Stablecoins As A Strategic Tool: Enhancing Bank Liquidity And Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins as a Strategic Tool: Enhancing Bank Liquidity and Deposits

The banking industry is undergoing a significant transformation, driven by technological advancements and evolving customer expectations. Amidst this shift, stablecoins are emerging as a powerful tool with the potential to revolutionize bank liquidity management and attract new deposits. This article explores how stablecoins can enhance bank operations and address longstanding challenges within the financial sector.

What are Stablecoins?

Before diving into their strategic applications, let's define stablecoins. These cryptocurrencies are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, stablecoins aim for price stability, making them attractive for various financial transactions. Several mechanisms exist to maintain this stability, including collateralization with reserves and algorithmic adjustments.

Enhancing Bank Liquidity:

One of the most significant advantages of stablecoins lies in their ability to improve bank liquidity. Traditional liquidity management relies on holding substantial reserves of cash and government securities. However, this can be costly and inefficient. Stablecoins offer a more efficient alternative:

- Reduced Reserve Requirements: Banks could potentially reduce their reliance on traditional reserves by utilizing stablecoins as a readily available liquidity buffer. This frees up capital for lending and investment opportunities.

- Faster Transactions: Stablecoin transactions are significantly faster than traditional interbank transfers, enabling quicker responses to liquidity demands. This speed is crucial during periods of market stress or unexpected withdrawals.

- 24/7 Accessibility: Unlike traditional banking systems, stablecoin transactions can occur 24/7, providing continuous access to liquidity regardless of time zones or business hours.

Attracting Deposits and Expanding Customer Base:

Stablecoins also present an opportunity to attract a new generation of depositors, particularly those familiar with digital assets. Banks integrating stablecoin platforms can:

- Offer Competitive Interest Rates: Banks can leverage stablecoins to offer attractive interest rates on deposits, potentially exceeding those offered on traditional accounts.

- Enhanced Accessibility: Stablecoins can make banking more accessible to underserved populations, particularly in regions with limited access to traditional financial services.

- Innovative Product Offerings: Integration of stablecoins allows banks to develop innovative financial products, such as stablecoin-backed loans and investment vehicles, further attracting customers.

Challenges and Considerations:

While the potential benefits are significant, integrating stablecoins into banking operations presents challenges:

- Regulatory Uncertainty: The regulatory landscape surrounding stablecoins is still evolving, creating uncertainty for banks considering their adoption. Clear regulatory frameworks are crucial for widespread acceptance.

- Security Risks: Like any digital asset, stablecoins are vulnerable to security breaches and hacking. Robust security measures are essential to mitigate these risks.

- Counterparty Risk: The stability of a stablecoin is heavily reliant on the issuer's ability to maintain its peg. Banks must carefully assess the creditworthiness of stablecoin issuers.

Conclusion:

Stablecoins represent a potentially transformative technology for the banking sector. Their ability to enhance liquidity, attract deposits, and foster innovation makes them a compelling strategic tool. However, addressing regulatory uncertainties and security concerns is crucial for realizing the full potential of stablecoins in the banking industry. As the regulatory landscape clarifies and technology matures, we can expect to see increasing adoption of stablecoins as banks seek to enhance their operations and meet the demands of a rapidly evolving financial landscape. The future of banking may well be intertwined with the stable and efficient world of digital assets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins As A Strategic Tool: Enhancing Bank Liquidity And Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

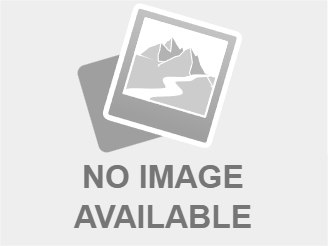

2023 Canadian Federal Election Brampton South Results And Voter Turnout

Apr 30, 2025

2023 Canadian Federal Election Brampton South Results And Voter Turnout

Apr 30, 2025 -

Authorities Decline To File Charges In The Death Of Hockey Player Adam Johnson

Apr 30, 2025

Authorities Decline To File Charges In The Death Of Hockey Player Adam Johnson

Apr 30, 2025 -

Tribeca Premiere Honeyjoon Showcases Azores Landscape

Apr 30, 2025

Tribeca Premiere Honeyjoon Showcases Azores Landscape

Apr 30, 2025 -

The Hans Zimmer Score That Defied Expectations A Blockbuster Story

Apr 30, 2025

The Hans Zimmer Score That Defied Expectations A Blockbuster Story

Apr 30, 2025 -

Jeremy Renner Speaks Out The Aftermath Of His Devastating Snowplow Accident

Apr 30, 2025

Jeremy Renner Speaks Out The Aftermath Of His Devastating Snowplow Accident

Apr 30, 2025

Latest Posts

-

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025 -

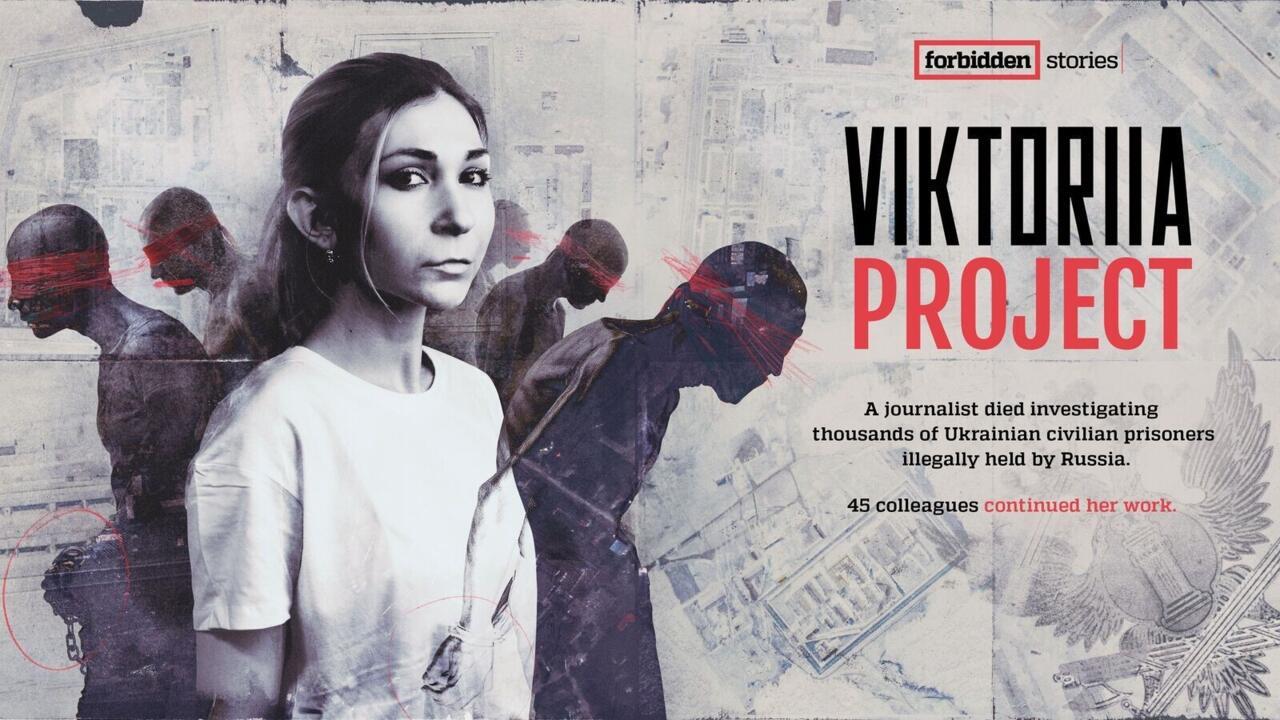

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025 -

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025 -

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025 -

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025