Stablecoin Regulation In The US: A Catalyst For CBDC Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Regulation in the US: A Catalyst for CBDC Growth?

The cryptocurrency market is buzzing with anticipation as the US grapples with regulating stablecoins. This regulatory uncertainty, while potentially disruptive in the short term, could ironically act as a powerful catalyst for the growth and adoption of Central Bank Digital Currencies (CBDCs) in the long run. The current landscape presents a fascinating interplay between private stablecoins and the potential for a publicly backed digital dollar.

The Current State of Stablecoin Regulation

The collapse of TerraUSD (UST) in 2022 sent shockwaves through the crypto world, highlighting the inherent risks associated with algorithmic stablecoins and the urgent need for robust regulatory frameworks. The US is currently navigating this complex issue, with various proposals and discussions underway at the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and Congress. Key concerns revolve around consumer protection, financial stability, and the potential for stablecoins to be used for illicit activities. The lack of a clear, unified regulatory approach creates uncertainty for businesses operating in the stablecoin market, hindering innovation and potentially driving investors towards alternative solutions.

Why Stablecoin Regulation Could Boost CBDC Adoption

Several factors suggest that stricter stablecoin regulations could inadvertently pave the way for CBDC adoption:

-

Increased Trust and Stability: A well-regulated CBDC, backed by the full faith and credit of the US government, would offer significantly greater stability and transparency than privately issued stablecoins. This increased trust could attract investors and consumers wary of the risks associated with unregulated digital assets.

-

Reduced Systemic Risk: The potential for widespread runs on privately issued stablecoins poses a systemic risk to the financial system. A CBDC, managed by the Federal Reserve, would mitigate this risk, providing a safer and more reliable digital payment system.

-

Enhanced Financial Inclusion: A CBDC could extend financial services to underbanked and unbanked populations, offering a more accessible and efficient way to manage their finances. This is a significant advantage over traditional banking systems and even existing private stablecoin solutions which may face accessibility barriers.

-

Improved Cross-Border Payments: A US CBDC could streamline international transactions, offering faster, cheaper, and more secure cross-border payments compared to existing systems. This would enhance the competitiveness of US businesses in the global marketplace.

-

Technological Advancement: The development and implementation of a CBDC would require significant investment in underlying technologies, potentially leading to advancements in areas like blockchain technology, distributed ledger technology (DLT), and digital identity verification.

Challenges to CBDC Implementation

Despite the potential benefits, the path to a US CBDC is not without its challenges:

-

Privacy Concerns: Balancing the need for financial privacy with the prevention of illicit activities will be a critical consideration in the design and implementation of a CBDC.

-

Technological Complexity: Developing and maintaining a secure and scalable CBDC requires significant technological expertise and infrastructure investment.

-

International Coordination: The success of a US CBDC will depend on international cooperation and coordination to ensure seamless interoperability with other digital currencies.

Conclusion:

The ongoing debate surrounding stablecoin regulation in the US is likely to have a profound impact on the future of digital finance. While stricter regulations might initially stifle innovation in the private stablecoin sector, they could simultaneously create a more favorable environment for the emergence of a US CBDC. This outcome is not guaranteed, and significant hurdles remain, but the current regulatory uncertainty may ironically serve as the catalyst needed to propel the US toward a future of digitally native finance. The coming years will be crucial in determining whether the US embraces this opportunity to solidify its position at the forefront of the global digital currency landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Regulation In The US: A Catalyst For CBDC Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Benji Ball The Real Reason For Galvins Wests Tigers Transfer

Apr 26, 2025

Is Benji Ball The Real Reason For Galvins Wests Tigers Transfer

Apr 26, 2025 -

Smarter Security Response Strike Readys Ai Powered Platform For Proactive Threat Management

Apr 26, 2025

Smarter Security Response Strike Readys Ai Powered Platform For Proactive Threat Management

Apr 26, 2025 -

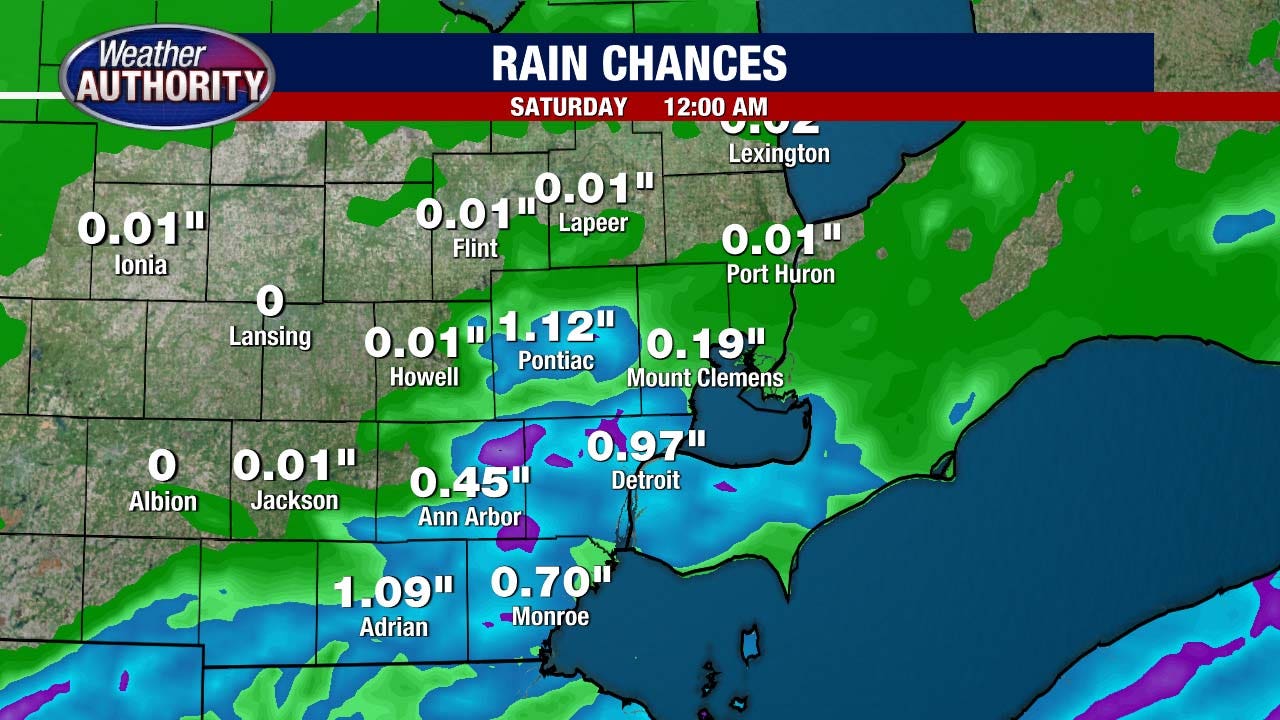

Severe Weather Outlook Metro Detroit Braces For Afternoon Storms Weekend Cool Down

Apr 26, 2025

Severe Weather Outlook Metro Detroit Braces For Afternoon Storms Weekend Cool Down

Apr 26, 2025 -

Kalinskaya Vs Keys Madrid Open 2025 Odds Prediction And Preview

Apr 26, 2025

Kalinskaya Vs Keys Madrid Open 2025 Odds Prediction And Preview

Apr 26, 2025 -

Talagi Content Despite Slow Rise To Panthers Top Spot

Apr 26, 2025

Talagi Content Despite Slow Rise To Panthers Top Spot

Apr 26, 2025