Stablecoins Take Center Stage: Revolutionizing Crypto Debit Card Use

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins Take Center Stage: Revolutionizing Crypto Debit Card Use

The crypto landscape is constantly evolving, and one of the most significant shifts we're witnessing is the rise of stablecoins in everyday transactions, particularly through crypto debit cards. Gone are the days when using cryptocurrency for everyday purchases felt like a risky gamble. The volatility inherent in many cryptocurrencies deterred widespread adoption. However, the emergence of stablecoins—cryptocurrencies pegged to the value of a stable asset like the US dollar—is changing the game, making crypto debit cards a much more attractive and accessible option for millions.

What are Stablecoins and Why are They Important?

Stablecoins, unlike Bitcoin or Ethereum, maintain price stability by being pegged to a reserve asset. This means their value remains relatively constant, mitigating the risk of significant price fluctuations. This stability is crucial for widespread adoption, allowing users to confidently spend their digital assets without worrying about sudden drops in value. Popular stablecoins like USD Coin (USDC), Tether (USDT), and Binance USD (BUSD) are driving this transformation.

How Stablecoins are Fueling Crypto Debit Card Growth:

The integration of stablecoins with crypto debit cards is a game-changer. These cards allow users to seamlessly convert their stablecoins into fiat currency (like USD) at the point of sale, enabling everyday purchases at any merchant that accepts debit cards. This offers several key advantages:

- Reduced Volatility Risk: The inherent stability of stablecoins eliminates the fear of significant value loss during transactions.

- Increased Accessibility: Crypto debit cards linked to stablecoins make cryptocurrency accessible to a much broader audience, removing the technical hurdles and price volatility concerns that previously hindered adoption.

- Convenience and Simplicity: The user experience is streamlined, making it as easy to use a crypto debit card as a traditional debit card.

- Global Reach: The decentralized nature of stablecoins and blockchain technology allows for potentially faster and cheaper international transactions.

The Future of Stablecoin-Backed Debit Cards:

The potential for stablecoin-backed crypto debit cards is enormous. As adoption increases, we can expect:

- Increased Merchant Acceptance: More businesses are likely to adopt cryptocurrency payment options as the demand increases and the convenience becomes apparent.

- Enhanced User Experience: Further development will likely lead to even more seamless and user-friendly applications and features.

- Integration with other Financial Services: We could see increased integration with traditional banking systems and other financial services, blurring the lines between traditional finance and decentralized finance (DeFi).

Challenges and Considerations:

While the future looks bright, some challenges remain:

- Regulatory Uncertainty: The regulatory landscape surrounding stablecoins and cryptocurrencies is still evolving, creating uncertainty for both issuers and users.

- Security Concerns: As with any digital asset, security remains paramount. Users must choose reputable platforms and practice safe digital hygiene.

- Transaction Fees: While often lower than traditional international transactions, fees associated with stablecoin transactions should be considered.

Conclusion:

Stablecoins are undeniably revolutionizing the use of crypto debit cards, making cryptocurrency a more practical and accessible option for everyday spending. While challenges remain, the increasing convenience, stability, and potential for global reach make stablecoin-backed debit cards a significant development in the evolution of the cryptocurrency market. This trend is likely to continue, paving the way for a more inclusive and innovative financial future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins Take Center Stage: Revolutionizing Crypto Debit Card Use. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mainstream Adoption Of Decentralized Cloud Infrastructure A Necessity For Enhanced Security And Resilience

May 13, 2025

Mainstream Adoption Of Decentralized Cloud Infrastructure A Necessity For Enhanced Security And Resilience

May 13, 2025 -

Us Imposes Cattle Import Ban On Mexico Due To Maggot Infestation

May 13, 2025

Us Imposes Cattle Import Ban On Mexico Due To Maggot Infestation

May 13, 2025 -

Wordle Solution Hints For The May 13 2025 Wordle Puzzle

May 13, 2025

Wordle Solution Hints For The May 13 2025 Wordle Puzzle

May 13, 2025 -

Pepe Cryptocurrency Cools Down After Massive Rally Is The Trend Over

May 13, 2025

Pepe Cryptocurrency Cools Down After Massive Rally Is The Trend Over

May 13, 2025 -

The Office Legacy Continues The Paper Spinoff Coming To Peacock In September

May 13, 2025

The Office Legacy Continues The Paper Spinoff Coming To Peacock In September

May 13, 2025

Latest Posts

-

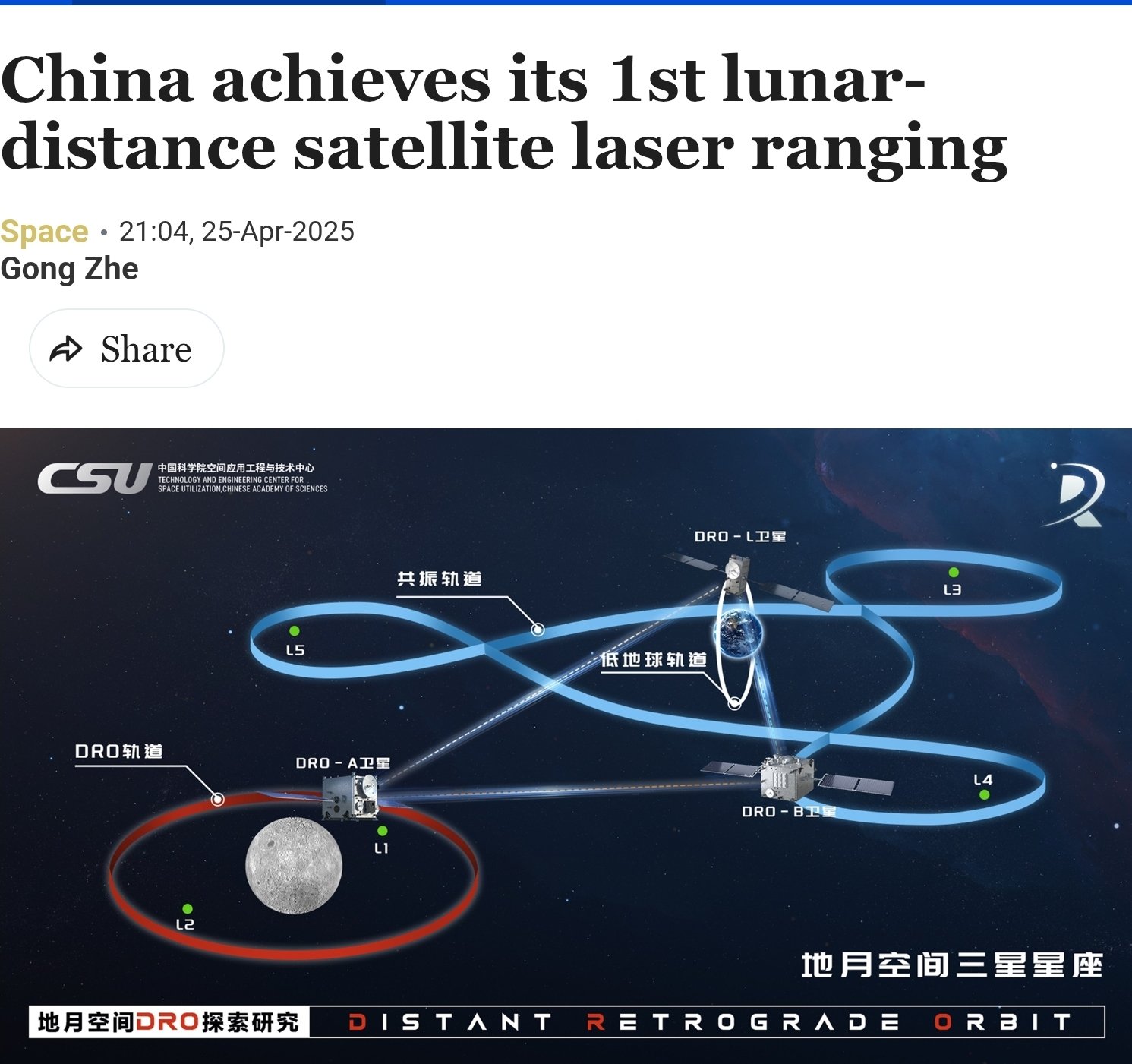

Lunar Laser Ranging A Chinese Satellites Technological Feat

May 13, 2025

Lunar Laser Ranging A Chinese Satellites Technological Feat

May 13, 2025 -

Follow The Action Draper Vs Moutet Italian Open Last 16 Live Score

May 13, 2025

Follow The Action Draper Vs Moutet Italian Open Last 16 Live Score

May 13, 2025 -

Uptick In Singapore Covid 19 Infections Authorities Expect Recurring Waves

May 13, 2025

Uptick In Singapore Covid 19 Infections Authorities Expect Recurring Waves

May 13, 2025 -

Hondas Financial Woes Deepen The Lasting Impact Of Trumps Trade Policies On Japan

May 13, 2025

Hondas Financial Woes Deepen The Lasting Impact Of Trumps Trade Policies On Japan

May 13, 2025 -

Beyond The Propaganda Unmasking Russias False Sense Of Victory

May 13, 2025

Beyond The Propaganda Unmasking Russias False Sense Of Victory

May 13, 2025