Stablecoin Collaboration: The Quiet Revolution Brewing In America's Banking Sector

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Collaboration: The Quiet Revolution Brewing in America's Banking Sector

The future of finance is quietly being forged in the backrooms of America's banking sector. Forget flashy crypto headlines; a more significant transformation is underway: the burgeoning collaboration between traditional banks and stablecoin issuers. This partnership, though subtle, has the potential to revolutionize payments, lending, and even the broader financial landscape. This isn't just about embracing technology; it's about survival in a rapidly changing world.

The relationship between banks and stablecoins, once characterized by suspicion and even outright hostility, is rapidly evolving. Driven by the increasing demand for efficient and cost-effective cross-border payments and the growing acceptance of digital assets, many forward-thinking banks are seeing the strategic advantages of engaging with the stablecoin ecosystem.

H2: Why are Banks Embracing Stablecoins?

Several key factors are driving this quiet revolution:

- Enhanced Payment Efficiency: Stablecoins offer significantly faster and cheaper transaction processing compared to traditional methods. This is particularly appealing for international payments, where speed and reduced fees are crucial.

- Improved Liquidity: Stablecoins can enhance liquidity within the banking system, allowing for smoother and more efficient operations.

- Access to New Markets: Collaboration with stablecoin providers can open doors to new customer segments and markets that were previously inaccessible.

- Innovation and Competitive Advantage: Banks that embrace this technology can position themselves as innovators, attracting both customers and investors seeking cutting-edge financial solutions.

- Regulatory Compliance: With increased regulatory scrutiny on cryptocurrencies, established banks are seen as partners of choice by stablecoin issuers seeking legitimacy and navigating the complex regulatory landscape.

H2: The Challenges Remain

While the potential benefits are significant, the path to widespread adoption is not without its challenges:

- Regulatory Uncertainty: The regulatory environment surrounding stablecoins remains complex and evolving. Clearer guidelines are needed to foster further collaboration and investment.

- Security Concerns: Ensuring the security and stability of stablecoin systems is paramount. Any security breach could severely damage the reputation of both the bank and the stablecoin issuer.

- Technological Integration: Integrating stablecoin technology into existing banking infrastructure requires significant investment and expertise.

- Consumer Trust: Building public trust in this relatively new technology is crucial for its widespread acceptance.

H3: Specific Examples of Collaboration

While many collaborations remain under wraps, we are beginning to see examples of banks exploring partnerships with stablecoin companies. These partnerships often involve pilot programs testing the integration of stablecoins into existing payment systems or exploring the use of stablecoins for international remittances. More concrete details are expected as the technology matures and regulations become clearer.

H2: The Future of Finance: A Hybrid Model?

The future of finance may well be a hybrid model, integrating traditional banking infrastructure with the innovative capabilities of stablecoins. This collaborative approach can harness the strengths of both worlds, leading to a more efficient, inclusive, and interconnected financial system. This isn't a replacement of traditional banking, but rather an evolution – a powerful augmentation of existing systems.

H2: Conclusion: A Watchful Eye on the Revolution

The collaboration between banks and stablecoins is a quiet revolution with the potential to reshape American finance. While challenges remain, the potential benefits – increased efficiency, enhanced liquidity, and access to new markets – are too significant to ignore. As regulations evolve and technology matures, we can expect to see an acceleration of this partnership, leading to a more dynamic and innovative financial landscape in the years to come. Keep a close eye on this space; the future of finance is being built, one stablecoin partnership at a time.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Collaboration: The Quiet Revolution Brewing In America's Banking Sector. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Aussie Teen Senna Agius Stunning Last Lap Moto2 Victory

May 25, 2025

Aussie Teen Senna Agius Stunning Last Lap Moto2 Victory

May 25, 2025 -

Opelka Crushes Hijikata In French Open Upset

May 25, 2025

Opelka Crushes Hijikata In French Open Upset

May 25, 2025 -

Hollywood Headlines Cannes Film Festival Winners Josh O Connors Next Project And Wheel Of Time Update

May 25, 2025

Hollywood Headlines Cannes Film Festival Winners Josh O Connors Next Project And Wheel Of Time Update

May 25, 2025 -

4x Energy Gain From Laser Fusion A Significant Advance From Livermore

May 25, 2025

4x Energy Gain From Laser Fusion A Significant Advance From Livermore

May 25, 2025 -

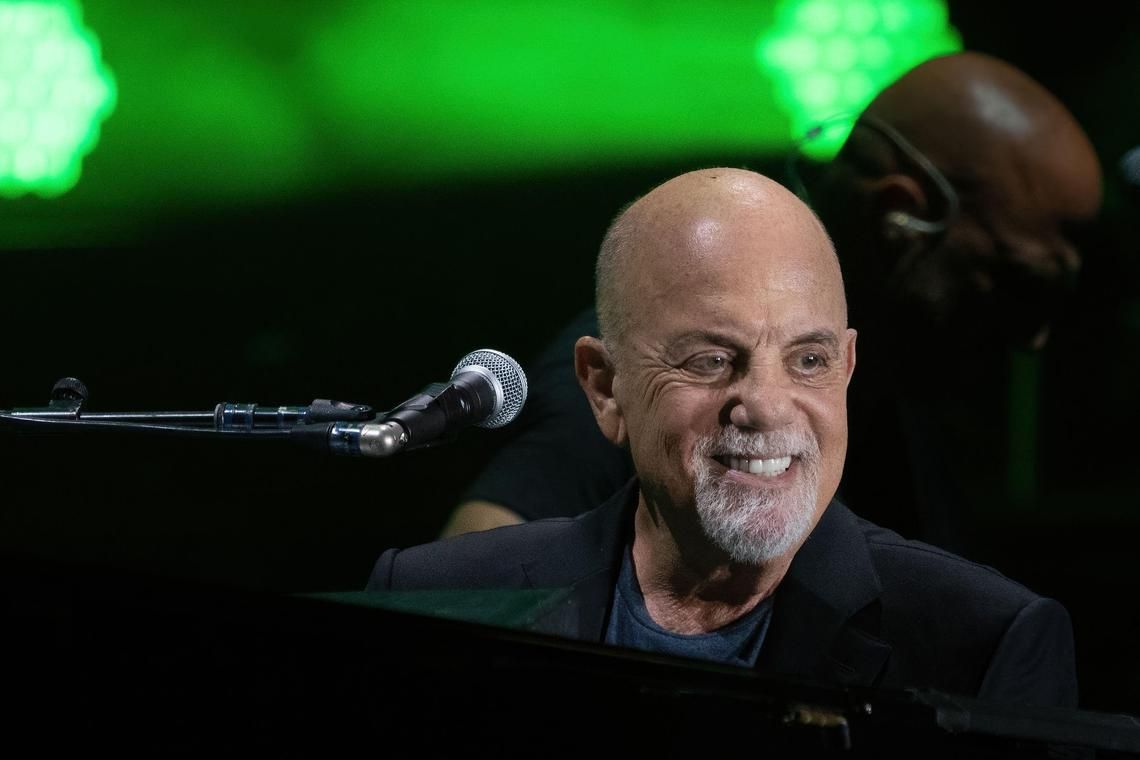

Brain Disorder Forces Billy Joel To Cancel Upcoming Concert Dates

May 25, 2025

Brain Disorder Forces Billy Joel To Cancel Upcoming Concert Dates

May 25, 2025

Latest Posts

-

Crucials 8 Tb Ssd Incredible Storage Density In A Compact Form Factor

May 25, 2025

Crucials 8 Tb Ssd Incredible Storage Density In A Compact Form Factor

May 25, 2025 -

Rakhimova No Match For Sabalenka In French Open 2025 Opener

May 25, 2025

Rakhimova No Match For Sabalenka In French Open 2025 Opener

May 25, 2025 -

Critical Spectators Gaza Comments Condemned Impact On Singapores Social Cohesion

May 25, 2025

Critical Spectators Gaza Comments Condemned Impact On Singapores Social Cohesion

May 25, 2025 -

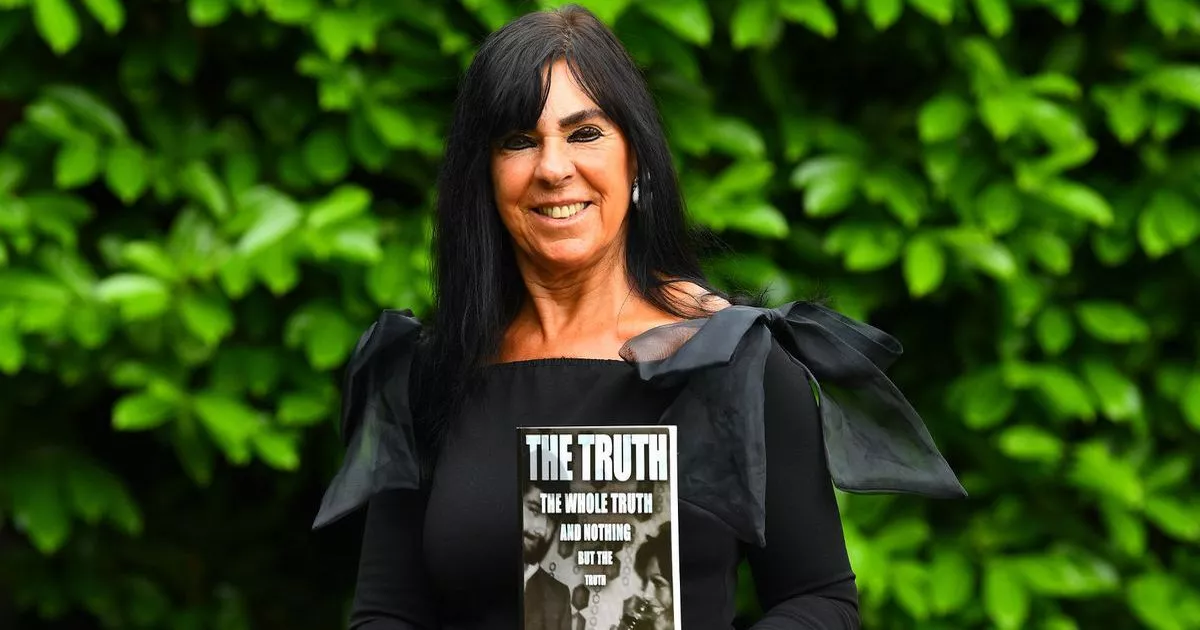

A Notorious Husband A Wifes Perspective On Life With A Uk Prison Inmate

May 25, 2025

A Notorious Husband A Wifes Perspective On Life With A Uk Prison Inmate

May 25, 2025 -

Conquering Wordle 1435 Hints And Answer For May 24

May 25, 2025

Conquering Wordle 1435 Hints And Answer For May 24

May 25, 2025