Stablecoins As A Tool For Banks: Enhancing Liquidity And Attracting Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins as a Tool for Banks: Enhancing Liquidity and Attracting Deposits

The traditional banking sector is facing a period of significant transformation, driven by technological advancements and evolving customer expectations. One innovative solution gaining traction is the integration of stablecoins into banking operations. These cryptocurrencies, pegged to a stable asset like the US dollar, offer banks a compelling opportunity to enhance liquidity, attract new deposits, and navigate the complexities of the modern financial landscape. This article explores the potential benefits and challenges associated with banks adopting this emerging technology.

H2: Addressing Liquidity Challenges with Stablecoin Integration

Maintaining sufficient liquidity is paramount for banks to meet their obligations and withstand market fluctuations. Traditional methods, such as holding large reserves of cash or government bonds, can be less efficient and less profitable. Stablecoins, however, offer a potential solution. Their inherent stability and ease of transfer allow banks to manage their liquidity more effectively. By integrating stablecoins into their internal systems, banks can:

- Optimize reserve management: Reduce reliance on less liquid assets, freeing up capital for lending and investment.

- Facilitate faster interbank transactions: Stablecoin transfers can be significantly quicker and cheaper than traditional wire transfers, enhancing operational efficiency.

- Mitigate risks associated with volatile assets: Unlike cryptocurrencies subject to price swings, stablecoins provide a more predictable and stable value.

H2: Attracting Deposits with the Appeal of Stablecoins

The increasing popularity of cryptocurrencies has created a new generation of digitally native customers who are comfortable interacting with digital assets. Banks can leverage this trend by offering stablecoin-based deposit accounts, attracting a wider customer base and potentially increasing their deposit base. This approach allows banks to:

- Tap into a new customer segment: Attract tech-savvy individuals and businesses who prefer digital banking solutions and are familiar with cryptocurrencies.

- Offer competitive interest rates: Stablecoin-based accounts could potentially offer higher interest rates than traditional accounts, making them more attractive to depositors.

- Enhance customer engagement: Providing innovative financial services using cutting-edge technology improves customer experience and loyalty.

H2: Navigating the Regulatory Landscape and Security Concerns

Despite the potential benefits, the integration of stablecoins into banking operations presents significant challenges. The regulatory landscape surrounding stablecoins is still evolving, and banks must navigate complex compliance requirements to ensure they operate within legal boundaries. Furthermore, security is paramount. Banks must implement robust security measures to protect stablecoin holdings from cyber threats and ensure the integrity of their systems. Key considerations include:

- Regulatory uncertainty: A lack of clear regulatory frameworks poses a significant hurdle to widespread adoption.

- Security risks: Banks must invest heavily in security infrastructure to mitigate the risks of hacking and fraud.

- Counterparty risk: Banks must carefully assess the creditworthiness of the issuers of stablecoins they choose to utilize.

H2: The Future of Stablecoins in Banking

The use of stablecoins in the banking sector is still in its early stages, but the potential benefits are significant. As the regulatory landscape clarifies and technological advancements continue, we can expect to see increased adoption of stablecoins by banks worldwide. This will likely lead to a more efficient, competitive, and inclusive financial system, benefiting both banks and their customers. The successful integration of stablecoins will depend on careful planning, robust security measures, and a proactive approach to regulatory compliance. However, the potential rewards make it a development worth watching closely in the evolving landscape of finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins As A Tool For Banks: Enhancing Liquidity And Attracting Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba Playoffs Warriors Kerr On Game 6 Strategy Against Houston

May 05, 2025

Nba Playoffs Warriors Kerr On Game 6 Strategy Against Houston

May 05, 2025 -

Stranger Things 5 Teaser Trailer Netflix Release Date Hints And Clues

May 05, 2025

Stranger Things 5 Teaser Trailer Netflix Release Date Hints And Clues

May 05, 2025 -

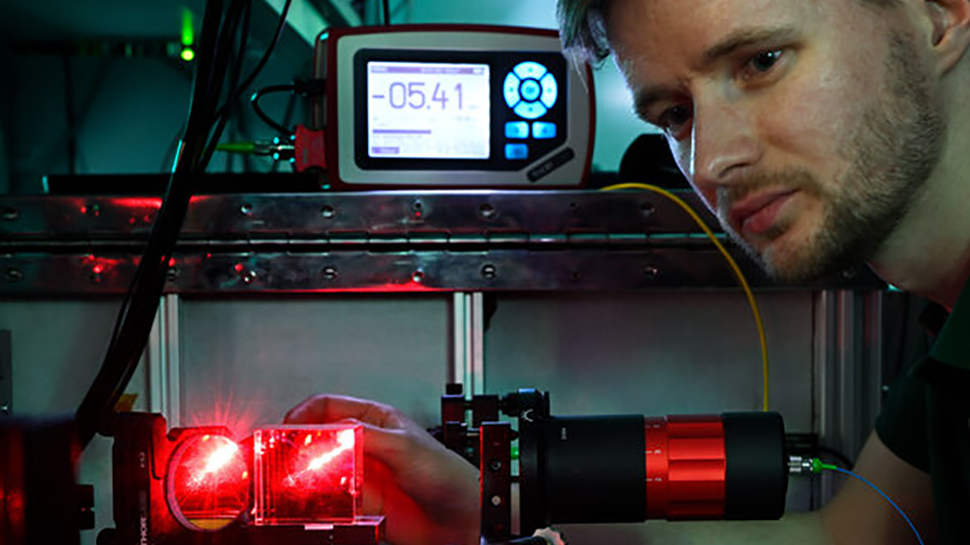

Breakthrough In Data Transmission Near 2 Million Hd Streams On A Single Infrared Light Beam

May 05, 2025

Breakthrough In Data Transmission Near 2 Million Hd Streams On A Single Infrared Light Beam

May 05, 2025 -

Roland Garros 2024 Venus Williams Unexpected New Role

May 05, 2025

Roland Garros 2024 Venus Williams Unexpected New Role

May 05, 2025 -

Ge 2025 A Deeper Look At The Poll Data And Its Impact On Wp Supporters

May 05, 2025

Ge 2025 A Deeper Look At The Poll Data And Its Impact On Wp Supporters

May 05, 2025