Stablecoin Regulation In The US: A Stepping Stone To CBDCs?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Regulation in the US: A Stepping Stone to CBDCs?

The US is on the cusp of significant change in its financial landscape. The ongoing debate and impending regulation of stablecoins are not just about curbing volatility and protecting consumers; many experts believe it's a crucial stepping stone towards the potential adoption of a Central Bank Digital Currency (CBDC). This development has profound implications for the future of finance, impacting everything from everyday transactions to international trade.

The Current State of Stablecoin Regulation:

The collapse of TerraUSD (UST) in 2022 served as a stark reminder of the risks associated with algorithmic stablecoins and the urgent need for robust regulatory frameworks. Currently, the regulatory landscape is fragmented, with various agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) vying for jurisdiction. This lack of clarity creates uncertainty for businesses and investors alike. However, recent proposals and bipartisan support suggest a move towards a more unified and comprehensive approach. Bills like the "Stablecoin TEFRA Act" aim to establish clear regulatory standards, focusing on aspects like:

- Reserve Requirements: Mandating stablecoin issuers to hold sufficient reserves to back their digital tokens.

- Transparency and Auditing: Ensuring regular audits and public disclosures of reserve composition.

- Consumer Protection: Implementing safeguards to prevent market manipulation and protect consumers from fraud.

These regulations, while primarily focused on stablecoins, share striking similarities with the requirements likely to govern a future CBDC.

The Link Between Stablecoin Regulation and CBDCs:

The push for stablecoin regulation is creating the necessary infrastructure and legal framework for a potential CBDC. Several key parallels exist:

- Technological Infrastructure: The development and implementation of robust regulatory frameworks for stablecoins necessitate advancements in blockchain technology, distributed ledger systems, and cybersecurity. These advancements directly benefit the potential development and launch of a CBDC.

- Regulatory Expertise: The regulatory processes surrounding stablecoins are building crucial expertise within government agencies, preparing them for the complex challenges of overseeing a CBDC.

- Public Awareness and Acceptance: The ongoing discussion around stablecoin regulation introduces the public to the concept of digital currencies and their potential benefits and risks. This gradual education paves the way for wider acceptance of a potential CBDC.

Arguments For and Against a US CBDC:

The prospect of a US CBDC is far from universally accepted.

Arguments in favor:

- Enhanced Efficiency and Reduced Costs: A CBDC could streamline payments, reduce transaction costs, and increase the efficiency of financial transactions.

- Financial Inclusion: It could provide access to financial services for underserved populations.

- Improved Monetary Policy: A CBDC could potentially improve the effectiveness of monetary policy.

- National Security: It could reduce reliance on foreign payment systems, strengthening national security.

Arguments against:

- Privacy Concerns: Balancing the need for transparency and anti-money laundering measures with individual privacy rights is a major challenge.

- Cybersecurity Risks: A CBDC would be a high-value target for cyberattacks, requiring robust security measures.

- Potential for Financial Instability: The introduction of a CBDC could have unforeseen consequences for the existing financial system.

The Future of Finance in the US:

The regulatory path for stablecoins in the US is setting a crucial precedent. Whether or not a CBDC is ultimately adopted, the lessons learned and infrastructure developed during this process will significantly shape the future of finance in the United States. The debate is far from over, but the increasing focus on stablecoin regulation strongly suggests a future where digital currencies play a much larger role in the American financial system. The coming years will be critical in determining the precise nature of that future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Regulation In The US: A Stepping Stone To CBDCs?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Zverev And Becker An Inside Look At Their Coaching Partnership And Its Aftermath

Apr 27, 2025

Zverev And Becker An Inside Look At Their Coaching Partnership And Its Aftermath

Apr 27, 2025 -

Milans Revamped Approach A Critical Venezia Match Preview

Apr 27, 2025

Milans Revamped Approach A Critical Venezia Match Preview

Apr 27, 2025 -

Dtes Rate Hike Request An 11 Increase For Residential Consumers

Apr 27, 2025

Dtes Rate Hike Request An 11 Increase For Residential Consumers

Apr 27, 2025 -

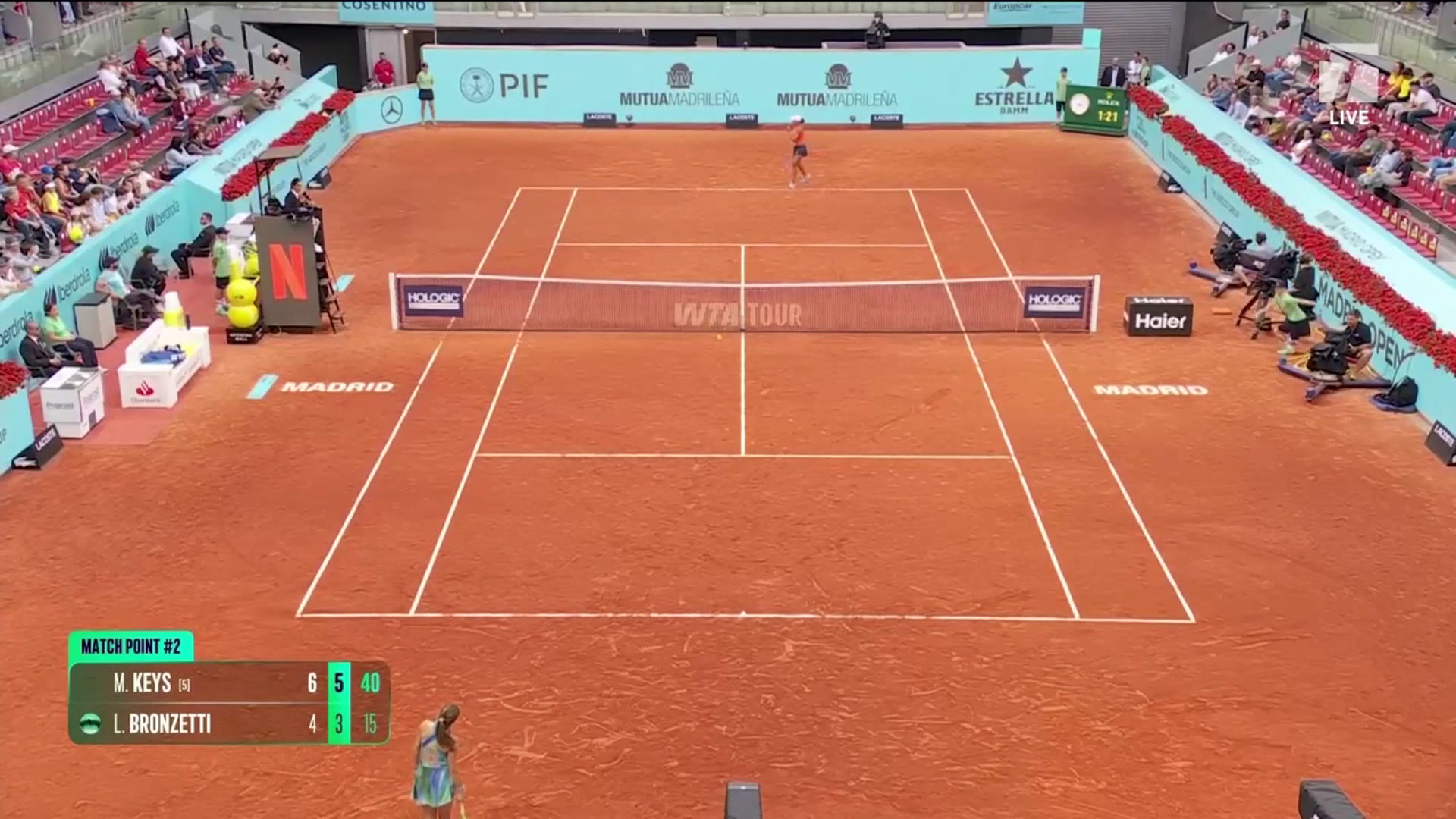

Madison Keys Advances To Madrid Open Third Round

Apr 27, 2025

Madison Keys Advances To Madrid Open Third Round

Apr 27, 2025 -

Chelsea Vs Everton Crucial Clash For Champions League Qualification

Apr 27, 2025

Chelsea Vs Everton Crucial Clash For Champions League Qualification

Apr 27, 2025