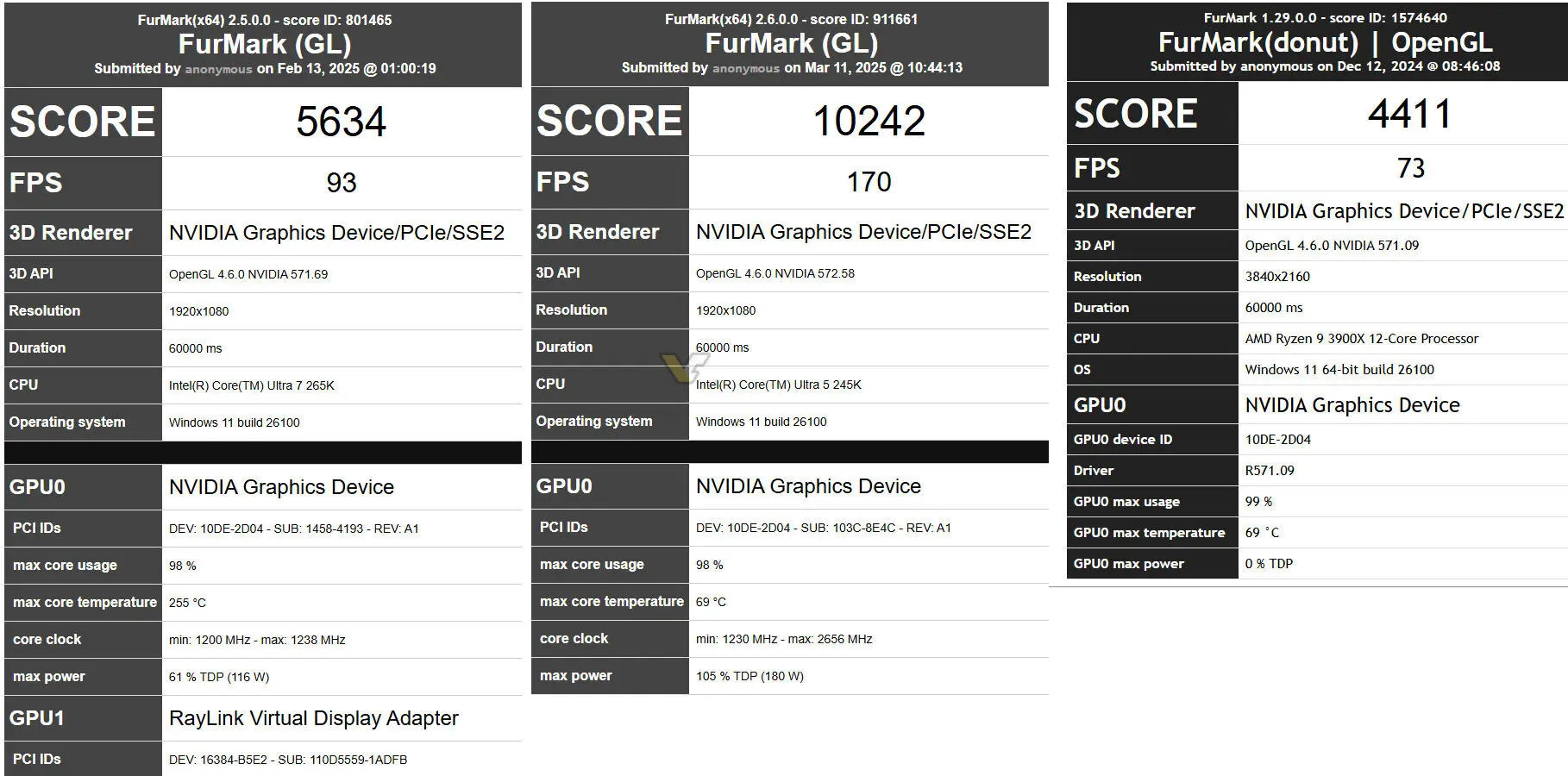

Rtx 5060 Ti 180 W Tdp Performance Fur Mark Database Results Analyzed

Apr 07, 2025

Rtx 5060 Ti 180 W Tdp Performance Fur Mark Database Results Analyzed

Apr 07, 2025 -

Manly Sea Eagles Round 5 Team Late Mail And Predicted Lineup

Apr 07, 2025

Manly Sea Eagles Round 5 Team Late Mail And Predicted Lineup

Apr 07, 2025 -

Trump Tariffs And Market Crash Rs 20 16 Lakh Crore Investor Wealth Lost

Apr 07, 2025

Trump Tariffs And Market Crash Rs 20 16 Lakh Crore Investor Wealth Lost

Apr 07, 2025 -

Verstappen Secures Pole Position At Japanese Grand Prix Qualifying

Apr 07, 2025

Verstappen Secures Pole Position At Japanese Grand Prix Qualifying

Apr 07, 2025