Stablecoins As Financial "Superconductors": Stripe's $91.5B Valuation And The Future Of Payments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins as Financial "Superconductors": Stripe's $91.5B Valuation and the Future of Payments

Stripe's recent $91.5 billion valuation isn't just a headline-grabbing figure; it's a powerful indicator of the burgeoning influence of stablecoins on the future of global payments. This valuation reflects not only Stripe's success in facilitating online payments but also its strategic embrace of stablecoins as a crucial component of a faster, cheaper, and more efficient financial system. Think of stablecoins as the "superconductors" of finance – enabling frictionless, high-speed transactions across borders.

The Stripe Advantage: Leveraging Stablecoin Technology

Stripe, a prominent player in the fintech world, has quietly positioned itself at the forefront of stablecoin integration. While they haven't explicitly declared a wholesale shift to stablecoin-based payments, their investment and strategic partnerships strongly suggest a growing reliance on this technology. This strategic move allows Stripe to:

- Reduce Transaction Costs: Traditional payment processing involves numerous intermediaries and hefty fees. Stablecoins, pegged to fiat currencies like the US dollar, significantly reduce these costs, boosting profitability for both Stripe and its clients.

- Accelerate Transaction Speeds: Stablecoin transactions are significantly faster than traditional bank transfers, offering a near-instantaneous settlement experience that enhances customer satisfaction and streamlines business operations.

- Improve Cross-Border Payments: International transactions often face delays and high fees due to currency conversion and regulatory hurdles. Stablecoins simplify this process, enabling faster and cheaper cross-border payments, opening new markets for businesses using Stripe's platform.

- Enhance Financial Inclusion: Millions globally lack access to traditional banking systems. Stablecoins offer a potential pathway to financial inclusion, enabling individuals and businesses in underserved regions to participate in the global economy more easily.

Stablecoins: The Engine of a New Financial System?

The rapid adoption of stablecoins by companies like Stripe underscores their potential to revolutionize the payments landscape. Their inherent stability, tied to a reserve of fiat currency or other assets, mitigates the volatility associated with cryptocurrencies, making them a more appealing option for mainstream adoption. However, challenges remain:

- Regulatory Uncertainty: The regulatory landscape surrounding stablecoins is still evolving, with varying approaches across different jurisdictions. This uncertainty creates challenges for widespread adoption and could potentially stifle innovation.

- Security Concerns: While stablecoins offer inherent stability, they are not entirely immune to security risks. Vulnerabilities within the underlying infrastructure or smart contracts could potentially lead to losses.

- Scalability Issues: As adoption grows, ensuring the scalability of stablecoin networks becomes crucial. Addressing potential bottlenecks and improving transaction throughput will be vital for sustaining growth.

The Future is Stable (and Fast):

Stripe's impressive valuation, intertwined with its strategic focus on stablecoin technology, paints a compelling picture of the future of payments. While challenges remain, the potential benefits – reduced costs, increased speed, and enhanced accessibility – are undeniable. As regulatory clarity emerges and technological advancements address scalability concerns, stablecoins are poised to play an increasingly pivotal role in shaping a more efficient, inclusive, and globally connected financial system. The "superconductor" analogy, while metaphorical, accurately captures their potential to revolutionize how we transact and move money in the digital age.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins As Financial "Superconductors": Stripe's $91.5B Valuation And The Future Of Payments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Withdrawal From Nato Global Implications And Consequences

Mar 04, 2025

Us Withdrawal From Nato Global Implications And Consequences

Mar 04, 2025 -

Global Ai Spending A 350 Billion Market Poised For Explosive Growth

Mar 04, 2025

Global Ai Spending A 350 Billion Market Poised For Explosive Growth

Mar 04, 2025 -

Trumps Crypto Portfolio 2 Million Rebound And A 12 Billion Trump Stake Boost

Mar 04, 2025

Trumps Crypto Portfolio 2 Million Rebound And A 12 Billion Trump Stake Boost

Mar 04, 2025 -

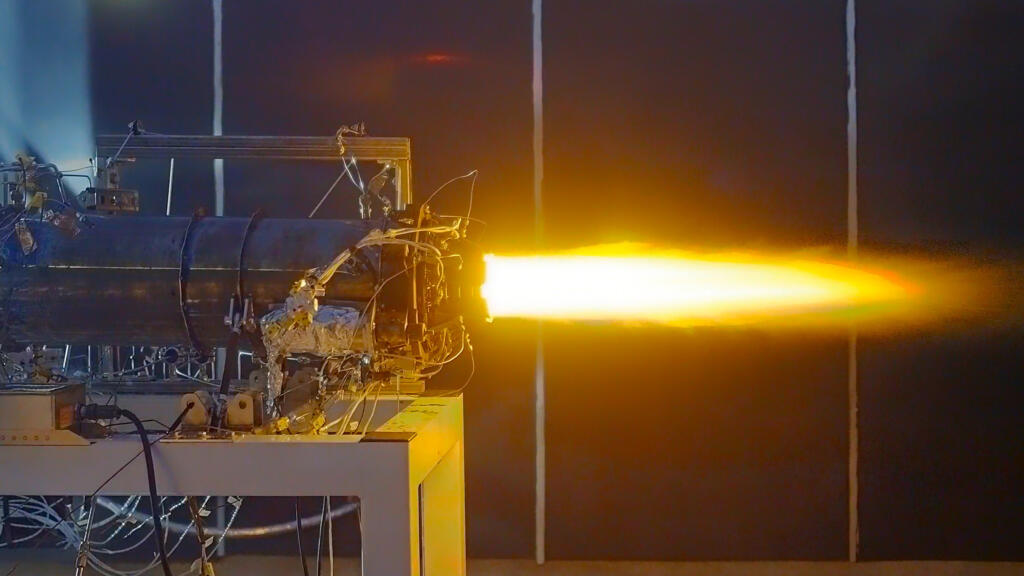

Vdr 2 Engine First Ignition A Major Leap Forward For Venus Aerospace

Mar 04, 2025

Vdr 2 Engine First Ignition A Major Leap Forward For Venus Aerospace

Mar 04, 2025 -

Revolutionary Mini Pc Superior Performance To Mac Studio And Digits At A Significantly Lower Price

Mar 04, 2025

Revolutionary Mini Pc Superior Performance To Mac Studio And Digits At A Significantly Lower Price

Mar 04, 2025