Stablecoin Regulation In The US: A Catalyst For CBDC Innovation?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Regulation in the US: A Catalyst for CBDC Innovation?

The cryptocurrency market is buzzing with anticipation as the US grapples with the regulation of stablecoins. This isn't just another regulatory hurdle; many experts believe it could be a powerful catalyst for the development and adoption of a Central Bank Digital Currency (CBDC) in the United States. The current regulatory uncertainty surrounding stablecoins, particularly concerning their reserve requirements and oversight, is forcing a crucial conversation about the future of digital finance and the potential role of a government-backed digital dollar.

The Current Landscape of Stablecoin Regulation

The US currently lacks a comprehensive regulatory framework for stablecoins. This absence of clear rules has led to concerns about systemic risk, consumer protection, and the potential for market manipulation. Proposals are circulating within Congress, with different agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) vying for jurisdiction. This regulatory ambiguity is stifling innovation and investor confidence. Key issues under debate include:

- Reserve Transparency and Backing: Ensuring stablecoins maintain a 1:1 backing with their underlying assets, whether it's fiat currency, government bonds, or other assets, is paramount. Stricter regulations on reserve composition and auditing are being considered to prevent runs and maintain stability.

- Consumer Protection: Protecting consumers from fraudulent or poorly managed stablecoins is crucial. Regulations are needed to ensure transparency in fees, risks, and the underlying assets backing these digital currencies.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Stablecoins, like other financial instruments, need to comply with stringent AML and KYC regulations to prevent their use in illicit activities.

How Stablecoin Regulation Could Spur CBDC Development

The ongoing debate surrounding stablecoin regulation is inadvertently highlighting the potential benefits of a CBDC. A US CBDC, often referred to as a digital dollar, could offer several advantages:

- Enhanced Financial Stability: A CBDC issued by the Federal Reserve would eliminate the risks associated with privately issued stablecoins, providing a more stable and secure digital payment system.

- Improved Payment Efficiency: A CBDC could significantly enhance the speed and efficiency of domestic and international payments.

- Financial Inclusion: A CBDC could potentially extend financial services to the unbanked and underbanked populations, fostering greater financial inclusion.

- Innovation in Payment Systems: A CBDC would provide a robust foundation for the development of innovative payment solutions and financial technologies.

Challenges and Considerations for a US CBDC

Despite the potential advantages, the implementation of a US CBDC presents significant challenges:

- Privacy Concerns: Balancing the need for transparency with individual privacy is a critical consideration. Robust privacy-preserving technologies will be essential for a successful CBDC.

- Technological Infrastructure: Developing and deploying a secure and scalable CBDC infrastructure would require substantial investment and collaboration between the Federal Reserve, private sector partners, and technology providers.

- International Coordination: The design and implementation of a US CBDC will require close collaboration with other central banks and international organizations to ensure interoperability and global stability.

Conclusion: A Necessary Evolution?

The current push for stablecoin regulation in the US could be the tipping point for the adoption of a CBDC. While significant challenges remain, the potential benefits of a digital dollar – particularly in terms of financial stability, efficiency, and inclusion – are compelling. The ongoing debate will shape the future of digital finance in the US, and careful consideration of both the risks and opportunities is paramount. The path forward requires a collaborative effort between policymakers, regulators, and the private sector to ensure a smooth transition to a more secure and efficient digital financial system. The regulatory uncertainty surrounding stablecoins is undeniably a catalyst, pushing the conversation about the digital dollar to the forefront and potentially paving the way for its eventual implementation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Regulation In The US: A Catalyst For CBDC Innovation?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Against All Odds Bompastor Leads Lyon To Victory Against Barcelona

Apr 28, 2025

Against All Odds Bompastor Leads Lyon To Victory Against Barcelona

Apr 28, 2025 -

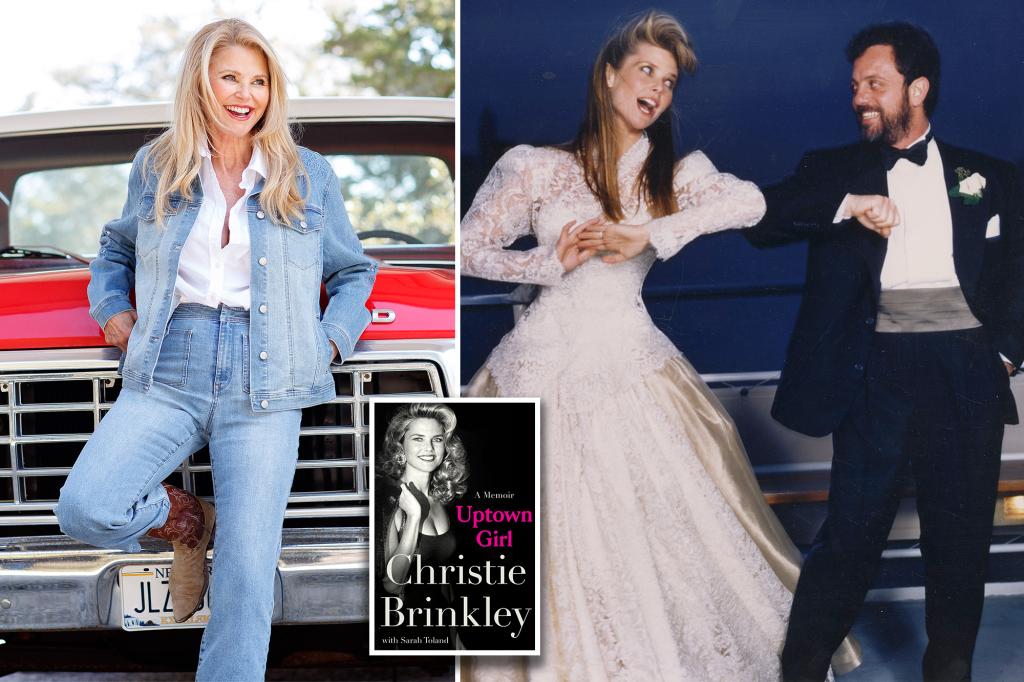

Christie Brinkley And Billy Joel A Love Story Ended By Disappearance And Unbearable Strain

Apr 28, 2025

Christie Brinkley And Billy Joel A Love Story Ended By Disappearance And Unbearable Strain

Apr 28, 2025 -

Ru Pauls Drag Race Mourns The Loss Of Jiggly Caliente At 44

Apr 28, 2025

Ru Pauls Drag Race Mourns The Loss Of Jiggly Caliente At 44

Apr 28, 2025 -

Experience Unmatched Speed Adatas New Memory Card And Compatible Reader

Apr 28, 2025

Experience Unmatched Speed Adatas New Memory Card And Compatible Reader

Apr 28, 2025 -

Canadian Voters To Punish Trumps Trade Policies At The Ballot Box

Apr 28, 2025

Canadian Voters To Punish Trumps Trade Policies At The Ballot Box

Apr 28, 2025

Latest Posts

-

Unrecognizable The Rocks Jaw Dropping Transformation For 40 M Project

Apr 29, 2025

Unrecognizable The Rocks Jaw Dropping Transformation For 40 M Project

Apr 29, 2025 -

Tensions Rise Trump Confronts Bezos Over Amazon Tariff Strategy

Apr 29, 2025

Tensions Rise Trump Confronts Bezos Over Amazon Tariff Strategy

Apr 29, 2025 -

Urgent Evacuations Ordered Wildfire Races Southeast Of Tucson

Apr 29, 2025

Urgent Evacuations Ordered Wildfire Races Southeast Of Tucson

Apr 29, 2025 -

Huawei Launches Fastest Ai Chip Amidst Us Restrictions On Nvidia H20 Exports

Apr 29, 2025

Huawei Launches Fastest Ai Chip Amidst Us Restrictions On Nvidia H20 Exports

Apr 29, 2025 -

Arsenals Champions League Hope Hinges On Stopping Psg Star

Apr 29, 2025

Arsenals Champions League Hope Hinges On Stopping Psg Star

Apr 29, 2025