Stablecoin Integration: A Strategic Plan For Banks To Increase Liquidity And Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Integration: A Strategic Plan for Banks to Increase Liquidity and Deposits

The banking sector is at a crossroads. Traditional methods of managing liquidity and attracting deposits are facing new challenges in the age of digital finance. Enter stablecoins – digital assets pegged to fiat currencies like the US dollar – offering a potential game-changer for banks seeking to enhance their financial flexibility and attract a new generation of customers. This article explores a strategic plan for banks to integrate stablecoins, boosting liquidity and deposit growth while mitigating associated risks.

The Allure of Stablecoins for Banks:

Stablecoins offer several compelling advantages for banks:

-

Enhanced Liquidity Management: Fluctuations in market liquidity can severely impact a bank's operations. Stablecoins, with their inherent stability, provide a readily accessible and liquid asset, enabling banks to better manage their short-term funding needs and mitigate liquidity risks. This is particularly crucial during periods of market stress.

-

Increased Deposit Growth: Millennials and Gen Z, increasingly comfortable with digital assets, represent a significant untapped market for banks. Offering stablecoin-based deposit accounts can attract this demographic, leading to substantial deposit growth and expanding the bank's customer base.

-

Reduced Transaction Costs: Traditional interbank transactions can be expensive and time-consuming. Stablecoin transactions, facilitated by blockchain technology, are often faster and cheaper, leading to significant cost savings for banks.

-

Improved Cross-Border Payments: International transactions often involve delays and high fees. Stablecoins can streamline cross-border payments, making them faster, cheaper, and more efficient for both banks and their customers.

A Strategic Integration Plan:

Successfully integrating stablecoins requires a multi-faceted approach:

1. Due Diligence and Regulatory Compliance: Thorough research into the regulatory landscape surrounding stablecoins is paramount. Banks must ensure compliance with all applicable laws and regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Understanding the specific regulations in their jurisdiction is crucial for avoiding legal pitfalls.

2. Technology Infrastructure: Banks need to invest in robust technological infrastructure capable of handling stablecoin transactions securely and efficiently. This includes integrating blockchain technology and developing secure wallets for storing stablecoins. Partnering with reputable fintech companies specializing in blockchain solutions can significantly expedite this process.

3. Risk Management Framework: A comprehensive risk management framework is essential to mitigate potential risks associated with stablecoin integration, including volatility risks (even though stablecoins aim for stability, some risks remain), cybersecurity risks, and operational risks. Regular audits and stress testing are crucial components of effective risk management.

4. Customer Education and Support: Banks need to educate their customers about stablecoins and their benefits. Providing clear and concise information, along with excellent customer support, is crucial for fostering trust and encouraging adoption.

5. Gradual Implementation: A phased rollout approach is recommended, starting with pilot programs to test the integration process and identify potential issues before full-scale deployment. This allows for iterative improvements and minimizes disruption.

Conclusion:

Stablecoin integration presents a significant opportunity for banks to enhance their liquidity, attract new customers, and reduce operational costs. However, a well-defined strategic plan that prioritizes regulatory compliance, robust technology, and comprehensive risk management is crucial for successful implementation. By carefully navigating the challenges and embracing the potential, banks can position themselves for growth and innovation in the evolving landscape of digital finance. The future of banking might just be more stable thanks to stablecoins.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Integration: A Strategic Plan For Banks To Increase Liquidity And Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hegseth Claims To Ax Woke Trump Era Womens Security Program

Apr 30, 2025

Hegseth Claims To Ax Woke Trump Era Womens Security Program

Apr 30, 2025 -

Joao Cancelos Absence Confirmed Al Hilals Acl Semi Final Setback

Apr 30, 2025

Joao Cancelos Absence Confirmed Al Hilals Acl Semi Final Setback

Apr 30, 2025 -

Narines Front Foot Leadership Kolkata Triumphs Over Delhi In Thrilling Ipl Encounter

Apr 30, 2025

Narines Front Foot Leadership Kolkata Triumphs Over Delhi In Thrilling Ipl Encounter

Apr 30, 2025 -

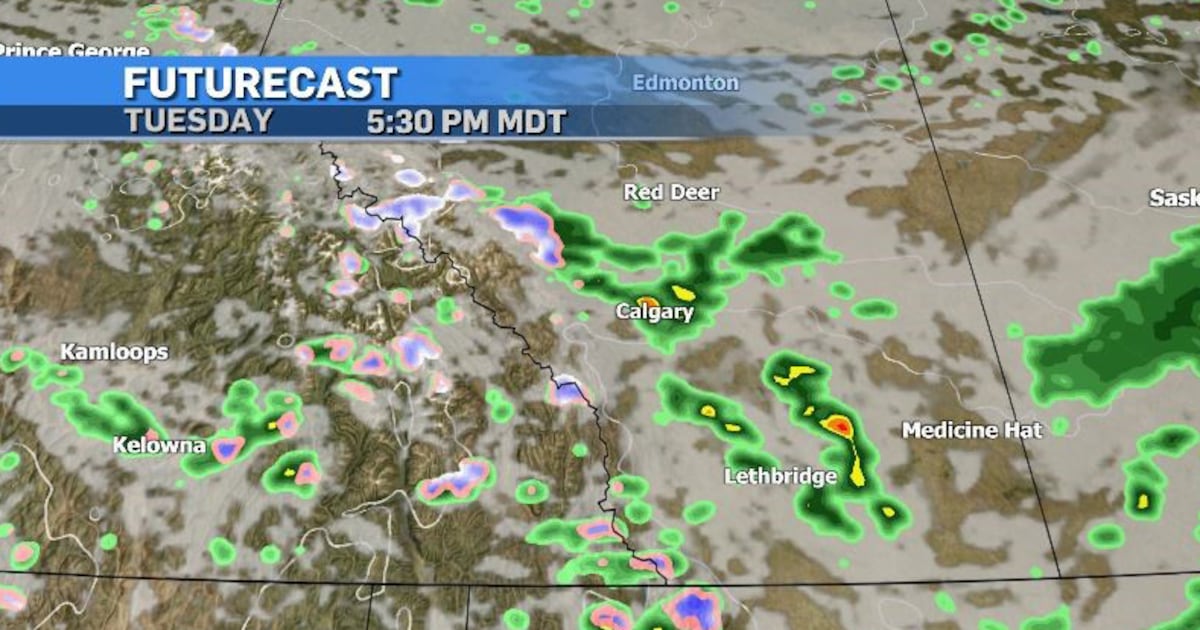

Windy And Cloudy Tuesday In Calgary Risk Of Thunderstorms Throughout The Day

Apr 30, 2025

Windy And Cloudy Tuesday In Calgary Risk Of Thunderstorms Throughout The Day

Apr 30, 2025 -

Will It Pass Parliament To Decide Fate Of Post Trump Us Trade Deal

Apr 30, 2025

Will It Pass Parliament To Decide Fate Of Post Trump Us Trade Deal

Apr 30, 2025

Latest Posts

-

Delhi Capitals Vs Kolkata Knight Riders Live Cricket Score And Updates

Apr 30, 2025

Delhi Capitals Vs Kolkata Knight Riders Live Cricket Score And Updates

Apr 30, 2025 -

Study Ai Shows Promise In Identifying Potential Guide Dogs

Apr 30, 2025

Study Ai Shows Promise In Identifying Potential Guide Dogs

Apr 30, 2025 -

Tornado Hits Australian Navy Ship China Made Boats Under Scrutiny

Apr 30, 2025

Tornado Hits Australian Navy Ship China Made Boats Under Scrutiny

Apr 30, 2025 -

Iga Swiatek Survives Shnaider Test Advances In Madrid

Apr 30, 2025

Iga Swiatek Survives Shnaider Test Advances In Madrid

Apr 30, 2025 -

Boeings Comeback 737 Max And Other Aircraft Rejected By China Take To The Skies

Apr 30, 2025

Boeings Comeback 737 Max And Other Aircraft Rejected By China Take To The Skies

Apr 30, 2025