Stablecoin Integration: A Roadmap For Banks Seeking Increased Liquidity And Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Integration: A Roadmap for Banks Seeking Increased Liquidity and Deposits

The global banking landscape is undergoing a seismic shift, driven by the rapid adoption of digital assets and innovative financial technologies. For banks seeking to enhance liquidity, attract new deposits, and remain competitive in the evolving fintech arena, integrating stablecoins presents a compelling opportunity. But navigating this new territory requires a carefully planned roadmap. This article outlines the key steps banks should consider when exploring stablecoin integration.

H2: Understanding the Benefits of Stablecoin Integration for Banks

Stablecoins, pegged to fiat currencies like the US dollar, offer several key advantages for banks:

- Enhanced Liquidity: Stablecoins can provide a readily available source of liquidity, particularly crucial during periods of market volatility. Their inherent stability minimizes the risk associated with traditional volatile cryptocurrencies.

- Increased Deposits: Offering stablecoin-based deposit accounts can attract a new generation of tech-savvy customers who are comfortable with digital assets. This expands the bank's customer base and potential deposit pool.

- Reduced Transaction Costs: Stablecoin transactions often involve lower fees compared to traditional wire transfers, leading to cost savings for both the bank and its customers.

- Faster Transaction Speeds: Stablecoin transactions are typically processed much faster than traditional banking transactions, improving efficiency and customer satisfaction.

- Improved Cross-Border Payments: Stablecoins facilitate faster and cheaper cross-border payments, opening up new opportunities for international banking operations.

H2: Navigating the Regulatory Landscape: Key Considerations for Banks

Before integrating stablecoins, banks must thoroughly understand and comply with the evolving regulatory environment. This includes:

- KYC/AML Compliance: Strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are paramount to mitigate risks associated with illicit activities. Banks must ensure their stablecoin integration processes adhere to all relevant regulations.

- Data Privacy Regulations: Banks need to comply with data privacy laws such as GDPR and CCPA when handling customer data related to stablecoin transactions.

- Licensing and Permits: Depending on the jurisdiction, banks may require specific licenses or permits to offer stablecoin-related services. Thorough legal due diligence is crucial.

- Cybersecurity Measures: Robust cybersecurity measures are essential to protect against hacking and data breaches, given the digital nature of stablecoins.

H2: A Step-by-Step Roadmap for Stablecoin Integration

Implementing stablecoin integration requires a phased approach:

- Due Diligence and Risk Assessment: Conduct a comprehensive assessment of the regulatory landscape, technological infrastructure, and potential risks associated with stablecoin integration.

- Technology Selection and Integration: Choose a reliable and secure technology platform capable of handling stablecoin transactions and integrating with the bank's existing systems.

- Pilot Program: Begin with a small-scale pilot program to test the integration process and identify potential issues before full-scale implementation.

- Customer Education and Onboarding: Educate customers about stablecoins and their benefits, offering clear and concise information on how to use them.

- Ongoing Monitoring and Compliance: Continuously monitor the system for compliance with regulations and address any arising issues promptly.

H2: The Future of Banking: Embracing the Stablecoin Revolution

The integration of stablecoins represents a significant opportunity for banks to modernize their operations, enhance customer experience, and gain a competitive edge. While navigating the regulatory and technological challenges requires careful planning and execution, the potential rewards of increased liquidity, expanded deposits, and enhanced efficiency make stablecoin integration a strategic imperative for forward-thinking banks. By following a well-defined roadmap and prioritizing security and compliance, banks can successfully integrate stablecoins and thrive in the rapidly evolving digital financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Integration: A Roadmap For Banks Seeking Increased Liquidity And Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Shai Gilgeous Alexander Vs Clippers Revenge Factor In The 2024 Playoffs

May 08, 2025

Shai Gilgeous Alexander Vs Clippers Revenge Factor In The 2024 Playoffs

May 08, 2025 -

Buffalos Skeleton Hdd A Transparent Look Inside An External Hard Drive

May 08, 2025

Buffalos Skeleton Hdd A Transparent Look Inside An External Hard Drive

May 08, 2025 -

Stellar Lumens Xlm Price Prediction Bearish Trend And Crucial Support Level

May 08, 2025

Stellar Lumens Xlm Price Prediction Bearish Trend And Crucial Support Level

May 08, 2025 -

How The Warriors Secured A Game 1 Win Over The Timberwolves Without A Healthy Steph Curry

May 08, 2025

How The Warriors Secured A Game 1 Win Over The Timberwolves Without A Healthy Steph Curry

May 08, 2025 -

Reshuffle Looms Albanese To Axe Two Ministers

May 08, 2025

Reshuffle Looms Albanese To Axe Two Ministers

May 08, 2025

Latest Posts

-

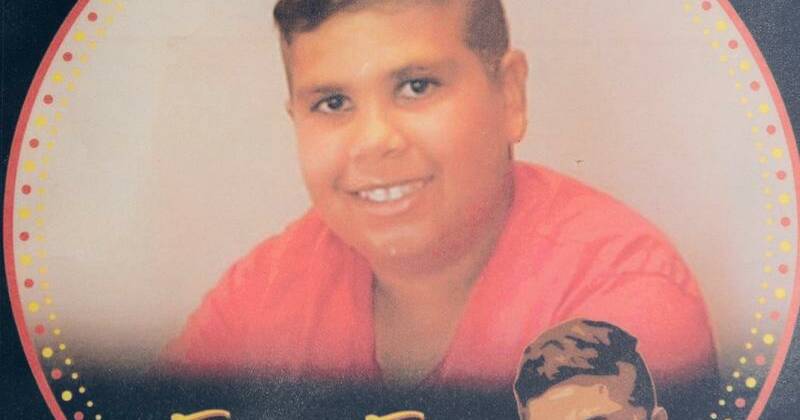

Key Developments In Indigenous Teen Murder Trial Guilty Verdicts Announced

May 08, 2025

Key Developments In Indigenous Teen Murder Trial Guilty Verdicts Announced

May 08, 2025 -

Will Wiggins Deliver For The Heat Analyzing Expectations For Next Season

May 08, 2025

Will Wiggins Deliver For The Heat Analyzing Expectations For Next Season

May 08, 2025 -

Rudd Slams Trumps Proposed Bluey Tax Faruqi Defiant On Bandts Melbourne Prospects

May 08, 2025

Rudd Slams Trumps Proposed Bluey Tax Faruqi Defiant On Bandts Melbourne Prospects

May 08, 2025 -

Analysis Grand Theft Auto Vis Second Trailer And Its Bonnie And Clyde Narrative

May 08, 2025

Analysis Grand Theft Auto Vis Second Trailer And Its Bonnie And Clyde Narrative

May 08, 2025 -

Shadow Force Kerry Washingtons Latest Film Explored

May 08, 2025

Shadow Force Kerry Washingtons Latest Film Explored

May 08, 2025