Stablecoin Regulation And The Inevitable Rise Of US CBDCs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Regulation and the Inevitable Rise of US CBDCs: A Perfect Storm Brewing?

The cryptocurrency market is experiencing a pivotal moment. The increasing scrutiny of stablecoins, coupled with growing global interest in Central Bank Digital Currencies (CBDCs), is creating a perfect storm that could reshape the financial landscape. Recent regulatory crackdowns and the inherent vulnerabilities of stablecoins are pushing the US, and other nations, closer to embracing CBDCs as a safer, more regulated alternative.

The Stablecoin Shake-Up: A Catalyst for Change

The collapse of TerraUSD (UST) in 2022 served as a stark reminder of the risks associated with algorithmic stablecoins. This event, coupled with ongoing regulatory uncertainty surrounding stablecoins pegged to the US dollar, has fueled calls for stricter oversight. The debate centers around how best to regulate these digital assets, balancing innovation with consumer protection. Key concerns include:

- Transparency and Reserves: Ensuring that stablecoin issuers maintain adequate reserves to back their tokens and that these reserves are transparently audited is paramount.

- Capital Requirements: Similar to traditional banks, stablecoin issuers may need to meet specific capital requirements to mitigate systemic risk.

- Consumer Protection: Robust consumer protection measures are necessary to safeguard users from potential losses due to market volatility or issuer insolvency.

The lack of a clear regulatory framework for stablecoins creates a breeding ground for uncertainty and instability, potentially impacting the broader financial system. This uncertainty is accelerating the discussion around a more robust and regulated digital currency solution: the US CBDC.

The Rise of the US CBDC: A Necessary Evolution?

A US Central Bank Digital Currency (CBDC), often referred to as a "digital dollar," is gaining significant traction as a potential solution to the challenges posed by stablecoins and the evolving digital economy. Proponents argue that a CBDC offers several key advantages:

- Enhanced Financial Inclusion: A CBDC could provide access to financial services for underserved populations, particularly those without bank accounts.

- Improved Payment Efficiency: CBDCs offer the potential for faster and more efficient cross-border payments, reducing transaction costs and delays.

- Increased Monetary Policy Effectiveness: The Federal Reserve could potentially use a CBDC to more effectively implement monetary policy.

- Reduced Reliance on Private Stablecoins: A well-regulated CBDC could reduce reliance on potentially volatile private stablecoins, promoting greater stability in the financial system.

Challenges and Considerations for a US CBDC

Despite the potential benefits, several challenges need to be addressed before a US CBDC becomes a reality:

- Privacy Concerns: Balancing the need for transparency and accountability with the protection of individual privacy is a major hurdle.

- Cybersecurity Risks: Protecting a CBDC from cyberattacks and ensuring its operational resilience are critical considerations.

- Technological Infrastructure: Implementing and maintaining a robust technological infrastructure to support a nationwide CBDC requires substantial investment.

The Future of Digital Currency in the US

The regulatory landscape for stablecoins and the ongoing debate surrounding a US CBDC are intricately linked. The increasing scrutiny of stablecoins is acting as a catalyst for the adoption of a more regulated digital currency solution. While challenges remain, the potential benefits of a US CBDC, including increased financial inclusion, improved payment efficiency, and reduced systemic risk, are driving the momentum towards its eventual implementation. The future of digital currency in the US is likely to be shaped by a combination of robust stablecoin regulation and the inevitable rise of a CBDC. The question is not if a US CBDC will emerge, but when and how.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Regulation And The Inevitable Rise Of US CBDCs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Experience Unprecedented Speed Adatas New Memory Card And Its Dedicated Reader

Apr 29, 2025

Experience Unprecedented Speed Adatas New Memory Card And Its Dedicated Reader

Apr 29, 2025 -

Navigating Web3 Risks The Dangers Of Over Relying On Verification

Apr 29, 2025

Navigating Web3 Risks The Dangers Of Over Relying On Verification

Apr 29, 2025 -

Team News And Prediction Udineses Clash Against Bologna

Apr 29, 2025

Team News And Prediction Udineses Clash Against Bologna

Apr 29, 2025 -

Demi Finale Aller Ligue Des Champions Suivez Arsenal Psg En Direct Avec Doue Et Dembele

Apr 29, 2025

Demi Finale Aller Ligue Des Champions Suivez Arsenal Psg En Direct Avec Doue Et Dembele

Apr 29, 2025 -

Ameri Corps Funding Cuts Under Doge Uncertainty For Philadelphias Vital Volunteer Services

Apr 29, 2025

Ameri Corps Funding Cuts Under Doge Uncertainty For Philadelphias Vital Volunteer Services

Apr 29, 2025

Latest Posts

-

Investigation Closed No Charges In Death Of Adam Johnson Minnesota Native

Apr 29, 2025

Investigation Closed No Charges In Death Of Adam Johnson Minnesota Native

Apr 29, 2025 -

Jeremy Renners Recovery From Snowplow Accident To Rehabilitation

Apr 29, 2025

Jeremy Renners Recovery From Snowplow Accident To Rehabilitation

Apr 29, 2025 -

Analyzing Kvaratskhelias Impact Psgs Georgian Sensation

Apr 29, 2025

Analyzing Kvaratskhelias Impact Psgs Georgian Sensation

Apr 29, 2025 -

Sucessor De Buffett Greg Abel Assume Decisoes De Investimento Da Berkshire

Apr 29, 2025

Sucessor De Buffett Greg Abel Assume Decisoes De Investimento Da Berkshire

Apr 29, 2025 -

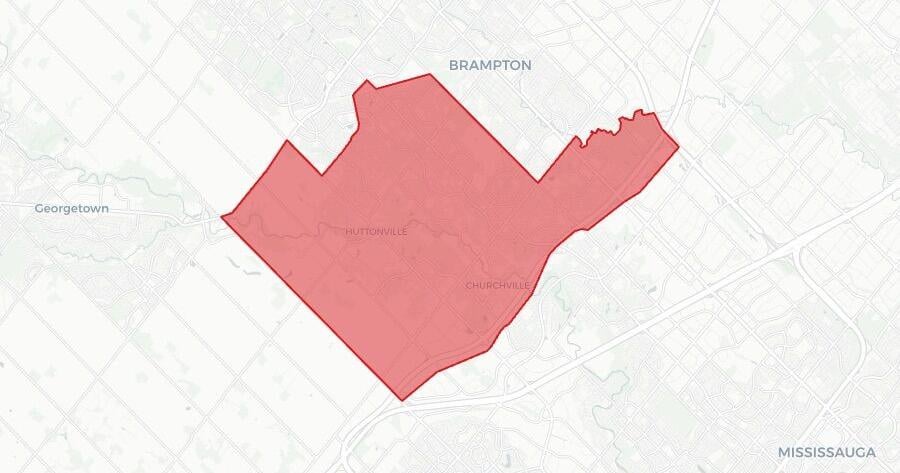

2023 Brampton South Federal Election Real Time Results And Winning Candidate

Apr 29, 2025

2023 Brampton South Federal Election Real Time Results And Winning Candidate

Apr 29, 2025