Stablecoin Spending: Why Crypto Debit Cards Are Becoming The Norm

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoin Spending: Why Crypto Debit Cards are Becoming the Norm

The world of finance is rapidly evolving, and cryptocurrencies are playing an increasingly significant role. While Bitcoin and Ethereum often steal the headlines, a quieter revolution is underway: the rise of stablecoins and their integration into everyday spending via crypto debit cards. This isn't just a niche trend; it's a significant shift that's making crypto more accessible and user-friendly than ever before.

What are Stablecoins and Crypto Debit Cards?

Before diving into the reasons for their burgeoning popularity, let's clarify the basics. Stablecoins are cryptocurrencies pegged to a stable asset, typically the US dollar. This means their value remains relatively constant, unlike volatile cryptocurrencies like Bitcoin. This stability is crucial for everyday spending.

Crypto debit cards, on the other hand, are prepaid cards linked to a cryptocurrency wallet. Users load their cards with stablecoins, and then use them just like any regular debit card – for online purchases, in-store transactions, and even ATM withdrawals. This seamless integration bridges the gap between the digital and physical worlds of finance.

The Growing Popularity of Stablecoin Debit Cards: Key Factors

Several factors are driving the adoption of stablecoin debit cards:

-

Ease of Use: The simplicity is undeniable. Users don't need to navigate complex exchanges or worry about volatile cryptocurrency prices. They simply load their cards and spend. This user-friendly experience is a game-changer for mass adoption.

-

Increased Accessibility: Crypto debit cards make cryptocurrency accessible to a broader audience. Individuals who are hesitant about navigating the complexities of cryptocurrency exchanges can now participate in the crypto economy with ease.

-

Global Transactions: These cards offer the potential for smooth, low-cost international transactions, bypassing traditional banking systems and their associated fees. This is particularly attractive for frequent travelers or individuals conducting business across borders.

-

Privacy and Security: While not offering complete anonymity, stablecoin debit cards provide a layer of privacy compared to traditional banking, as transactions are not directly linked to personal bank accounts. Furthermore, reputable providers prioritize robust security measures to protect user funds.

-

Faster Transactions: Compared to traditional banking systems, transactions using stablecoin debit cards are often faster and more efficient, especially for international payments.

The Future of Stablecoin Spending:

The future looks bright for stablecoin spending and crypto debit cards. As technology improves and regulation clarifies, we can anticipate even wider adoption. The potential benefits – increased financial inclusion, lower transaction fees, and greater accessibility – are substantial. Expect to see further innovation in this space, including the integration of loyalty programs, improved security features, and potentially even the emergence of decentralized finance (DeFi) applications directly linked to these cards.

Choosing a Reputable Provider:

It's crucial to choose a reputable provider for your stablecoin debit card. Research providers thoroughly, paying attention to their security measures, fees, and customer support. Look for providers with a strong track record and positive user reviews.

Conclusion:

Stablecoin debit cards are not just a fleeting trend; they represent a significant step towards mainstream cryptocurrency adoption. Their ease of use, increased accessibility, and potential for global transactions are driving their growing popularity. As technology continues to evolve, stablecoin debit cards are poised to reshape the future of finance, making crypto a practical and convenient part of everyday life for millions worldwide.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoin Spending: Why Crypto Debit Cards Are Becoming The Norm. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Spielberg War Movie Formula Unpacking 11 Iconic Minutes

May 14, 2025

The Spielberg War Movie Formula Unpacking 11 Iconic Minutes

May 14, 2025 -

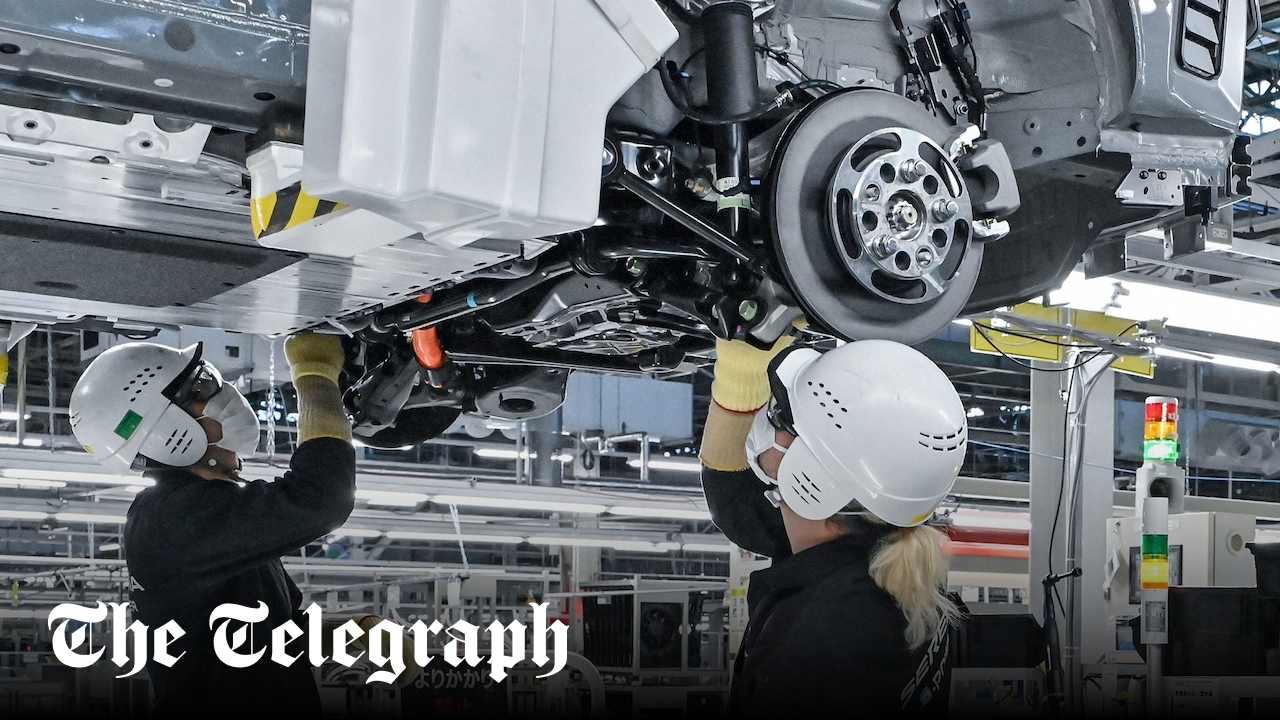

Global Impact Nissan To Eliminate 20 000 Jobs

May 14, 2025

Global Impact Nissan To Eliminate 20 000 Jobs

May 14, 2025 -

Cotas De Casas Alternativa Inteligente Para Desfrutar Da Praia E Do Campo Sem Comprar

May 14, 2025

Cotas De Casas Alternativa Inteligente Para Desfrutar Da Praia E Do Campo Sem Comprar

May 14, 2025 -

Sigue En Directo Alcaraz Khachanov Octavos De Roma

May 14, 2025

Sigue En Directo Alcaraz Khachanov Octavos De Roma

May 14, 2025 -

Rediscovering A Wwii Classic Two Iconic Actors Early Career Roles 1945

May 14, 2025

Rediscovering A Wwii Classic Two Iconic Actors Early Career Roles 1945

May 14, 2025

Latest Posts

-

Unesco Heritage Site Under Fire Advocates Condemn Disturbing Behavior

May 14, 2025

Unesco Heritage Site Under Fire Advocates Condemn Disturbing Behavior

May 14, 2025 -

Cybersecurity Alert Click Fix Campaign Hits Windows And Linux Machines

May 14, 2025

Cybersecurity Alert Click Fix Campaign Hits Windows And Linux Machines

May 14, 2025 -

Todays Nyt Mini Crossword Answers May 10th Saturday Full Solution

May 14, 2025

Todays Nyt Mini Crossword Answers May 10th Saturday Full Solution

May 14, 2025 -

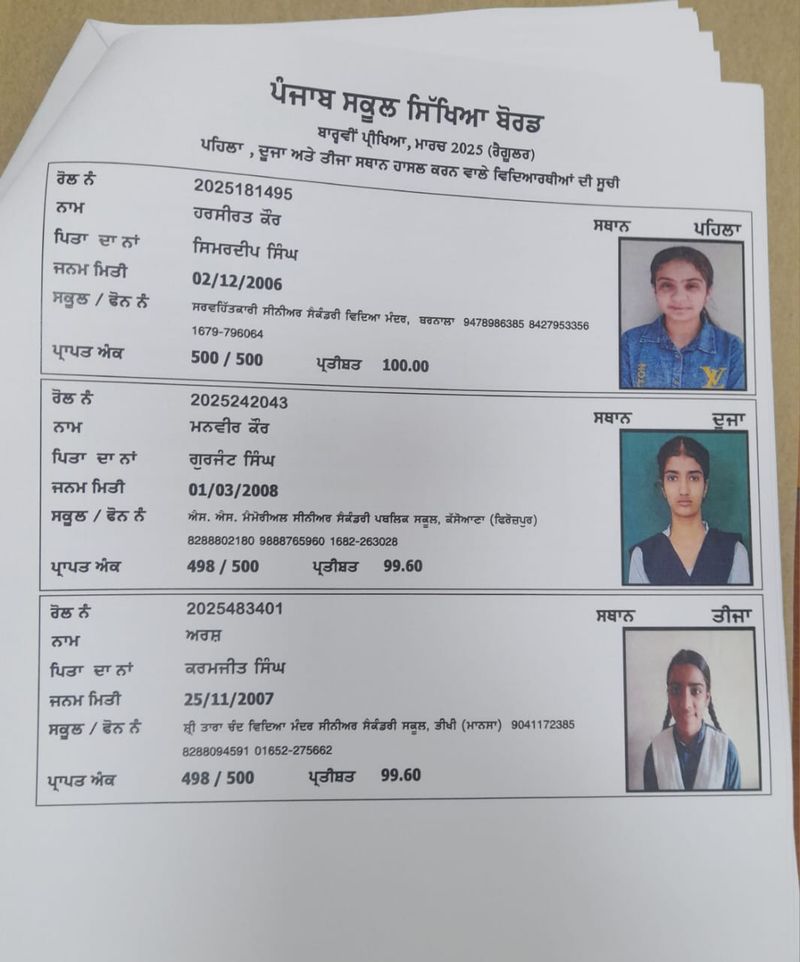

100 In Pseb Class 12 Exams Barnala Girls Triumphant Result

May 14, 2025

100 In Pseb Class 12 Exams Barnala Girls Triumphant Result

May 14, 2025 -

Leaked Kung Fury 2 Footage Arnold Schwarzenegger Rides A Dinosaur

May 14, 2025

Leaked Kung Fury 2 Footage Arnold Schwarzenegger Rides A Dinosaur

May 14, 2025