Stablecoins: The Future Of Bank Liquidity And Deposit Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins: The Future of Bank Liquidity and Deposit Strategies?

The traditional banking system is facing a seismic shift, with stablecoins emerging as a potential game-changer in liquidity management and deposit strategies. While still nascent, these cryptocurrencies pegged to fiat currencies like the US dollar are attracting significant attention from banks and financial institutions exploring innovative ways to optimize their operations. This article delves into the potential impact of stablecoins on the future of banking liquidity and deposit strategies.

What are Stablecoins and Why are Banks Interested?

Stablecoins, unlike volatile cryptocurrencies like Bitcoin, aim to maintain a stable value, typically by being backed by reserves of fiat currency, government bonds, or other assets. This stability makes them attractive to banks grappling with several challenges:

- Increased Liquidity Needs: Modern banking requires significant liquidity to meet regulatory requirements and manage unexpected withdrawals. Stablecoins offer a potential avenue for accessing readily available liquidity.

- Lower Transaction Costs: Traditional interbank transactions can be expensive and time-consuming. Stablecoin transactions, facilitated by blockchain technology, offer the potential for faster and cheaper settlements.

- Enhanced Efficiency: The automation inherent in blockchain technology can streamline banking processes, improving efficiency in liquidity management and deposit operations.

- Global Reach: Stablecoins can facilitate cross-border transactions more efficiently than traditional methods, expanding the reach of banking services.

Opportunities and Challenges for Banks:

The integration of stablecoins into banking operations presents both exciting opportunities and significant challenges:

Opportunities:

- Improved Risk Management: Diversifying liquidity sources with stablecoins could reduce reliance on traditional interbank markets, potentially mitigating risks associated with market volatility.

- New Revenue Streams: Banks could explore new revenue streams by offering stablecoin-based products and services to their customers.

- Enhanced Customer Experience: Faster and cheaper transactions could lead to improved customer satisfaction.

Challenges:

- Regulatory Uncertainty: The regulatory landscape surrounding stablecoins is still evolving, creating uncertainty for banks considering their adoption. Clear regulatory frameworks are crucial for widespread acceptance.

- Security Risks: While stablecoins aim for stability, they are not immune to security risks associated with blockchain technology and smart contracts. Robust security measures are paramount.

- Counterparty Risk: The stability of a stablecoin is dependent on the underlying assets and the issuer's credibility. Banks need to carefully assess counterparty risk.

- Integration Complexity: Integrating stablecoin technology into existing banking systems requires significant technological investment and expertise.

The Future of Stablecoins in Banking:

The future role of stablecoins in banking is still unfolding. While widespread adoption may take time, several factors suggest a growing influence:

- Technological Advancements: Ongoing advancements in blockchain technology are likely to enhance the efficiency and security of stablecoins.

- Regulatory Clarity: Clearer regulatory frameworks will reduce uncertainty and encourage broader adoption by banks.

- Growing Demand: Increased demand from businesses and consumers for faster and cheaper cross-border payments could drive adoption.

Conclusion:

Stablecoins present a significant opportunity for banks to revolutionize their liquidity management and deposit strategies. While challenges remain, particularly in the areas of regulation and security, the potential benefits – including enhanced efficiency, reduced costs, and improved risk management – are compelling. The future of banking may well be intertwined with the future of stablecoins, and it's a space to watch closely for significant developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins: The Future Of Bank Liquidity And Deposit Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

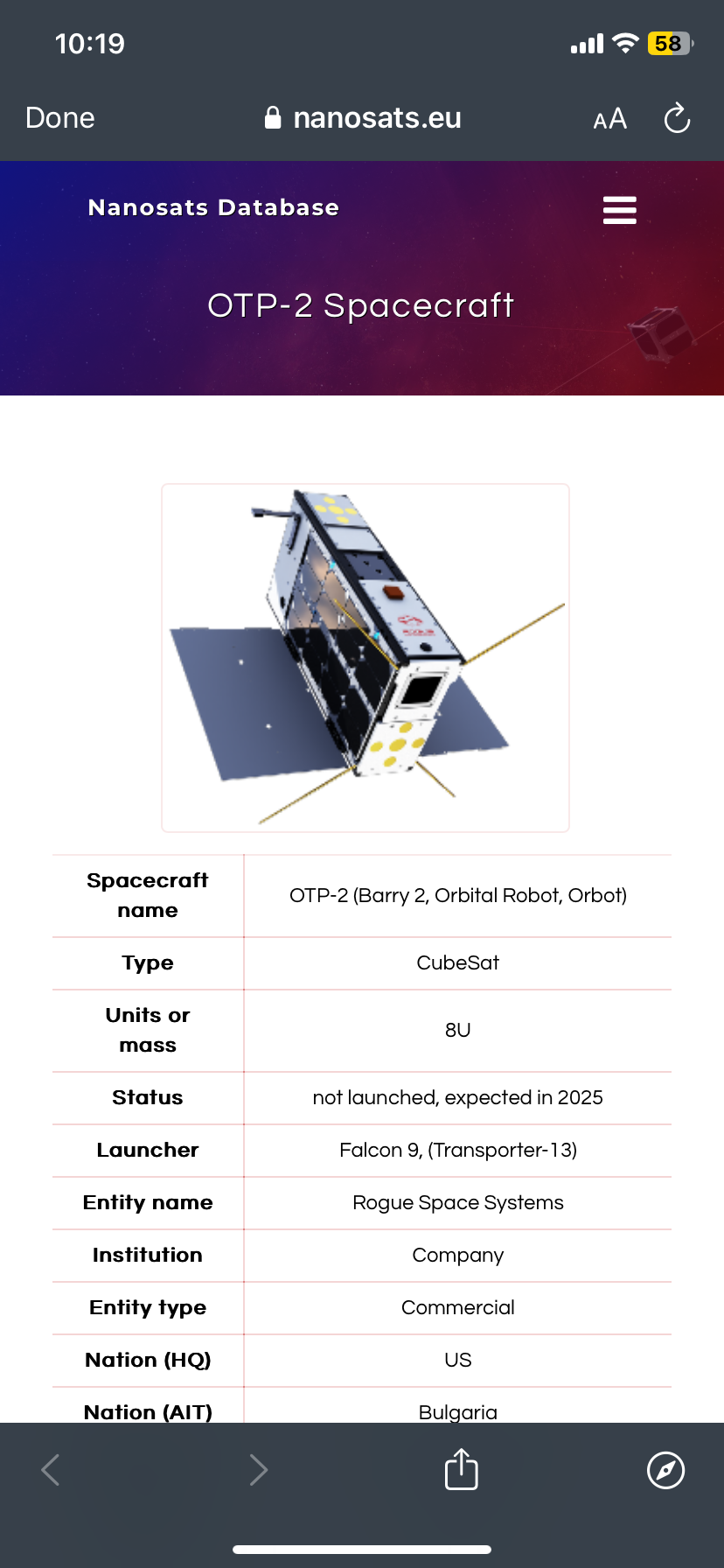

Otp 2 Two Propulsion Experiments Detailed Next Big Future Com Analysis

May 02, 2025

Otp 2 Two Propulsion Experiments Detailed Next Big Future Com Analysis

May 02, 2025 -

Tottenham Hotspur Vs Bodo Glimt Europa League Semi Final First Leg Preview

May 02, 2025

Tottenham Hotspur Vs Bodo Glimt Europa League Semi Final First Leg Preview

May 02, 2025 -

Deepwater Horizon Oil Spill A Decade And A Half Of Restoration Along The Texas Coast

May 02, 2025

Deepwater Horizon Oil Spill A Decade And A Half Of Restoration Along The Texas Coast

May 02, 2025 -

New Music Lordes Virgin Album The Charli Xcx Connection

May 02, 2025

New Music Lordes Virgin Album The Charli Xcx Connection

May 02, 2025 -

Europa League Pellegrini On Betis Prospects Against Fiorentina

May 02, 2025

Europa League Pellegrini On Betis Prospects Against Fiorentina

May 02, 2025