Stablecoins: The Future Of Bank Liquidity And Deposit Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins: The Future of Bank Liquidity and Deposit Growth?

The traditional banking system faces challenges. Declining interest rates, increased regulatory scrutiny, and the rise of fintech disruptors have forced banks to rethink their strategies for maintaining liquidity and attracting deposits. Enter stablecoins, a class of cryptocurrencies pegged to a stable asset like the US dollar, which are increasingly being viewed as a potential game-changer for the future of banking. But are they truly the answer to banks' liquidity and deposit growth woes? Let's delve deeper.

What are Stablecoins?

Stablecoins are cryptocurrencies designed to minimize volatility, unlike Bitcoin or Ethereum. Their value is typically tied to a reserve asset, often the US dollar, ensuring price stability. This stability makes them attractive for various purposes, including everyday transactions and as a store of value, potentially impacting the banking sector significantly. Several types of stablecoins exist, each with its own mechanism for maintaining the peg:

- Fiat-collateralized stablecoins: Backed by a reserve of fiat currency held in a bank account.

- Crypto-collateralized stablecoins: Backed by other cryptocurrencies, often over-collateralized to mitigate risk.

- Algorithmic stablecoins: Maintain their peg through algorithmic mechanisms, often involving smart contracts and trading strategies. These are generally considered higher-risk.

Stablecoins and Bank Liquidity:

Banks are constantly juggling liquidity needs. Stablecoins could offer a new source of liquidity. Imagine a scenario where banks accept stablecoin deposits, giving them access to a readily available pool of funds. This could reduce reliance on traditional interbank lending markets and potentially lower borrowing costs. Furthermore, stablecoins can facilitate faster and cheaper cross-border transactions, enhancing liquidity management across geographical boundaries.

Stablecoins and Deposit Growth:

Attracting deposits is crucial for bank profitability. Stablecoins could attract a new segment of depositors, particularly younger generations more comfortable with digital technologies and cryptocurrencies. Offering stablecoin deposit accounts could allow banks to compete more effectively with fintech companies offering innovative financial products. The potential to offer higher yields on stablecoin deposits compared to traditional accounts could also prove attractive to depositors.

Challenges and Regulatory Hurdles:

Despite the potential benefits, several challenges remain:

- Regulatory Uncertainty: The regulatory landscape for stablecoins is still evolving. Governments worldwide are grappling with how to regulate these digital assets, creating uncertainty for banks considering their integration.

- Security Risks: The risk of hacks and security breaches associated with stablecoin platforms and custodians poses a significant concern for banks.

- Counterparty Risk: Reliance on a third-party issuer for fiat-collateralized stablecoins introduces counterparty risk, impacting the overall stability of the system.

- Volatility Concerns: Even though designed for stability, algorithmic stablecoins have demonstrated vulnerabilities to market fluctuations, raising concerns about their suitability for banking applications.

The Future Outlook:

The integration of stablecoins into the banking system is still in its early stages. While the potential benefits for liquidity and deposit growth are significant, significant regulatory clarity and robust security protocols are necessary to mitigate the risks. The future of stablecoins in banking depends heavily on how regulators address these challenges and how banks successfully navigate the complexities of integrating these new digital assets into their operations. However, the potential for disruption and transformation is undeniable, making it a space worth watching closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins: The Future Of Bank Liquidity And Deposit Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

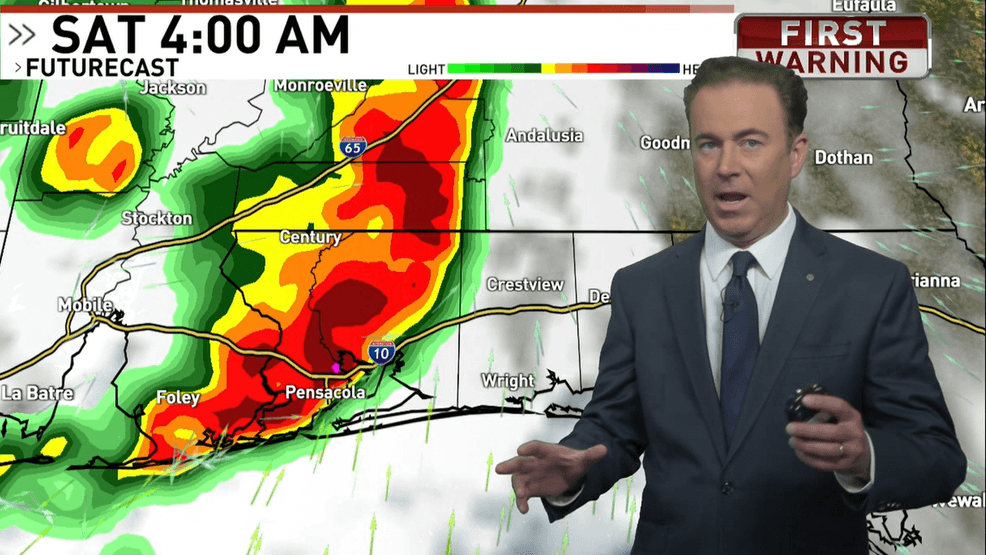

Get Ready Strong Storms And Heavy Rain Expected This Weekend

May 03, 2025

Get Ready Strong Storms And Heavy Rain Expected This Weekend

May 03, 2025 -

How Beyond Paradise Can Learn From Death In Paradise After Its Near Perfect Finale

May 03, 2025

How Beyond Paradise Can Learn From Death In Paradise After Its Near Perfect Finale

May 03, 2025 -

Fresh Us Sanctions On Russia Imminent Amidst Ongoing Ukraine War

May 03, 2025

Fresh Us Sanctions On Russia Imminent Amidst Ongoing Ukraine War

May 03, 2025 -

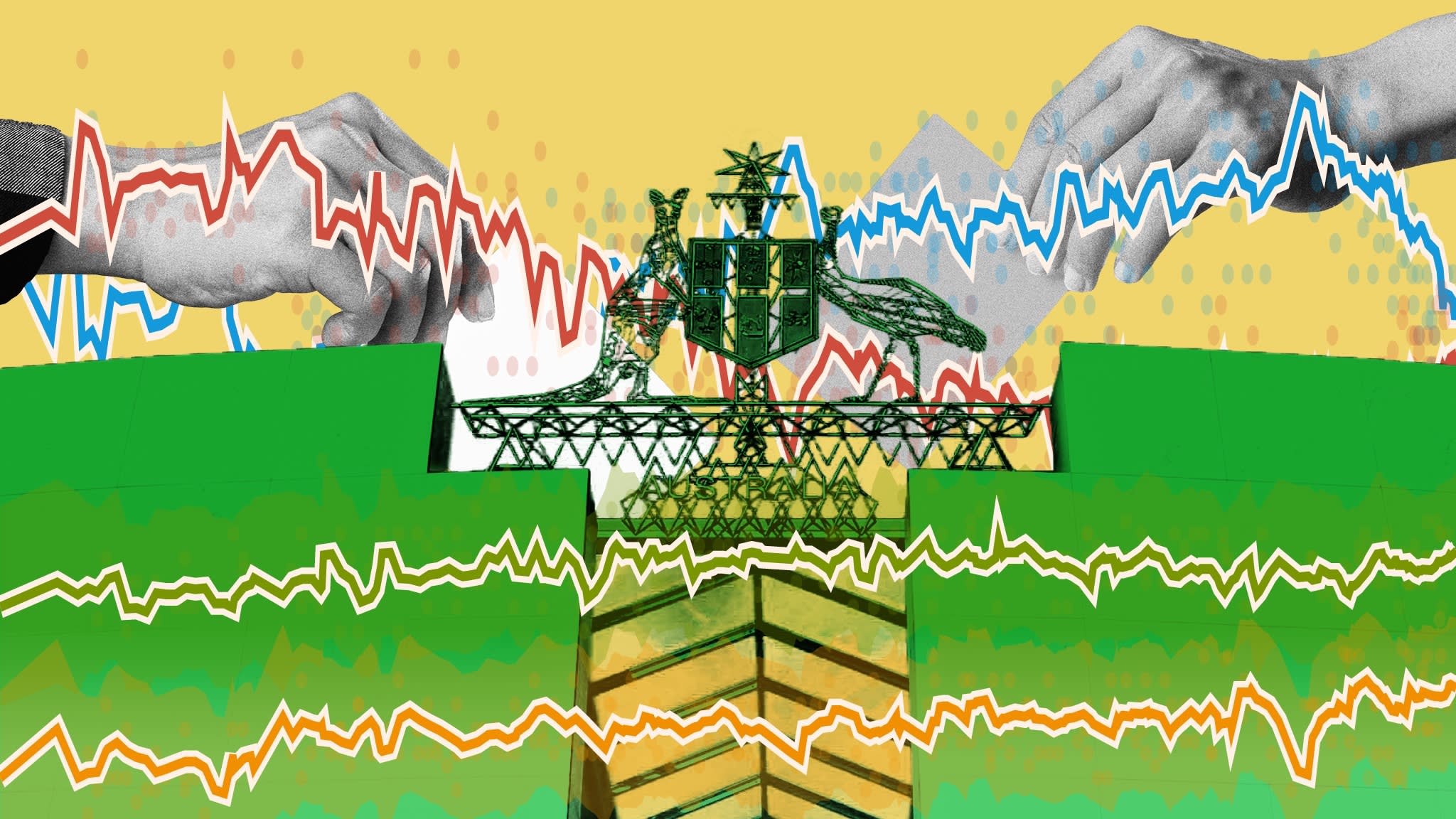

Australias Election A Critical Analysis Of National Security Under Albanese And Dutton

May 03, 2025

Australias Election A Critical Analysis Of National Security Under Albanese And Dutton

May 03, 2025 -

Australias Tightrope Walk Navigating A Slowing China And An Unstable Us

May 03, 2025

Australias Tightrope Walk Navigating A Slowing China And An Unstable Us

May 03, 2025

Latest Posts

-

Paul Goldschmidts 3 Run Homer Game Changing Moment For Cardinals

May 03, 2025

Paul Goldschmidts 3 Run Homer Game Changing Moment For Cardinals

May 03, 2025 -

Beyond Paradise Couples Exit Confirmed Fans React To Heartbreaking Departure

May 03, 2025

Beyond Paradise Couples Exit Confirmed Fans React To Heartbreaking Departure

May 03, 2025 -

Singapores Ge 2025 A Deep Dive Into The Political Parties And Their Platforms

May 03, 2025

Singapores Ge 2025 A Deep Dive Into The Political Parties And Their Platforms

May 03, 2025 -

Australia Votes Donald Trumps Unexpected Role In The 2023 Election

May 03, 2025

Australia Votes Donald Trumps Unexpected Role In The 2023 Election

May 03, 2025 -

Analyzing The Singapore Election Paps Vulnerability And The Push For A More Representative Parliament

May 03, 2025

Analyzing The Singapore Election Paps Vulnerability And The Push For A More Representative Parliament

May 03, 2025