Stablecoins: The Future Of Finance? Stripe's $91.5B Valuation Suggests So

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins: The Future of Finance? Stripe's $91.5B Valuation Suggests So

The recent $91.5 billion valuation of Stripe, a global payments giant, has sent ripples through the financial tech world. While the company's success stems from numerous factors, its heavy reliance on stablecoins as a foundational element of its infrastructure is fueling speculation: could stablecoins truly be the future of finance? This isn't just a theoretical question anymore; Stripe's valuation provides compelling, albeit indirect, evidence suggesting a strong affirmative.

Stripe's Reliance on Stablecoin Technology:

Stripe's operations heavily depend on the smooth and efficient transfer of value globally. Traditional banking systems, with their inherent complexities and geographical limitations, often fall short. Stablecoins, pegged to fiat currencies like the US dollar, offer a compelling alternative. They provide the speed and efficiency of cryptocurrencies while minimizing the volatility that plagues other digital assets. Stripe leverages this stability to offer seamless cross-border payments and other financial services. This reliance is a significant factor driving its success and, consequently, its impressive valuation.

Why Stablecoins are Gaining Traction:

Several factors contribute to the growing popularity and potential dominance of stablecoins in the financial landscape:

- Reduced Volatility: Unlike cryptocurrencies like Bitcoin, stablecoins aim to maintain a relatively stable value, minimizing the risk associated with price fluctuations. This makes them attractive for businesses and individuals seeking predictable transactions.

- Faster and Cheaper Transactions: Stablecoin transactions often clear faster and at lower costs than traditional banking transfers, especially for international payments. This efficiency translates to significant savings and improved operational speed.

- Enhanced Transparency and Security: Blockchain technology, underpinning many stablecoins, provides a transparent and auditable record of transactions, increasing security and reducing the risk of fraud.

- Increased Accessibility: Stablecoins can offer financial services to underbanked and unbanked populations globally, fostering greater financial inclusion.

Challenges and Risks Facing Stablecoin Adoption:

Despite their promise, stablecoins aren't without challenges:

- Regulatory Uncertainty: The regulatory landscape surrounding stablecoins is still evolving. Uncertainty regarding regulations can hinder widespread adoption and investment.

- Algorithmic Stability Concerns: Some stablecoins rely on algorithms to maintain their peg to fiat currencies. The complexities of these algorithms raise concerns about their stability during periods of market stress.

- Counterparty Risk: The stability of some stablecoins depends on the creditworthiness of the issuing entity. If this entity fails, the value of the stablecoin could be compromised.

The Future Outlook:

Stripe's remarkable valuation serves as a powerful indicator of the growing significance of stablecoin technology within the broader financial ecosystem. While challenges remain, the increasing demand for faster, cheaper, and more transparent financial transactions is driving the adoption of stablecoins. Whether they will become the future of finance remains to be seen, but their growing integration into major players like Stripe strongly suggests a significant role in shaping the future of payments and financial services. The coming years will likely witness significant developments in the regulation and technology of stablecoins, ultimately determining their long-term impact. Keep an eye on how regulatory bodies navigate this evolving landscape – it will be crucial in determining the ultimate success of stablecoins.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins: The Future Of Finance? Stripe's $91.5B Valuation Suggests So. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exploring The Innovations Showcased At Mwc 2025 In Barcelona

Mar 04, 2025

Exploring The Innovations Showcased At Mwc 2025 In Barcelona

Mar 04, 2025 -

Us Nato Relationship Examining The Implications Of A Potential Us Withdrawal

Mar 04, 2025

Us Nato Relationship Examining The Implications Of A Potential Us Withdrawal

Mar 04, 2025 -

A Us Exit From Nato Assessing The Risks And Uncertainties For Global Security

Mar 04, 2025

A Us Exit From Nato Assessing The Risks And Uncertainties For Global Security

Mar 04, 2025 -

Barcelonas Mwc 2025 Key Highlights And Analysis

Mar 04, 2025

Barcelonas Mwc 2025 Key Highlights And Analysis

Mar 04, 2025 -

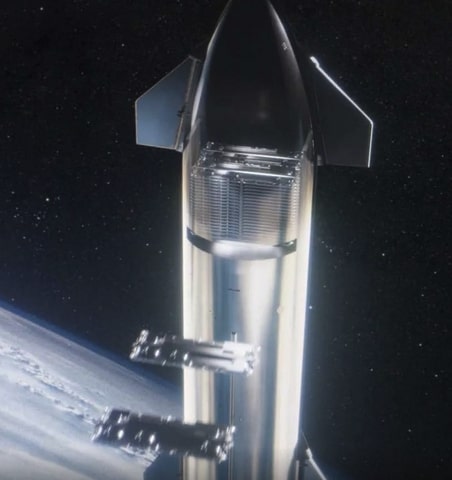

Starlink Reaches 5 Million Users Space Xs V3 Satellite Launch And Starship Reusability Plans

Mar 04, 2025

Starlink Reaches 5 Million Users Space Xs V3 Satellite Launch And Starship Reusability Plans

Mar 04, 2025