Stablecoins: Strategic Tool For Banks To Increase Liquidity And Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins: A Strategic Tool for Banks to Increase Liquidity and Deposits

The banking sector is facing a liquidity crunch, and stablecoins might just be the answer. For years, banks have relied on traditional methods to manage liquidity and attract deposits. However, in today's rapidly evolving financial landscape, these methods are proving insufficient. Enter stablecoins – a potentially game-changing solution offering banks a strategic advantage in managing liquidity and boosting deposits. This article explores how stablecoins are poised to reshape the banking industry.

What are Stablecoins?

Stablecoins are cryptocurrencies pegged to a stable asset, typically the US dollar. Unlike volatile cryptocurrencies like Bitcoin, stablecoins maintain a relatively stable value, making them attractive for various financial applications. This price stability is achieved through different mechanisms, including backing by reserves of fiat currency, collateralized assets, or algorithmic mechanisms.

How Can Stablecoins Benefit Banks?

The benefits of integrating stablecoins into banking operations are numerous:

-

Enhanced Liquidity Management: Stablecoins provide banks with a readily available and liquid asset. This is crucial for meeting regulatory requirements and handling unexpected withdrawals. The instantaneous transferability of stablecoins offers a significant advantage over traditional interbank transfers, which can be slow and cumbersome.

-

Increased Deposit Base: Offering stablecoin-based deposit accounts can attract a new segment of customers, particularly those familiar with and comfortable using cryptocurrencies. This expands the bank's customer base and strengthens its deposit position.

-

Lower Transaction Costs: Compared to traditional payment systems, stablecoin transactions often involve lower fees, resulting in cost savings for the bank and its customers. This efficiency translates into improved profitability.

-

Faster Settlement Times: Stablecoin transactions settle much faster than traditional bank transfers, allowing banks to process transactions more quickly and efficiently. This speed advantage is particularly beneficial in high-volume transactions.

-

Access to New Markets: Stablecoins can facilitate cross-border payments, opening up new market opportunities for banks and reducing reliance on correspondent banking relationships. This expansion is vital for banks aiming to reach a global customer base.

Addressing Concerns and Challenges:

While the potential benefits are significant, the integration of stablecoins into banking operations also presents challenges:

-

Regulatory Uncertainty: The regulatory landscape surrounding stablecoins is still evolving. Banks need clarity on regulatory compliance to confidently adopt stablecoin technology.

-

Security Risks: Like any digital asset, stablecoins are vulnerable to security breaches. Banks must implement robust security measures to mitigate these risks.

-

Counterparty Risk: The stability of stablecoins depends on the backing asset and the issuer's solvency. Banks must carefully assess counterparty risk before integrating stablecoins into their operations.

The Future of Stablecoins in Banking:

Despite these challenges, the future of stablecoins in the banking sector appears bright. As regulations become clearer and technology matures, we anticipate a gradual but significant increase in stablecoin adoption by banks. This integration will transform liquidity management, enhance deposit mobilization, and drive innovation within the financial industry. Banks that proactively embrace this technology are poised to gain a competitive edge in the evolving financial landscape. The strategic use of stablecoins will be pivotal in ensuring the continued stability and growth of the banking sector in the years to come. Further research and discussion are vital to ensure responsible implementation and mitigate any potential risks associated with this transformative technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins: Strategic Tool For Banks To Increase Liquidity And Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

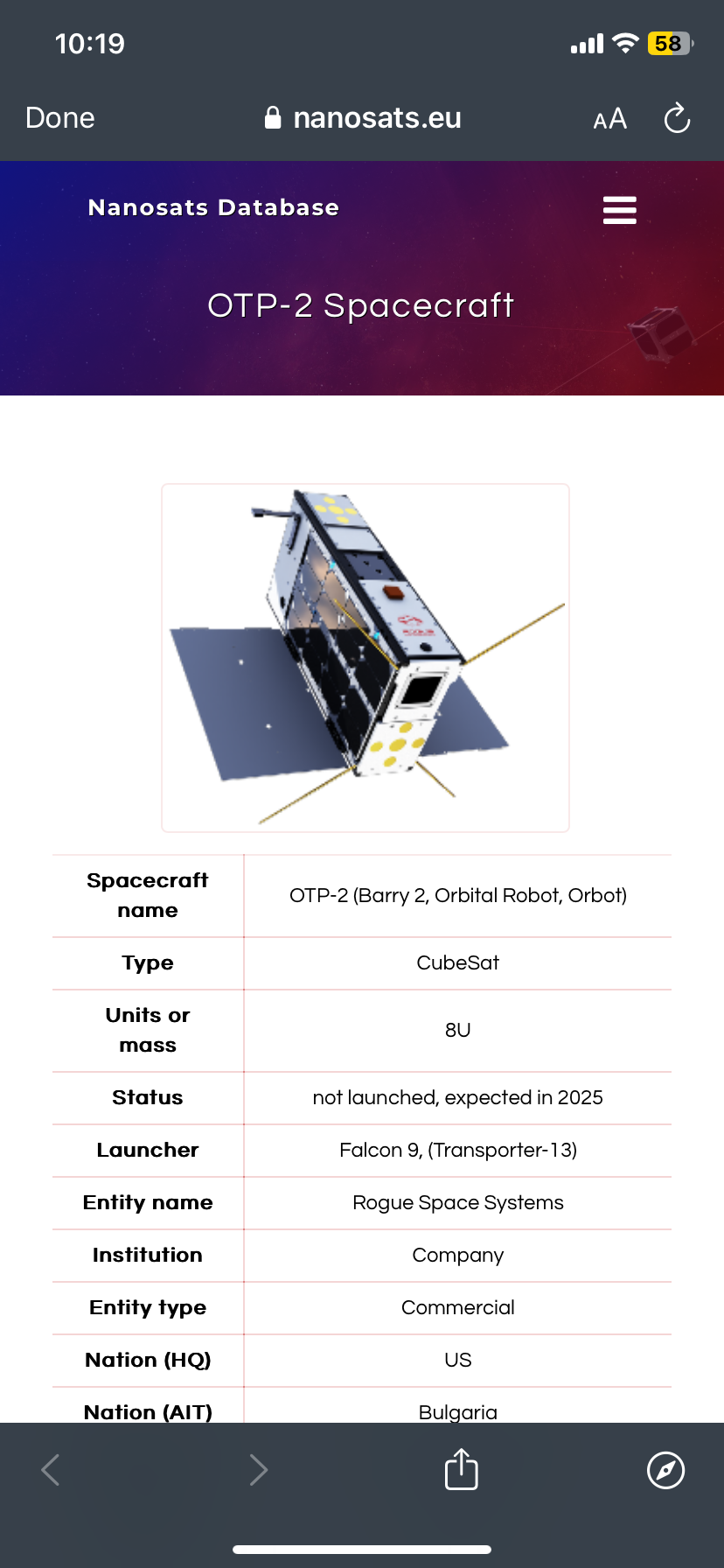

Examining Otp 2s Propulsion Two Experiments One Goal

May 02, 2025

Examining Otp 2s Propulsion Two Experiments One Goal

May 02, 2025 -

Manchester United Shake Up Ineos Purges Erik Ten Hags Key Scouting Figure

May 02, 2025

Manchester United Shake Up Ineos Purges Erik Ten Hags Key Scouting Figure

May 02, 2025 -

Postgame Drama Tyrese Haliburtons Heated Exchange With Father After Pacers Defeat Bucks

May 02, 2025

Postgame Drama Tyrese Haliburtons Heated Exchange With Father After Pacers Defeat Bucks

May 02, 2025 -

Matthew Berrys Love Hate 2025 Nfl Draft Prospect Analysis

May 02, 2025

Matthew Berrys Love Hate 2025 Nfl Draft Prospect Analysis

May 02, 2025 -

Sk Telecom Provides Free Sim Cards Following Data Breach

May 02, 2025

Sk Telecom Provides Free Sim Cards Following Data Breach

May 02, 2025