Stablecoin Integration: A New Strategy For Banks To Boost Deposits And Liquidity

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Integration: A New Strategy for Banks to Boost Deposits and Liquidity

The banking industry is facing a liquidity crunch. Traditional methods of attracting deposits are proving less effective in a rapidly evolving financial landscape. Enter stablecoins, a potential game-changer offering banks a novel strategy to boost deposits and enhance liquidity. This innovative approach promises to revitalize banking operations and reshape the future of finance.

The Allure of Stablecoins for Banks:

Stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, offer several compelling advantages for banks seeking to improve their financial standing:

- Attracting a New Generation of Customers: Millennials and Gen Z, increasingly comfortable with digital assets, represent a significant untapped market. Offering stablecoin-based services positions banks as forward-thinking institutions catering to this demographic's preferences.

- Enhanced Liquidity: The instant convertibility of stablecoins allows for rapid transactions, improving a bank's overall liquidity position and reducing reliance on traditional interbank lending. This agility is crucial in managing short-term cash flow fluctuations.

- Reduced Operational Costs: Stablecoin transactions can be processed more efficiently and at lower costs compared to traditional methods, leading to significant savings in operational expenses. This translates directly to improved profitability.

- Expanded Service Offerings: Integrating stablecoins allows banks to offer innovative financial products and services, such as high-yield savings accounts linked to stablecoins, thereby increasing customer engagement and loyalty.

- Access to Global Markets: Stablecoins facilitate seamless cross-border transactions, opening doors to new international markets and opportunities for growth.

Addressing Regulatory Hurdles and Risks:

While the potential benefits are considerable, banks must carefully navigate regulatory uncertainties and inherent risks:

- Regulatory Compliance: The regulatory landscape surrounding stablecoins is still evolving. Banks must ensure full compliance with all applicable laws and regulations to avoid penalties and maintain operational integrity. This necessitates close collaboration with regulatory bodies.

- Volatility Risk (Despite Stability): While designed for stability, underlying algorithmic mechanisms or collateral backing can be vulnerable to unforeseen events. Banks need robust risk management strategies to mitigate potential losses.

- Cybersecurity Threats: The digital nature of stablecoins exposes banks to increased cybersecurity risks. Robust security measures are paramount to protect sensitive customer data and prevent fraudulent activities.

- Reputational Risk: Any instability or negative publicity associated with stablecoins could damage a bank's reputation. Thorough due diligence and careful selection of stablecoin partners are crucial.

Strategic Implementation for Banks:

Successfully integrating stablecoins requires a well-defined strategy:

- Thorough Due Diligence: Banks should conduct extensive research to identify reputable and regulated stablecoin issuers.

- Pilot Programs: Implementing pilot programs allows banks to test the waters and evaluate the effectiveness of stablecoin integration before a full-scale rollout.

- Robust Risk Management: A comprehensive risk management framework is essential to mitigate potential risks associated with stablecoin integration.

- Customer Education: Educating customers about the benefits and risks of stablecoins is crucial for fostering trust and adoption.

- Collaboration with Regulators: Open communication and collaboration with regulatory bodies are vital for navigating the evolving regulatory landscape.

The Future of Banking and Stablecoin Integration:

Stablecoin integration is poised to transform the banking sector, offering banks a powerful tool to enhance liquidity, attract new customers, and improve profitability. While challenges remain, the potential rewards are significant for banks willing to embrace this innovative technology responsibly and strategically. The future of banking may well be inextricably linked to the successful integration of stablecoins into mainstream financial operations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Integration: A New Strategy For Banks To Boost Deposits And Liquidity. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unrecognizable The Rocks Stunning New Look For 40 Million Project With Usyk

Apr 30, 2025

Unrecognizable The Rocks Stunning New Look For 40 Million Project With Usyk

Apr 30, 2025 -

College Football 26 And Madden 26 Bundle Official Release Date Announcement

Apr 30, 2025

College Football 26 And Madden 26 Bundle Official Release Date Announcement

Apr 30, 2025 -

Man City Vs Arsenal Lewis Skellys Goal And The Unexpected Fan Reaction

Apr 30, 2025

Man City Vs Arsenal Lewis Skellys Goal And The Unexpected Fan Reaction

Apr 30, 2025 -

Ms Vs Qg Live Score Todays Psl Match Playing Xi Toss Winner And Match Updates

Apr 30, 2025

Ms Vs Qg Live Score Todays Psl Match Playing Xi Toss Winner And Match Updates

Apr 30, 2025 -

Dramatic Conclusion Higgins Claims Victory After Intense Battle

Apr 30, 2025

Dramatic Conclusion Higgins Claims Victory After Intense Battle

Apr 30, 2025

Latest Posts

-

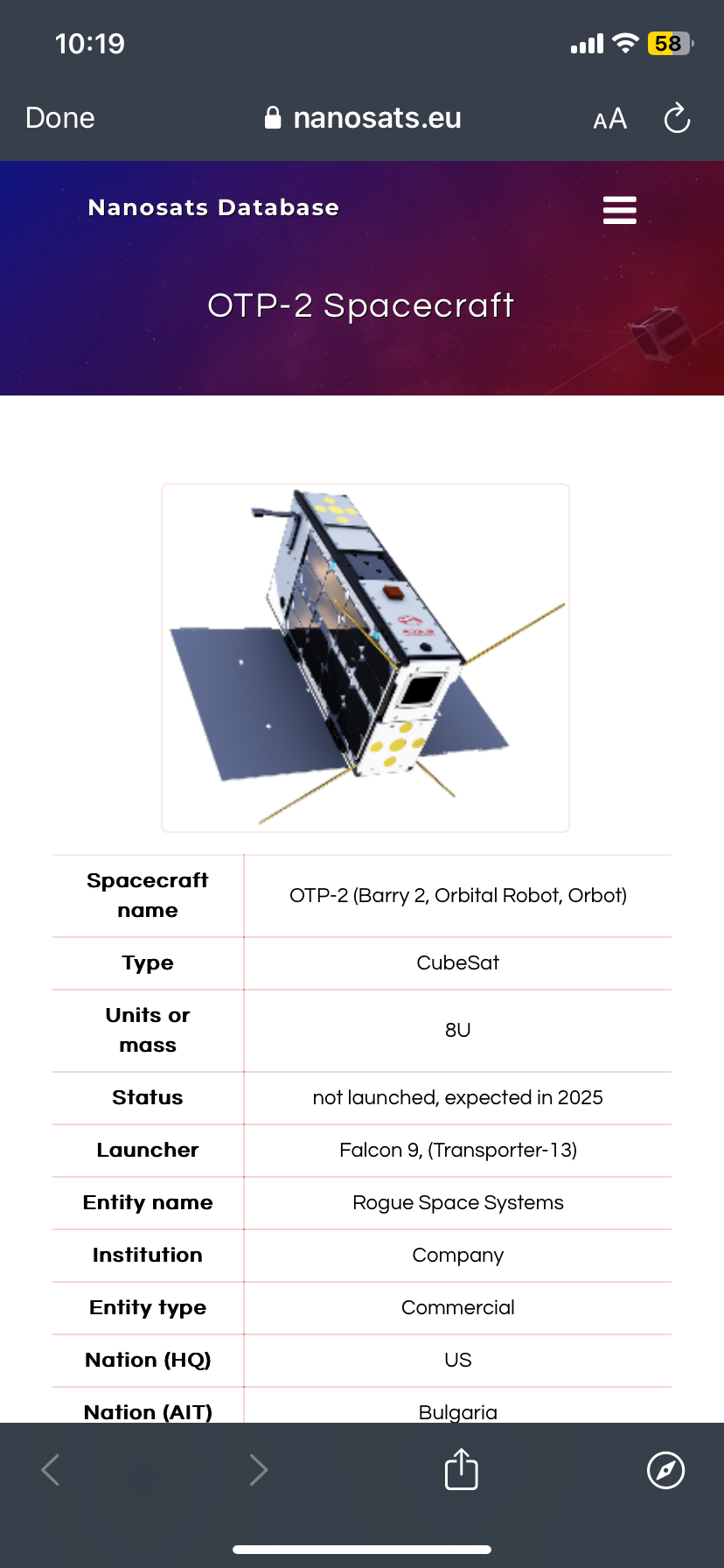

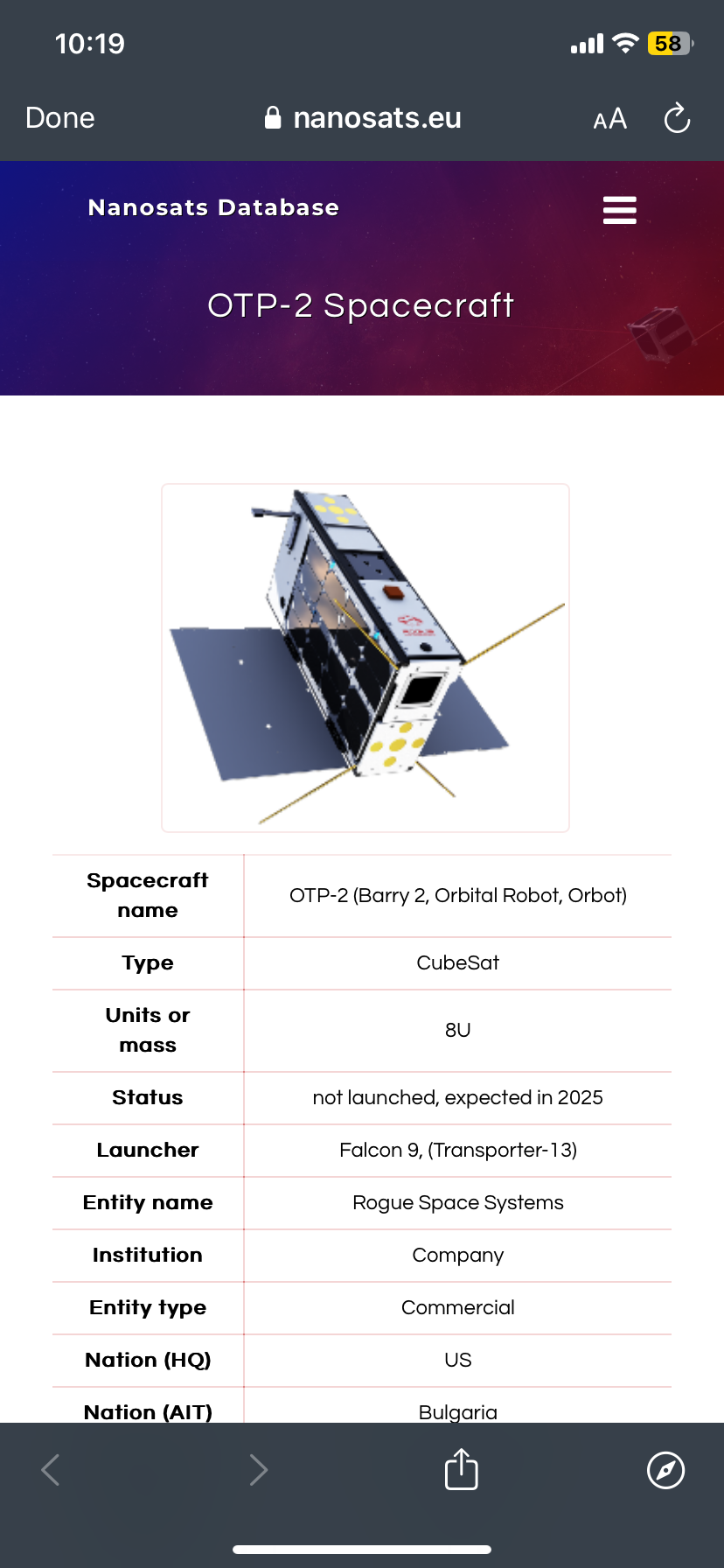

Exploring Novel Propulsion Otp 2 Experiment Results

May 01, 2025

Exploring Novel Propulsion Otp 2 Experiment Results

May 01, 2025 -

Next Big Future Com Analyzing Two Propulsion Tests On Otp 2

May 01, 2025

Next Big Future Com Analyzing Two Propulsion Tests On Otp 2

May 01, 2025 -

Thuram Starts For Inter Inzaghi Addresses Barcelonas Impressive Record

May 01, 2025

Thuram Starts For Inter Inzaghi Addresses Barcelonas Impressive Record

May 01, 2025 -

Watch Dewald Brevis Spectactular Catch Dismisses Shashank Singh In Ipl 2023

May 01, 2025

Watch Dewald Brevis Spectactular Catch Dismisses Shashank Singh In Ipl 2023

May 01, 2025 -

New Ryzen 9 3950 X Workstation 128 Gb Ram For Ai Professionals

May 01, 2025

New Ryzen 9 3950 X Workstation 128 Gb Ram For Ai Professionals

May 01, 2025